Can Taiwan Really Break Free from China’s Economic Grip?

Taiwan aims to shift away from China reliance through tech investments and regional partnerships—but can it succeed without economic shock? Explore timelines, risks, and strategic plans.

TAIPEI, July 7, 2025

INTRODUCTION: A Tectonic Economic Shift?

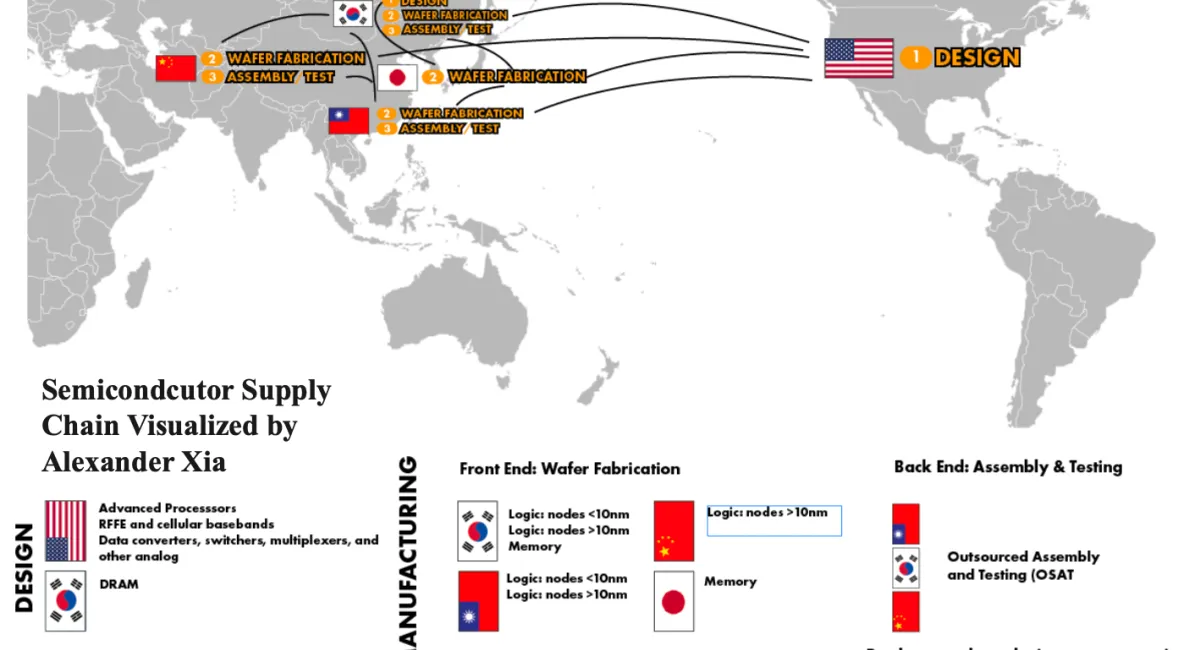

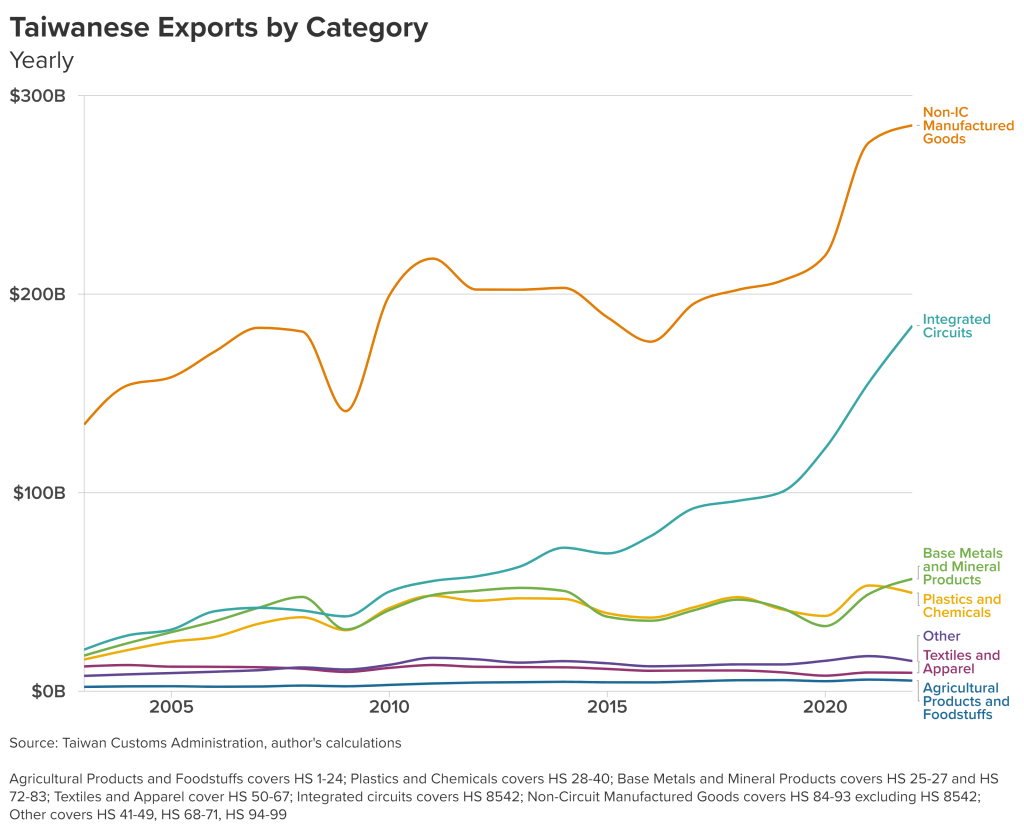

Taiwan’s vibrant, export-driven economy is now at a crossroads. While renowned globally for its technological prowess—especially its semiconductor dominance—Taiwan has built that success on deep, complex economic ties with China.

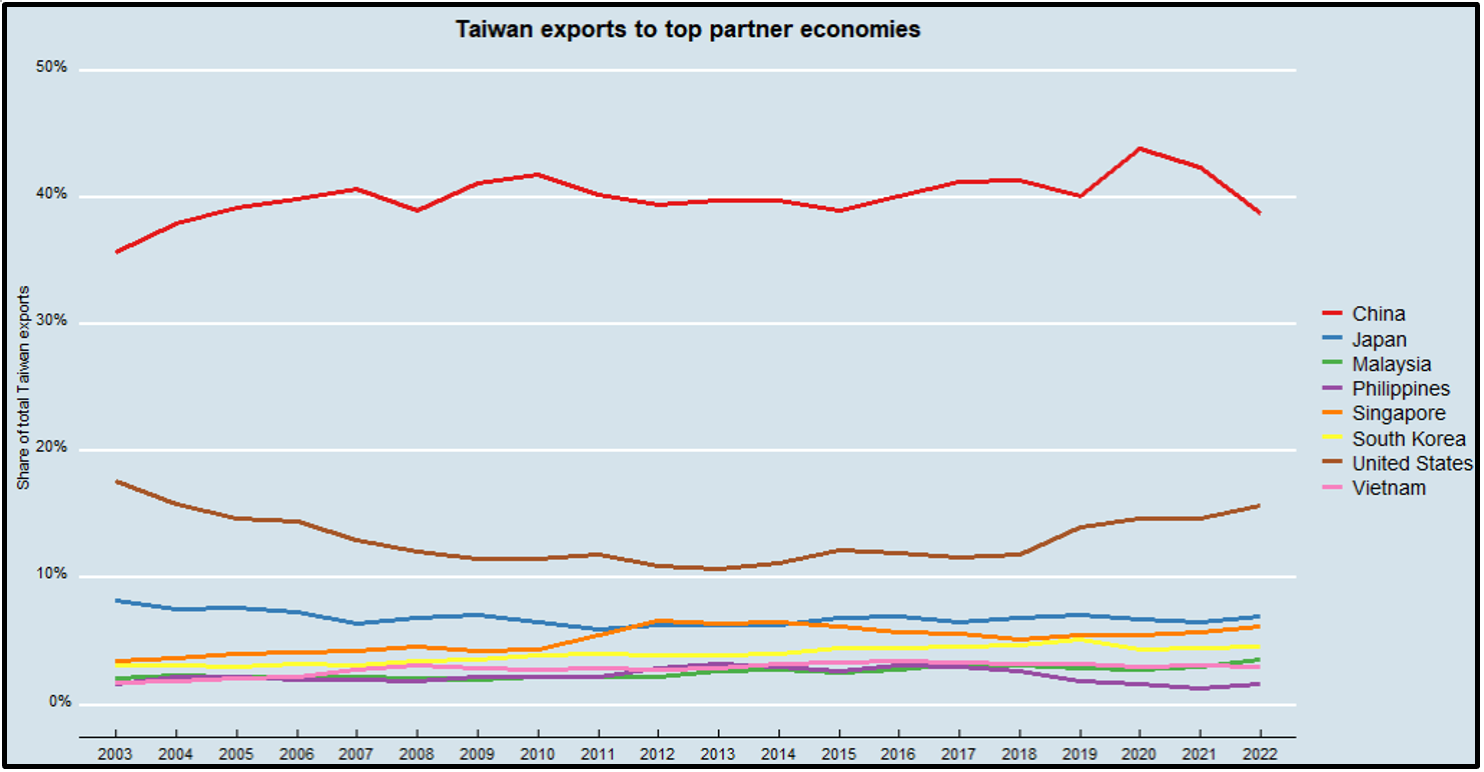

In 2024, over 40% of Taiwan’s exports still flowed to China and Hong Kong, with electronics and chip components forming the lion’s share. However, worsening geopolitical tensions, military threats from Beijing, and rising calls for “de-risking” have compelled Taipei to reconsider its economic future.

But how realistic is it to sever—or at least significantly loosen—those economic bonds? Can Taiwan shift its trade, industry, and infrastructure toward friendlier democracies without triggering economic chaos?

THE DRAGON IN THE ROOM: CHINA'S INFLUENCE

Taiwan’s Economic Dependency by the Numbers

- Over $180 billion in trade with China/Hong Kong in 2023

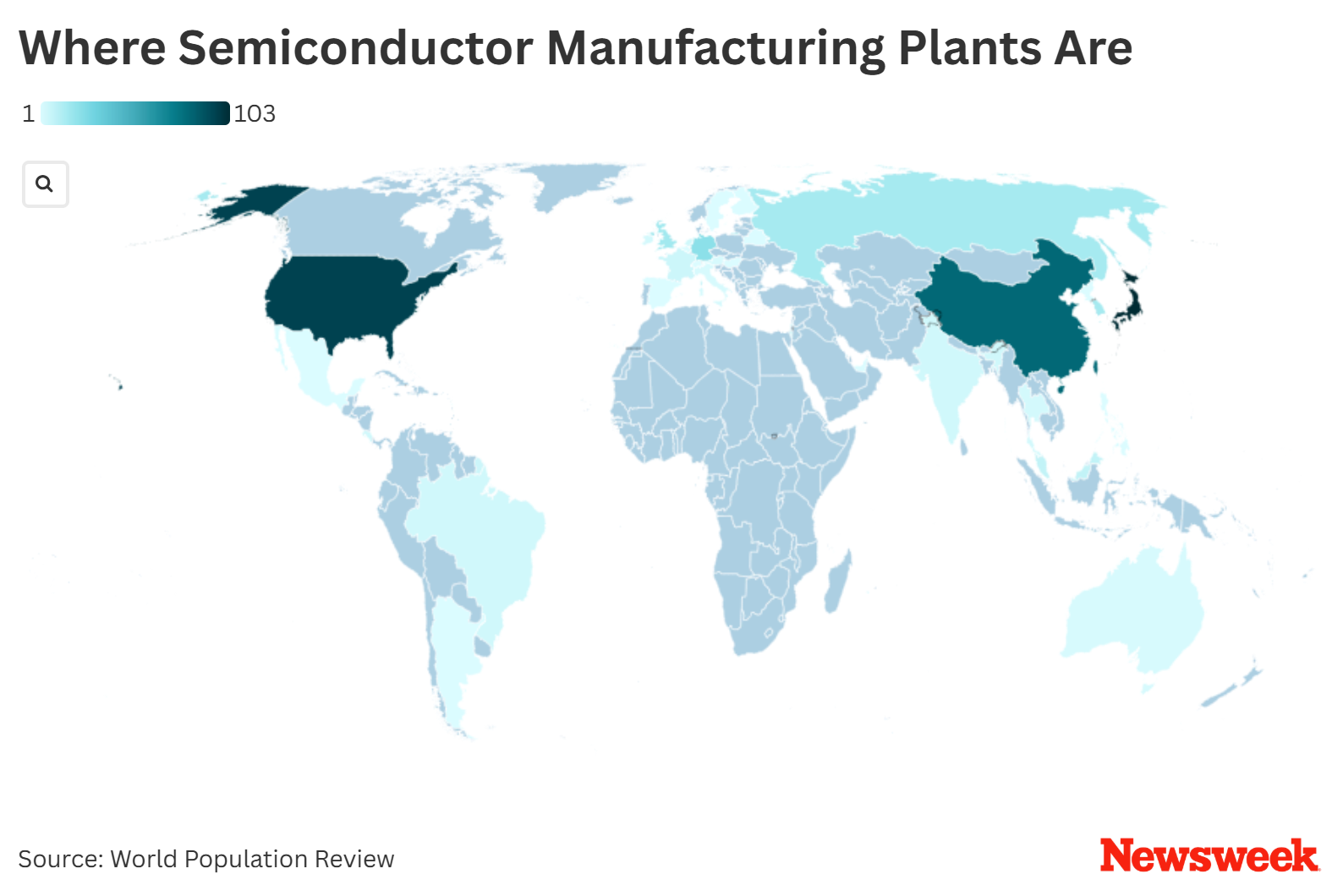

- TSMC (Taiwan Semiconductor Manufacturing Company) makes more than 60% of the world’s semiconductors, with China being a major buyer.

- China accounts for 38–42% of all Taiwanese exports.

“Taiwan is trapped in a golden cage. The profits are real, but the political risk is existential.” — Bonnie Glaser, German Marshall Fund

This kind of dependency makes Taiwan uniquely vulnerable to economic coercion, especially as Beijing’s strategy shifts from tanks to trade threats.

CASE STUDIES IN ECONOMIC COERCION

China has a proven track record of weaponizing trade:

- 2021 Pineapple Ban: Chinese authorities cited "pest concerns," but critics pointed to political retaliation after a pro-independence speech from Taipei.

- 2022 KMT Politician Visits: Following visits from Taiwanese opposition leaders to the U.S., China blocked key petrochemical imports.

- 2023 Semiconductor Threats: China placed unofficial restrictions on some advanced chip exports, hurting Taiwanese suppliers.

These moves underscore how trade becomes a tool of pressure, without a single shot being fired.

TAIWAN’S DIVERSIFICATION STRATEGY: NEW FRIENDS, OLD CHALLENGES

The New Southbound Policy (NSP)

Introduced in 2016 and renewed under President Lai Ching-te, the NSP aims to deepen economic ties with Southeast Asia, South Asia, Australia, and New Zealand.

- Exports to ASEAN rose by 15% in 2023

- Taiwan invested in industrial parks in Vietnam and India

- Tourism and education exchanges doubled with Thailand and Malaysia

While promising, these steps pale in comparison to the volume China represents.

“NSP is working—but it’s not a fire escape. It’s a long staircase.” — Dr. Shihoko Goto, Wilson Center

Strategic Trade Shifts: United States & Europe

- In 2023, Taiwan exported $24.6 billion worth of goods to the U.S., surpassing China for the first time in seven years.

- The U.S.–Taiwan Initiative on 21st-Century Trade established frameworks on anti-corruption, SMEs, and sustainable trade.

- EU discussions continue for a bilateral trade pact, but progress is slow due to China’s influence in Europe.

TSMC: Leading the Way Abroad

TSMC is building fabs in:

- Arizona ($65 billion investment)

- Kumamoto, Japan

- Dresden, Germany

These efforts are reshaping the global semiconductor supply chain, but such moves take years.

KEY SECTORS AT RISK (AND OPPORTUNITY)

1. Semiconductors

Status: The backbone of Taiwan’s economy and global tech

Risk: Any disruption (e.g., war or blockade) could trigger a global crisis

Feasibility of diversification: Moderate

Timeline: 8–12 years

2. Agriculture

Status: Heavily reliant on Chinese markets

Risk: Tariffs, sudden bans (as seen with pineapples, wax apples)

Feasibility: High, with the U.S., Japan, and Australia as potential markets

Timeline: 3–6 years

3. Tourism

Status: Chinese tourists made up over 40% of visitors pre-COVID

Risk: Beijing's tourism bans

Feasibility: Moderate—needs marketing shifts to India, Korea, SE Asia

Timeline: 4–6 years

OBSTACLES TO DECOUPLING

1. Supply Chain Complexity

Taiwanese firms often rely on Chinese subcomponents, labor, or rare earth materials. Simply shifting production doesn't solve these entanglements overnight.

2. Domestic Resistance

Many SMEs—especially in electronics, textiles, and agriculture—depend on Chinese buyers. Rapid decoupling could cause:

- Mass layoffs

- Price hikes

- Economic contraction

3. Political Division

The opposition party (KMT) often favors closer China ties. If they regain control, de-risking efforts may stall or reverse.

EXPERT VIEW

“Economic realignment is painful, political, and slow. But it’s also inevitable. Taiwan must think in decades, not quarters.”

— Dr. Richard Bush, Brookings Institution

“China will continue using trade to intimidate, but Taiwan is showing it’s not economically helpless.”

— Amanda Hsiao, International Crisis Group

WHAT HAPPENS NEXT?

Short-Term (2025–2027)

- U.S.–Taiwan trade pact implementation

- Completion of the TSMC Arizona facility

- Investment in ASEAN and India

Mid-Term (2028–2032)

- Shift of 15–20% of exports from China to South/Southeast Asia

- EU–Taiwan digital economy partnership

- Emergence of Taiwan-branded SMEs in Japan, Korea, and Australia

Long-Term (2033+)

- China's share of exports falls below 30%

- Complete supply chain sovereignty in semiconductors

- Strengthened national economic resilience during geopolitical shocks

IS FULL DECOUPLING POSSIBLE?

Likely not. Taiwan’s economic reality is regional. Decoupling ≠ Isolation—instead, think of it as diversification with insurance. China will likely remain a trade partner—but not the dominant one.

“Breaking free doesn’t mean cutting off. It means Taiwan stops being cornered.”

— Su Tzu-yun, Institute for National Defense and Security Research

DISCUSSION PROMPT

If China were to cut trade with Taiwan tomorrow, how would the global tech industry and regional economies respond? Could Taiwan’s current plans absorb the shock, or is deeper global coordination needed?