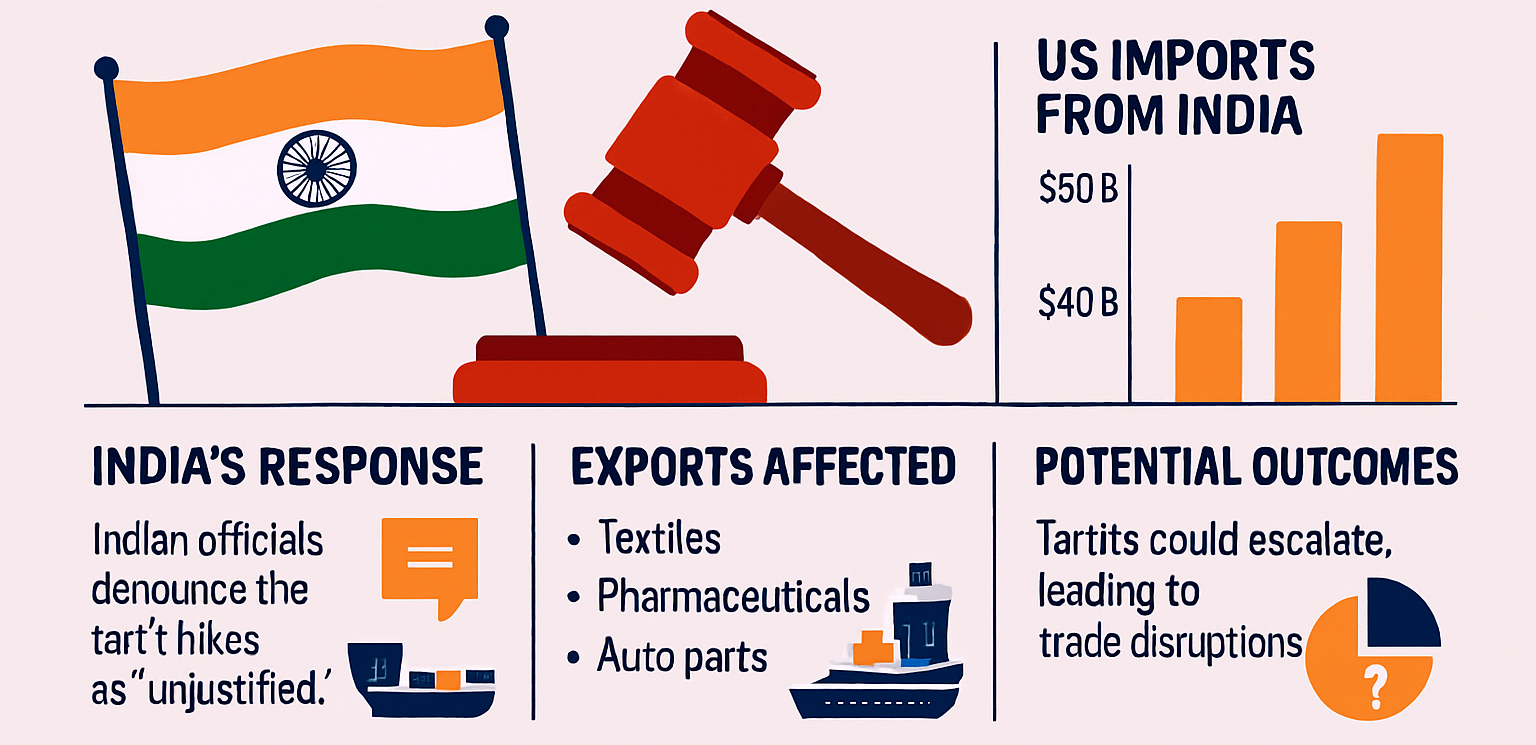

India Calls New US Tariffs ‘Unjustified’: Is a Trade War Inevitable?

India and the U.S. are on the brink of a full-blown trade war. Following the U.S. imposition of a 25% tariff and a new "penalty" on Indian goods, this report investigates the diplomatic fallout, economic impact on key sectors like textiles and pharma, and the growing domestic backlash.

Written by Lavanya, Intern, Allegedly The News

NEW DELHI, August 6, 2025

The diplomatic relationship between the world's two largest democracies has been upended. On August 1st, the U.S. announced a sweeping 25% tariff on all Indian goods, a move coupled with threats of an unspecified "penalty" for India’s continued trade with Russia. This unilateral action, taken in the backdrop of ongoing trade negotiations, has sent shockwaves through New Delhi and ignited a political firestorm. India’s Ministry of External Affairs responded with a sharp rebuke, labeling the tariffs as "unjustified and unreasonable" and accusing the U.S. of hypocrisy, pointing to continued European and American trade with Russia in other sectors.

A Visual Timeline of a Crumbling Trade Relationship

The recent tariffs are not a sudden development but the result of months of simmering tensions and stalled negotiations. Here is a visual timeline of key events:

- February 13, 2025: Prime Minister Narendra Modi and U.S. President Donald Trump hold an official working visit in Washington. They announce a new goal of "Mission 500" to more than double bilateral trade to $500 billion by 2030 and agree to negotiate a Bilateral Trade Agreement (BTA).

- April 2, 2025: The U.S. announces a baseline 10% tariff on most imports and threatens higher, country-specific reciprocal tariffs of up to 26-27% on nations with "unfair trade practices," targeting India, to begin on April 9.

- April 5, 2025: India offers to lower tariffs on select U.S. products like Harley-Davidson motorcycles and whiskey but draws a firm line, refusing to open up its sensitive agricultural and dairy sectors.

- April 9, 2025: In a surprise move, the U.S. pauses the implementation of the higher tariffs for 90 days, providing a window for negotiations.

- May-July, 2025: Five rounds of intense negotiations are held. The U.S. pushes for greater market access in India's agricultural and dairy sectors, while India stands firm, prioritizing the welfare of its farmers and MSMEs.

- July 30, 2025: President Trump announces on his social media platform, Truth Social, the imposition of a 25% tariff on all Indian goods, effective August 1. He also warns of an additional "penalty" for India's continued purchases of Russian oil and military equipment.

- August 1, 2025: The 25% tariff goes into effect. The rupee plunges to a record low against the dollar, and the Bombay Stock Exchange's Sensex sees a sharp downturn, with export-heavy sectors taking a major hit.

- August 4, 2025: India's Ministry of External Affairs releases a strongly worded statement, rejecting the tariffs as "unjustified and unreasonable." The MEA points out the hypocrisy of the U.S. and EU, which continue to trade with Russia in various sectors, and asserts India's right to secure its national interests.

- August 13, 2025 (Projected): Indian trade unions and opposition parties, including the Congress party, are preparing for a nationwide protest to condemn the U.S. tariffs. They demand a firm government response and are using the issue as a rallying cry against the current administration's foreign policy.

The Economic Fallout: Sectors on the Brink

The impact of the new tariffs, particularly the 25% rate on a broad list of Indian goods, is projected to be significant. The U.S. is India's largest trading partner, with bilateral trade reaching an estimated $212.3 billion in FY 2024-25. India enjoys a goods trade surplus of about $45.8 billion with the U.S., which is now directly under threat.

According to analysis by the Global Trade Research Initiative (GTRI), Indian exports to the U.S. could drop by nearly 30% this fiscal year, falling from $86.5 billion to an estimated $60.6 billion. The most affected sectors are:

- Textiles and Garments: This labor-intensive sector is particularly exposed, with India's knitted and woven garment exports to the U.S. facing new effective tariff rates of 38.9% and 35.3% respectively. This makes them uncompetitive against products from countries like Vietnam and Bangladesh, which face lower duties.

- Gems and Jewellery: With exports worth $10 billion to the U.S., this sector adds only a thin value of 3-4%. A 27.1% tariff will make it unsustainable, severely impacting the industry.

- Pharmaceuticals: As the U.S.'s biggest supplier of generic drugs, the pharma sector is also in the crosshairs. While currently exempt, there are hints of future tariffs on Indian medicines and tighter scrutiny on electronics that include Chinese components, creating an atmosphere of immense uncertainty.

- Agriculture: While India has successfully resisted opening its agricultural and dairy markets to the U.S., the tariffs could indirectly impact the sector. Any pressure on agricultural exports could further inflame domestic sentiment.

The Finance Ministry, in its recent economic review, has acknowledged the potential headwinds. While the ministry maintains a "steady as she goes" outlook for the Indian economy, it has flagged that "continued uncertainty on the U.S. tariff front may weigh on India's trade performance in the coming quarters."

The Political Backlash and the India-UK Deal

The U.S. tariffs are not just an economic issue; they are a political hot potato. Opposition parties have seized on the issue to attack the government's foreign policy. The Congress party, in a post on social media, accused the government of a failed foreign policy and being "afraid of Trump." They have invoked the "Howdy, Modi!" event from 2019, where PM Modi openly endorsed Trump, as a symbol of the government's miscalculation.

The growing domestic pressure is culminating in a planned nationwide protest by trade unions on August 13th. The unions are expected to demand a firm government response, including the possibility of retaliatory tariffs, to protect Indian industries and jobs.

This trade spat is also having an unintended consequence on India's other major diplomatic endeavors. The recently concluded India-UK trade deal is finding itself caught in the crossfire. Protests against the U.S. tariffs and a general rise in protectionist rhetoric could make it more difficult for the government to sell the benefits of other free trade agreements to a skeptical public. The India-UK deal, lauded by the government as a success, is now being viewed through the lens of a new, more aggressive global trade environment.

The Motive Behind the Tariffs: Electoral Politics and De-risking

The timing of the tariffs, announced just ahead of a pivotal election cycle in the U.S., suggests that electoral politics may be a significant motive. A populist appeal to protect American jobs and industries, coupled with a tough stance against "unfair" trading partners, could play well with a segment of the U.S. electorate. The tariffs are a tangible show of force, a fulfillment of a promise to put "America First."

Another motive could be "de-risking" from Asia. While much of the U.S.'s focus has been on its trade relationship with China, the tariffs on India could be part of a broader strategy to reduce reliance on Asian supply chains. The move could be an attempt to pressure India into aligning more closely with U.S. geopolitical interests, particularly concerning its relationship with Russia. By linking the tariffs to India's energy and military trade with Moscow, the U.S. is clearly sending a signal that it expects its partners to fall in line with its foreign policy agenda.

The Geopolitical Leverage Theory

The U.S. tariffs are not solely about rectifying a trade deficit. They are a deliberate and calculated geopolitical move to gain leverage over India. By linking tariffs to India's trade with Russia and its participation in the BRICS bloc, the U.S. is signaling that its economic partnership with New Delhi is conditional on its alignment with Washington's foreign policy objectives. This is an attempt to force India to choose sides in a new Cold War, a move that directly challenges India’s long-standing policy of strategic autonomy. The U.S. may be hoping that the economic pain of the tariffs will push India to re-evaluate its geopolitical stances, particularly concerning its defense and energy ties with Russia. The question is whether New Delhi will bow to this pressure or use this moment to double down on its multi-aligned foreign policy and seek stronger trade ties with other partners.

What Happens Next?

India's government is in a difficult position. It has a choice between a firm, retaliatory response and a more diplomatic approach aimed at de-escalation. The former risks a full-blown trade war, while the latter could be seen as a sign of weakness in the face of pressure. The opposition, particularly the Congress party, has already accused the government of a weak foreign policy, using the crisis to score political points.

The planned nationwide protests on August 13th will be a critical test of domestic pressure. The government's response to these protests and its subsequent actions will define the path forward. One key avenue being considered by New Delhi is a formal complaint to the World Trade Organization (WTO). While the U.S. has justified the tariffs under presidential authorities like Section 232 (national security) and Section 301 (unfair trade practices), a WTO challenge could at least provide a legal framework for the dispute, even if a resolution is not guaranteed.

The ongoing India-UK trade deal, which was recently signed, is also in a precarious position. The rising protectionist sentiment in India, fueled by the U.S. tariffs, could make it harder for the government to garner public support for further free trade agreements. The success of the India-UK deal, which aims to boost trade and ease professional mobility, may now be overshadowed by the bigger, more pressing issue of U.S. trade aggression.

New Questions for the Global Stage

How can India's government effectively balance the need for a strong, firm response to U.S. tariffs with the need to avoid a costly, prolonged trade war? How will this trade dispute impact the global drive for supply chain diversification, particularly for companies seeking to move production away from China to countries like India? To what extent is India's policy of strategic autonomy being tested by the U.S.'s new approach to trade and foreign policy?

Sources

United States Trade Representative (USTR), Global Trade Research Initiative (GTRI), India Today, The Economic Times, The Federal, Ministry of External Affairs, PIB India, Al Jazeera, Times of India.