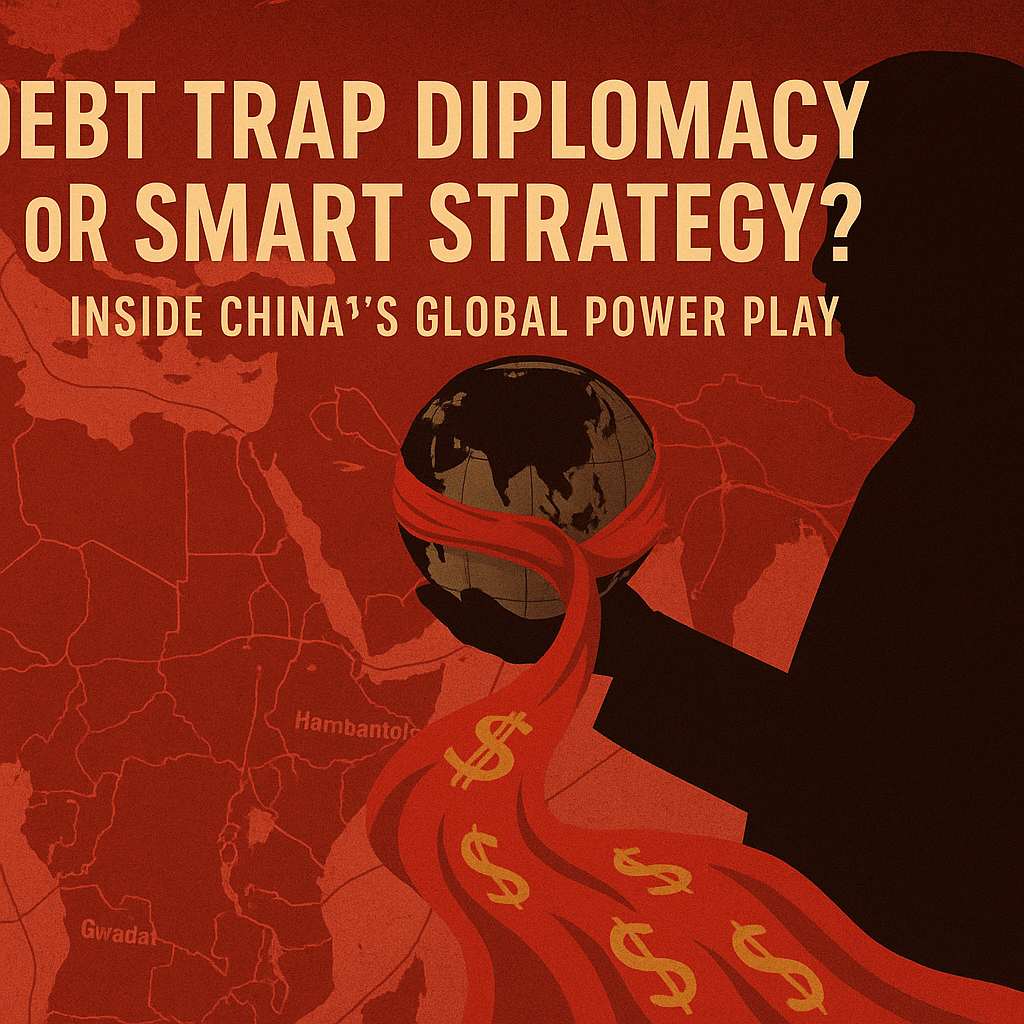

Debt Trap Diplomacy or Smart Strategy? The Real Story Behind China’s Belt and Road

China’s Belt and Road Initiative is a trillion-dollar network of infrastructure reshaping global trade and influence. While some see opportunity, others warn of debt traps and hidden leverage. This strategy blends development with geopolitical ambition on an unprecedented scale.

China's Belt and Road Initiative (BRI) is the largest infrastructure project of the 21st century a trillion-dollar web of ports, roads, and railways that stitches together Asia, Africa, and Europe.

Ask someone different, and the BRI is either a smart master plan for win-win globalization or a predatory plot to trap weaker countries in unsustainable debt.

So what's the truth? Is Beijing intent on rescuing or conquering the world?

Let's peel back the slogans and see what's actually going on beneath China's "New Silk Road."

What is the Belt and Road, Exactly?

Announced in 2013 by President Xi Jinping, the BRI was pledged to "promote economic cooperation and connectivity."

Key points:

- Infrastructure Loans: Chinese banks lend enormous amounts of money for highways, ports, pipelines, and telecom networks.

- Construction Contracts: Chinese state-owned companies construct them—often with Chinese workers and equipment.

- Strategic Footprint: Projects tend to run along major shipping routes and chokepoints.

The scheme runs through more than 140 nations, with committed investments exceeding $1 trillion. From Sri Lanka's Hambantota Port, Pakistan's Gwadar Port, and Kenya's Standard Gauge Railway to across the globe, BRI projects line up everywhere.

The Debt Trap Accusation

Those who oppose claim China is engaging in "debt trap diplomacy." The charge:

Beijing offers low-cost loans, waits for partners to default, and captures strategic assets.

Here's the viral narrative:

- Sri Lanka couldn't pay back its loans for Hambantota Port.

- In 2017, Colombo leased the port to China for 99 years.

- Western media dubbed it evidence of an intentional policy to increase China's geopolitical influence.

The narrative became a cause célèbre for BRI criticism, stoking alarm in Washington, Brussels, and New Delhi.

But Is It Really a Debt Trap?

Let's be real: the "debt trap" narrative is an oversimplification.

Evidence from credible organizations (such as the Rhodium Group and the Lowy Institute) indicates:

- Most BRI partners borrowed from China because Western capital was not available.

- China restructured or postponed payments in most instances of distress, not confiscated assets.

- Fewer than a dozen projects resulted in Chinese control over operations.

To illustrate, Pakistan's Gwadar Port is still under Pakistan's sovereign ownership, though delayed and concerned by debt issues.

But here's the catch: even if it's not always a trap, BRI loans have strings attached.

- Chinese firms usually receive the contracts.

- Chinese labor and equipment are in charge.

- Local debt swells rapidly.

Trap or not, Beijing gets leverage anyway.

The Strategic Payoffs

So why is China so keen to develop ports and railways across the world?

It's not an act of charity. It's a strategic move to:

- Diversify energy routes such as pipelines through Myanmar and Pakistan.

- Expand Chinese exports and reach.

- Diversify away from risky sea chokepoints.

- Build new zones of soft power.

Imagined the BRI as a giant spider web:

Each strand each road, each port drags a nation further into China's orbit.

BRI vs. The West's Response

As the BRI spread, America and Europe frantically sought to counterbalance it.

In 2021, the G7 unveiled the Build Back Better World (B3W) initiative, promising "high-standard, transparent infrastructure financing."

Problem: B3W is still mostly aspirational, with little actual projects being launched.

At the same time, Beijing continues writing checks.

Chinese financing in Africa surpasses combined Western development banks.

Google Trends data indicates interest in BRI surging whenever large projects are being announced particularly in Africa and South Asia.

Success Stories and Failures

Successes:

- Addis Ababa-Djibouti Railway: A lifeline for landlocked Ethiopia.

- Piraeus Port (Greece): Transformed into Europe's fastest-growing container hub.

Failures

- Sri Lanka's Hambantota Port: Underused, debt-ridden, leased to China.

- Kenya's Standard Gauge Railway: Expensive, losing money, debt burden rising.

Bottom line: Not all BRI projects are booby traps but many have dubious economics.

China's Playbook: Debt Restructuring with Influence

When borrowers can't pay, Beijing doesn't necessarily foreclose. Rather, it gives:

- Debt-for-equity swaps (as in Hambantota).

- Loan extensions (Pakistan, Angola).

- New credit lines sometimes doubling down.

But with every "rescue" come political strings:

- Support for China in UN votes.

- Access for Chinese companies.

- Alignment with Beijing’s core interests.

This is geoeconomics at work not quite colonialism, but not exactly benevolent development either.

The Numbers Don’t Lie

According to AidData’s 2021 report:

- 42 low-income countries now owe China more than 10% of their GDP.

- Over 50% of BRI lending is hidden or off the books—i.e., not fully disclosed to the IMF.

- More than $385 billion in loans are considered “risky.”

That is why critics say the BRI is less of a partnership, more of a leverage.

The Global Ripple Effects

The BRI has:

- Provided emerging economies with unprecedented access to financing for infrastructure.

- Enabled China to secure energy routes avoiding US-controlled chokepoints.

- Triggered geopolitical unease among India, the EU, and the US.

India especially views the BRI as an existential threat—particularly the China-Pakistan Economic Corridor passing through disputed Kashmir.

The US has imposed sanctions on BRI-associated firms, in light of "predatory lending and strategic coercion."

Debt Trap or Savvy Strategy?

Here's the straight shoot:

- For China, the BRI is savvy strategy, a century-defining opportunity to anchor global influence.

- For most borrowers, it can be a debt trap—not necessarily because China always means it, but because the transactions are murky, the risks are high, and the projects tend to be overpriced.

If you can't pay, you're out of leverage. That's the game.

Final Takeaways

If you're a policymaker or a journalist, here are three questions to ask about any BRI project:

- Is the debt sustainable?

If the answer is no, the project is a strategic liability in disguise.

- Who owns the asset in default?

If China owns collateral, look for strategic concessions in the future.

- Does the project make economic sense?

Lots do. But lots are constructed more for geopolitics than expansion.

Why You Should Care

The Belt and Road isn't simply about railways and ports.

It's about a new model of power projection:

- Leverage through infrastructure.

- Soft control through loans.

- Influence draped in the attire of "win-win."

Debt trap diplomacy? Occasionally. Clever strategy? Always.

If you wish to know what the 21st century holds, watch where China constructs—and who picks up the tab.

Sources

- CourtListener

- Justia

- Archive.org

- Google Trends

- Official Chinese Government Press Releases

- AidData Reports

- The Lowy Institute

- Reputable News Outlets: The Economist, The New York Times, Reuters, BBC

For more legal exposes and truth-behind-glamour stories, subscribe to AllegedlyNewsNetwork.com