De-Dollarization 2025: Can the Yuan or Digital Rupee Replace the Dollar?

“2025 marks a turning point in global finance. As China’s digital yuan and India’s digital rupee rise, the U.S. dollar’s monopoly is cracking. But will either currency truly replace the greenback or are we entering a new multipolar era of money?”

For decades, the U.S. dollar has been more than just a currency it’s been the air the global economy breathes. Oil is priced in dollars. Trade agreements reference dollars. Even countries drowning in debt stack their reserves with greenbacks. But as 2025 unfolds, a radical question looms: is the age of the dollar ending?

From Beijing’s digital yuan experiments to India’s digital rupee rollout, a silent financial war is underway. The battleground? The world’s reserve currency. And the prize? Nothing less than global economic power.

Why the World Wants to Escape the Dollar

The U.S. dollar’s dominance didn’t happen by accident. It was built after World War II, secured through oil-backed trade, and reinforced by America’s military and political influence. But this dominance comes at a cost for everyone else.

- Dependency: Nations tied to the dollar become vulnerable to U.S. monetary policy.

- Sanctions power: Washington can cut countries off from the global system with a single order.

- Volatility: Dollar strength often triggers debt crises in developing nations.

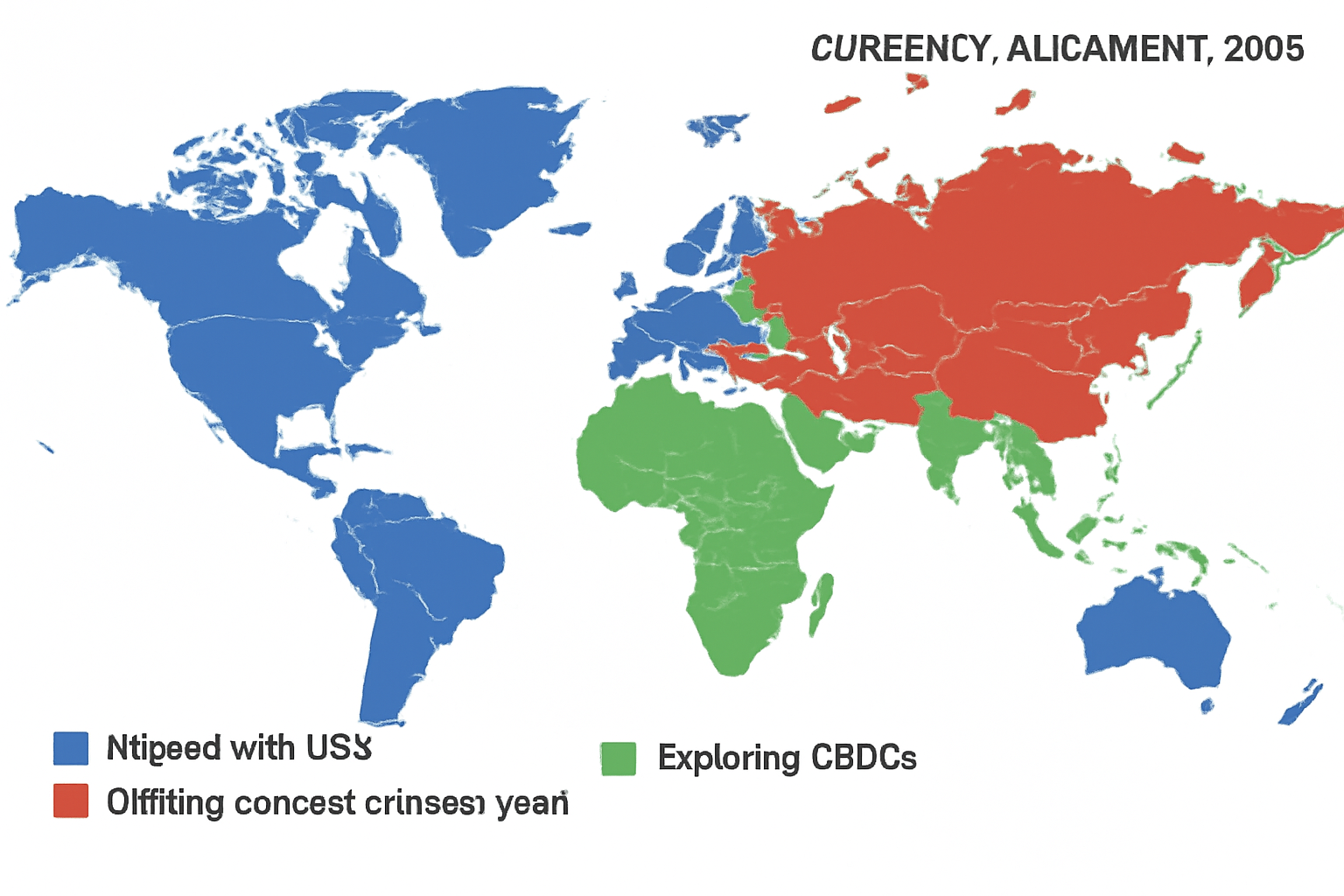

In the last five years, countries from Russia to Brazil to Saudi Arabia have begun openly questioning: why should one nation’s paper dictate the planet’s financial future?

Enter de-dollarization, the trend of shifting away from U.S. dollar dependence.

China’s Digital Yuan: The Red Dragon’s Bid for Power

China has been plotting this move for years. The digital yuan (e-CNY) is already live in major cities, used for metro rides, shopping, and cross-border trade pilots.

But Beijing’s goal isn’t to make tourists buy dumplings with an app it’s to internationalize its currency without relying on Western-controlled payment networks like SWIFT.

- Belt and Road Nations: Over 150 countries linked to China’s trillion-dollar Belt & Road projects are slowly being nudged toward using the yuan.

- Sanction resistance: Digital yuan transactions can bypass U.S. surveillance, making it attractive to countries under American pressure.

- State control: Unlike Bitcoin, the e-CNY isn’t decentralized it’s programmable. China can track, limit, or incentivize spending in real-time.

If this sounds Orwellian, that’s because it is. But for nations tired of dollar dependence, it’s also liberating.

India’s Digital Rupee: The Silent Challenger

While China takes the aggressive route, India is playing the long game. The Reserve Bank of India launched its digital rupee (e₹) pilot in late 2022, and by 2025, it has expanded into wholesale banking, retail payments, and cross-border trials.

Why does this matter? Because India isn’t trying to “replace” the dollar outright—it’s trying to build an alternative system that can scale with its booming economy.

- Population leverage: With over 1.4 billion people, India’s digital rupee rollout has a massive adoption base.

- Global South appeal: India positions itself as a neutral power—not a U.S. rival like China, but not submissive either. This makes its CBDC (Central Bank Digital Currency) more palatable to many.

- Tech integration: The e₹ is being integrated with India’s already dominant UPI payment network, making it one of the most practical CBDCs in existence.

The question isn’t whether India can dethrone the dollar. It’s whether it can outmaneuver China and lead the “non-dollar alliance” of nations.

The Dollar Fights Back

Of course, the U.S. isn’t sitting quietly. In 2025, the Federal Reserve has been experimenting with its own Digital Dollar prototype. Washington knows the risks of losing dominance it’s not just about money, but about geopolitical leverage.

Think about it:

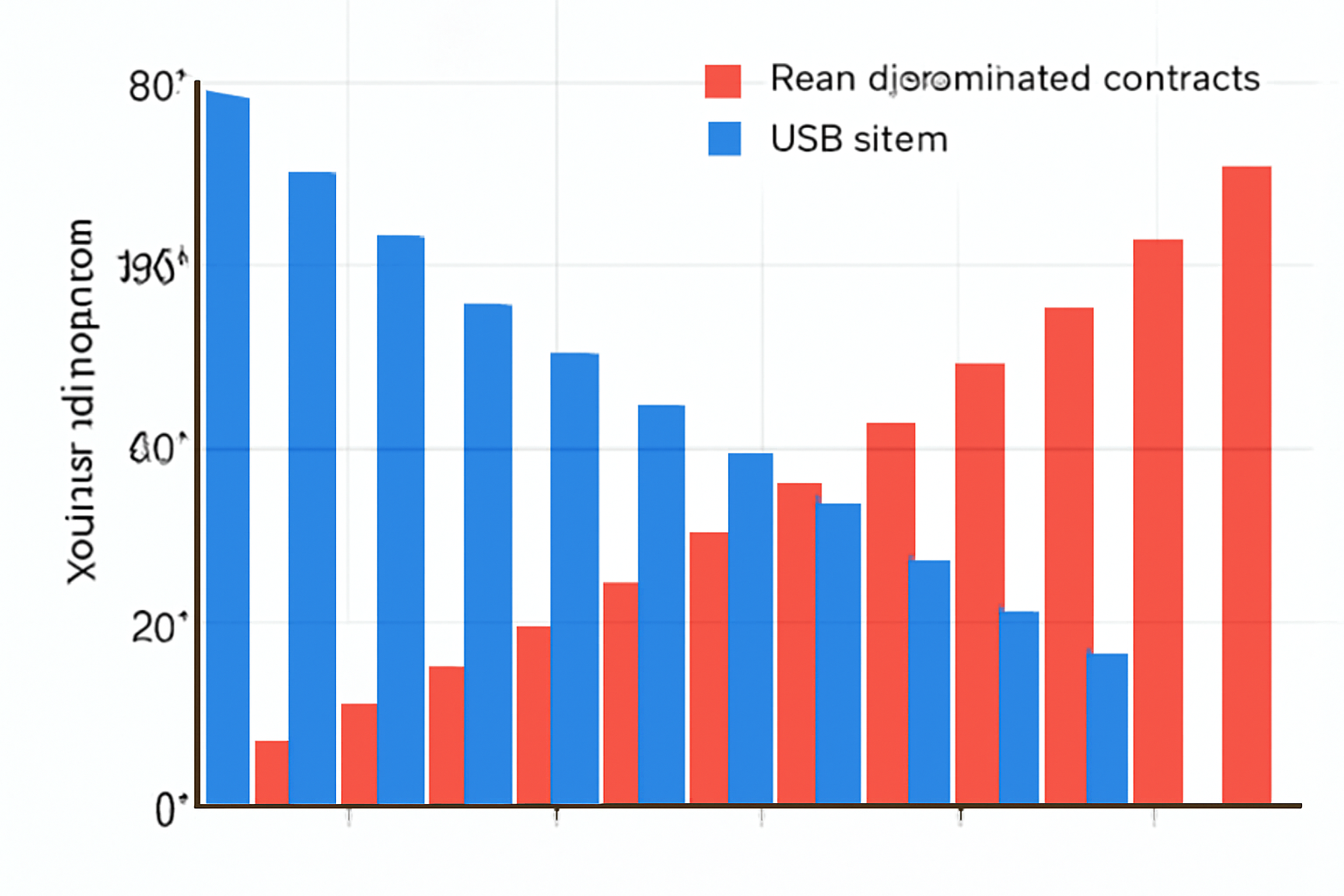

- If oil contracts move to yuan, OPEC nations suddenly owe less loyalty to the U.S.

- If the digital rupee becomes the default for remittances, India could gain influence over $700B+ annual global transfers.

- If the dollar weakens, U.S. debt financing collapses, leading to internal economic shocks.

That’s why Washington is doubling down on alliances, sanctions, and trade negotiations to keep the dollar’s grip alive. But the grip is slipping.

Yuan vs. Rupee: Who Really Wins?

This isn’t just about two currencies it’s about two visions of global finance.

- China’s Model: Centralized, state-driven, surveillance-friendly. Offers stability but little freedom.

India’s Model: Democratic, tech-integrated, and pitched as a trust-based alternative for the Global South.

Both face hurdles:

- The yuan still struggles with global trust and capital controls.

- The rupee faces challenges of scale, infrastructure gaps, and Western pushback.

The irony? The real “winner” may not be either currency, but the multipolar world where no single currency dominates, and nations use baskets of currencies, CBDCs, and even cryptocurrencies to settle trade.

The Future of Money: Multipolar Finance

Picture 2030: A Saudi oil deal settled in yuan. An African infrastructure loan cleared in rupees. A European consumer buying goods using a digital euro. A Filipino worker sending remittances through Bitcoin.

This isn’t science fiction it’s the blueprint of de-dollarization. Instead of one king currency, the future could look more like currency tribes, each powerful in its own sphere.

But make no mistake: the U.S. dollar won’t vanish overnight. It will likely remain dominant in the short term. What’s changing is the psychological monopoly the assumption that the dollar is eternal.

The Risks No One Talks About

Everyone loves the idea of “freedom from the dollar,” but the road is dangerous.

- Fragmentation: Competing digital currencies could make global trade messy.

- Surveillance: CBDCs give governments unprecedented control over individuals.

- Crypto wildcards: Bitcoin and stablecoins may still disrupt state plans.

- Financial wars: Expect sanctions, currency manipulation, and cyberattacks to escalate as the fight intensifies.

In other words, the end of dollar dominance doesn’t guarantee financial utopia. It might just mean new empires, new chains.

Final Word: The Power Shift Is Real

The U.S. dollar has ruled the world for nearly a century, but 2025 feels different. The cracks are showing. The yuan has the muscle. The rupee has the momentum. The dollar still has the crown but for how long?

The truth is, we may not see one “replacement.” Instead, we’re entering an age where currency dominance is shared, fragmented, and contested. A digital battlefield where power is coded, not printed.

And here’s the kicker: the future of money isn’t about banks or governments anymore. It’s about control of data, technology, and trust. Whoever wins that war, wins the world.