India's FY26 Growth Forecast: Can Optimism Withstand Global Headwinds?

India's FY26 GDP forecast (6.2-6.5%) faces global headwinds: slowing trade, investment woes, and a private capex puzzle. This analysis dissects risks, policy buffers, and sectoral drivers. Is the Finance Ministry's optimism realistic amidst structural bottlenecks for India's economic growth?

Written by Lavanya, Intern, Allegedly The News

NEW DELHI, July 31, 2025

India, often hailed as a resilient economic bright spot, faces a crucial juncture as its Finance Ministry forecasts a robust 6.2-6.5% GDP growth for Fiscal Year 2026. This projection, while indicative of strong domestic fundamentals, comes at a time of persistent global uncertainties, raising pertinent questions about the sustainability of India's growth trajectory. Can the nation's optimism truly withstand the formidable global headwinds, or are there underlying vulnerabilities that could temper this promising outlook?

The mid-year economic update from the Finance Ministry paints a cautiously optimistic picture, emphasizing India's resilience amidst an increasingly turbulent global landscape. However, a deeper analysis reveals a complex interplay of domestic strengths and external challenges that demand strategic foresight and agile policy responses.

Navigating the Global Tempest: Risks to India's Export-Led Sectors

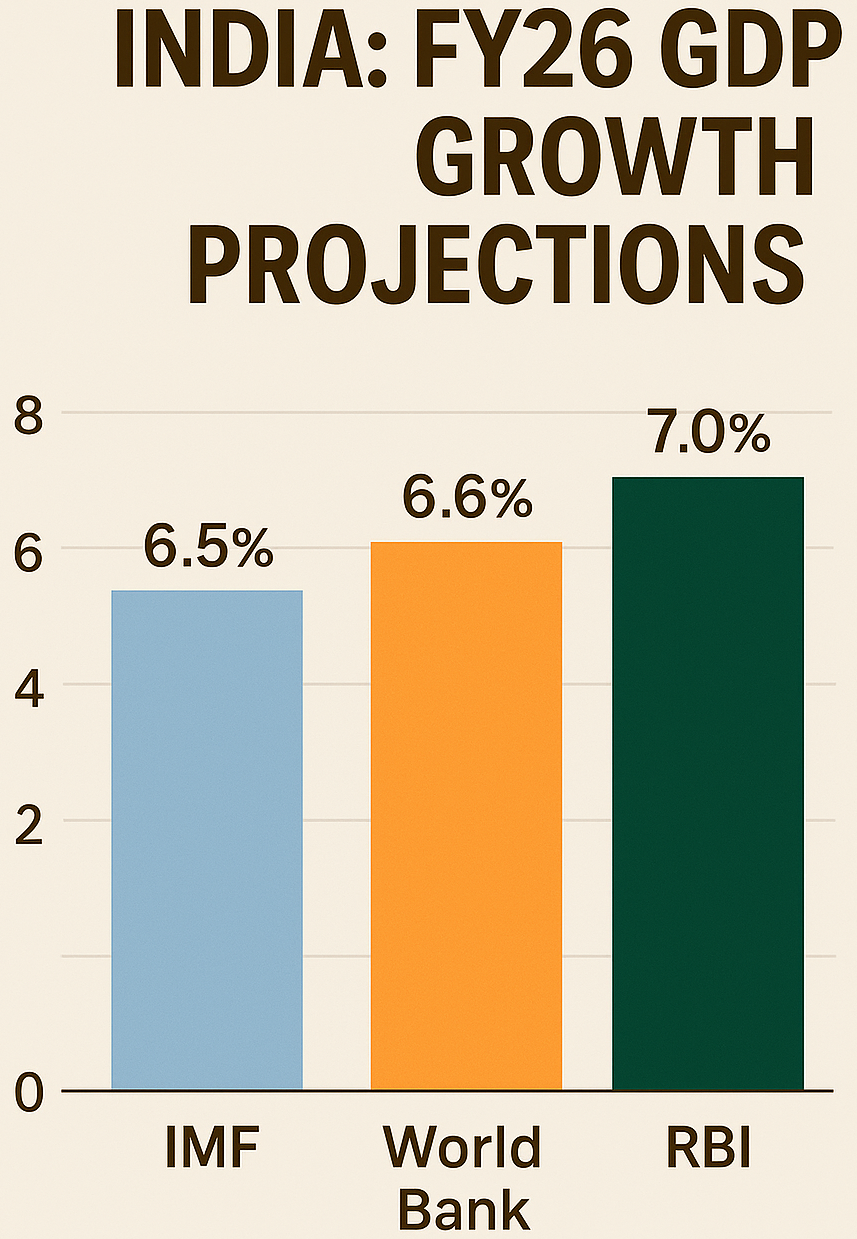

The global economic environment in 2025-26 remains fraught with volatility. The International Monetary Fund (IMF) has recently revised its global growth outlook upwards for 2025 and 2026, yet it simultaneously warned of downside risks stemming from higher tariffs, elevated uncertainty, and ongoing geopolitical tensions. For India, a nation increasingly reliant on exports for economic expansion, these global dynamics pose significant challenges.

Slowing Global Trade and Investment Sluggishness: The primary risk emanates from a potential global economic cooldown, particularly in major consumer markets like the EU and the US. The Finance Ministry's June Monthly Economic Review itself cautioned that a slowdown in the US economy, which contracted by 0.5% in Q1 2025, could "dampen further demand for Indian exports." This is compounded by the re-emergence of trade protectionism, exemplified by the US's "reciprocal" tariff measures on Indian goods. Such measures, if expanded, could significantly impact India's export performance in sectors like steel, textiles, pharmaceuticals, and electronics.

Furthermore, global investment flows are exhibiting sluggishness, driven by heightened uncertainty and rising interest rates in developed economies. This directly impacts India's ability to attract foreign direct investment (FDI) and portfolio investment, which are crucial for financing its ambitious infrastructure and manufacturing plans. While India has seen robust FDI inflows in FY25, the global landscape suggests a need for continued policy focus to remain an attractive investment destination.

Policy Buffers Against External Shocks: India has, however, built substantial policy buffers to mitigate these external shocks. The Reserve Bank of India (RBI) has maintained substantial foreign exchange reserves, which stood at a record-high of $702.78 billion as of July 2025, providing a robust shield against external volatility and ensuring import coverage exceeding 11 months. The Indian rupee has also displayed remarkable stability despite global oil price variations and geopolitical flare-ups.

The government's proactive fiscal prudence, coupled with monetary support from the RBI, has been highlighted by the Finance Ministry as key to India's macroeconomic resilience. Measures like the Production Linked Incentive (PLI) schemes are strategically designed to boost domestic manufacturing and reduce reliance on imports, thereby insulating India from some global supply chain disruptions. Additionally, ongoing efforts to diversify India's export basket and explore new markets are crucial to de-risk its trade exposure.

The Macroeconomic Optimism-Lending Disconnect: A Deeper Look

Despite the broadly positive macroeconomic outlook and strong bank balance sheets, a persistent disconnect exists in bank lending, particularly to Micro, Small, and Medium Enterprises (MSMEs) and rural sectors. The Finance Ministry report itself acknowledged that "credit growth slowed, reflecting cautious borrower sentiment and possibly risk-averse lender behaviour."

Sluggish Bank Lending to MSMEs and Rural Sectors: While overall credit growth has shown some momentum, the flow of credit to MSMEs and rural segments remains a concern. MSMEs, the backbone of India's economy and a major employer, often struggle with access to timely and affordable credit. While government schemes like the Emergency Credit Line Guarantee Scheme (ECLGS) have provided crucial liquidity support, the structural challenges persist. Banks, wary of non-performing assets (NPAs) and perceived higher risks in these segments, often prefer lending to larger, more established corporates or focusing on retail loans.

In rural areas, despite various initiatives for financial inclusion, a significant portion of the population and small businesses still rely on informal credit channels due to stringent collateral requirements, complex documentation, and limited reach of formal banking services. This credit vacuum hinders their growth potential and contributes to regional economic disparities.

Why the Disconnect? Several factors contribute to this disconnect. Firstly, the lingering impact of past NPA cycles has made public sector banks particularly risk-averse. Secondly, despite stable fundamentals, genuine demand for credit from MSMEs may be constrained by subdued consumer demand in certain sectors and the slow pace of private capital expenditure. Thirdly, a growing preference among corporates for bond markets and commercial papers due to lower borrowing costs shifts a portion of the credit demand away from traditional bank lending. Lastly, the stringent regulatory and compliance burdens on banks, while necessary, can sometimes disincentivize lending to smaller, less formal entities.

The Private Capex Conundrum: Unlocking Investment Potential

One of the most critical puzzles in India's growth narrative is the persistently low private capital expenditure (capex) despite stable macroeconomic fundamentals. While government capital expenditure has been a significant driver of growth, private investment, essential for sustainable long-term expansion and job creation, has lagged.

Reasons for Low Private Capex: According to a Drishti IAS analysis, private sector capex, after a strong cycle from FY21-FY24, is projected to decline by 25.5% in FY26. Several factors are at play:

- High Borrowing Costs: Elevated interest rates increase the cost of financing large-scale projects, making companies prefer internal accruals over external borrowing.

- Weak Consumer Demand: While recovering, consumer demand has not been robust enough to justify significant greenfield investments.

- Geopolitical Uncertainty and Trade Disruptions: Global tensions create unpredictability in trade and input costs, making industries reliant on imported materials cautious.

- Lack of Greenfield Projects: Most current investments are brownfield (expansion of existing units), often funded internally, while new units requiring bank funding are scarce.

- Structural Bottlenecks: Delays in land acquisition, environmental clearances, and rigid labor laws continue to be major impediments.

- Low Capacity Utilisation: While some sectors report decent utilization rates, overall rates have dropped, providing little incentive for firms to expand further.

- Caution Due to IBC Experiences: Past bankruptcies under the Insolvency and Bankruptcy Code (IBC) have made firms more risk-averse, leading to conservative financial planning.

- Overconcentration of Investment: New private investments are often concentrated among a few large corporations, lacking broader participation.

Structural Reforms Needed to Revive It: To unleash private capex, a multi-pronged approach to structural reforms is imperative:

- Streamlining Regulatory Processes: Expediting land acquisition, environmental clearances, and simplifying the labyrinthine regulatory framework are crucial. Strengthening the Project Monitoring Group (PMG) under the Cabinet Secretariat for faster clearances is a step in the right direction.

- Enhancing Ease of Doing Business (EoDB): States must be encouraged to liberalize standards, reduce tariffs and fees, and apply risk-based regulation to foster a truly investment-friendly environment.

- Labor Reforms: Addressing rigid labor laws to provide greater flexibility to industries while safeguarding worker interests can incentivize investment.

- Targeted Incentives and PLI Expansion: Expanding and fine-tuning PLI schemes to cover a wider array of sectors and ensuring timely disbursement can attract more private players.

- Improving Credit Access: While banks are cautious, innovative financial instruments, robust credit guarantee schemes, and fostering a stronger corporate bond market can help bridge the financing gap for new projects.

- Infrastructure Development: Continued government investment in infrastructure, especially logistics and connectivity, reduces operational costs for businesses and improves their competitiveness, indirectly spurring private capex.

- Dispute Resolution Mechanism: Strengthening the legal framework for contract enforcement and dispute resolution can boost investor confidence.

Balancing Optimism with Prudence: India's Mid-Term Economic Planning

India's mid-term economic planning is a delicate balancing act between maintaining cautious optimism and upholding fiscal prudence amidst external volatility. The Finance Ministry's report underscored this, stating that "despite global headwinds... India's macroeconomic fundamentals remained resilient... Aided by robust domestic demand, fiscal prudence, and monetary support, India appears poised to continue as one of the fastest-growing major economies."

Fiscal Prudence: The government has consistently emphasized fiscal consolidation, aiming to bring down the fiscal deficit. This commitment is vital for maintaining macroeconomic stability, attracting foreign investment, and ensuring long-term sustainable growth. However, balancing this with the need for continued public spending on infrastructure and social sectors, especially to crowd in private investment, is a tightrope walk. The Union Budget 2025-26, for instance, has outlined measures to invigorate private sector investments and uplift household sentiments, alongside focusing on agricultural growth, rural prosperity, and supporting MSMEs.

External Volatility: Managing external volatility, particularly currency fluctuations and global commodity price shocks, remains a key challenge. While India's forex reserves provide a buffer, sustained high oil prices or sudden capital outflows could exert pressure. The government's focus on diversifying trade partnerships, strengthening domestic supply chains, and promoting exports is critical to build resilience against such external shocks. The "National Manufacturing Mission" and the "Export Promotion Mission" are designed to achieve these objectives.

Industries Driving FY26 GDP: A Sectoral Outlook

In light of the Ministry's mid-year update and broader economic trends, several industries are poised to be the primary drivers of India's GDP in FY26.

- Infrastructure: The construction sector is projected to grow by 7-7.5% in FY26, supported by a healthy pipeline of infrastructure projects, strong order book visibility, and continued public capex. Urban infrastructure and the energy sector are expected to drive robust performance. The government's continued thrust on projects like the National Infrastructure Pipeline and PM Gati Shakti will be crucial.

- Digital Economy: India's digital economy, currently accounting for 10% of GDP, is projected to double to 20% by 2026. This phenomenal growth is fueled by the world's lowest data costs, rapid growth in internet users, and sweeping digitization of financial markets and payment systems (UPI). The digital push supports various sectors, from e-commerce to fintech and digital services, making it a powerful growth engine.

- Manufacturing: With initiatives like the Production Linked Incentive (PLI) schemes across 14 critical sectors, manufacturing is set to be a significant contributor. The "National Manufacturing Mission" introduced in Budget 2025-26 aims to increase manufacturing's share in GDP, create jobs, and foster technological advancements, especially in areas like solar cells, EV batteries, and high voltage transmission equipment. Sectors like electronics, pharmaceuticals, and processed food products are already showing strong export growth under PLI. The enhanced investment and turnover limits for MSMEs are also expected to boost their contribution to manufacturing and exports.

- Services: The services sector has consistently been the steadiest contributor to Gross Value Added (GVA), with its share rising to around 55% in FY25. With a robust digital infrastructure and a growing skilled workforce, IT services, financial services, and other modern services are expected to maintain their strong growth trajectory.

- Agriculture: While often subject to vagaries of weather, continuous government support for agricultural productivity, diversification, improved irrigation, and better credit access for farmers (as outlined in Budget 2025-26) aims to ensure its foundational contribution to GDP and rural prosperity.

Is the Finance Ministry's Tone Realistic or Overlooking Bottlenecks?

While the Finance Ministry's tone is largely optimistic, it also acknowledges inherent risks and challenges. The critical assessment lies in whether this optimism sufficiently accounts for deep-seated structural bottlenecks that could dampen FY26 growth.

Realistic Assessment: The Ministry's recognition of slowing credit growth, cautious borrower sentiment, and the potential impact of a global slowdown on exports demonstrates a degree of realism. The emphasis on fiscal prudence and ongoing reforms also reflects a pragmatic approach to economic management. The IMF's upward revision of India's growth forecast to 6.4% for both FY26 and FY27, citing a more benign external environment, further validates some of this optimism.

Overlooking Structural Bottlenecks: However, the report might not fully emphasize the severity of certain structural impediments. For instance, while acknowledging low private capex, the pace of land and labor reforms, and bureaucratic hurdles remains slow. The problem of "last-mile" credit delivery to MSMEs and rural areas, despite policy intentions, often faces on-ground implementation challenges. Furthermore, issues like skill gaps, particularly in emerging technologies, and the need for significant investments in human capital development, are crucial for long-term sustainable growth but might not be sufficiently highlighted as immediate growth dampeners for FY26.

The fragmented nature of investment, concentrated among a few large players, means that the benefits of economic growth may not be as widely distributed, potentially impacting consumption demand from a broader base. While the Economic Survey 2024-25 noted a declining Gini coefficient, suggesting reduced inequality, continued focus on inclusive growth is paramount.

Ultimately, while India possesses strong fundamentals and a resilient domestic demand base, the Finance Ministry's optimistic forecast for FY26 will truly withstand global headwinds only if accompanied by accelerated, decisive action on critical structural reforms and a robust response to the persistent challenges of credit flow and private investment. The journey to a $5 trillion economy, and beyond, hinges on India's ability to convert its demographic dividend and digital prowess into tangible, broad-based economic prosperity.

What Happens Next? Probing the Path Ahead

As India marches towards its ambitious economic targets, the interplay of global forces and domestic policies will be crucial. Will the anticipated rebound in global trade materialize sufficiently to provide the necessary tailwind for India's export ambitions? Can the government's continued push for public capex effectively crowd in private investment, or will lingering caution and structural impediments continue to hold back the corporate sector? How will the evolving geopolitical landscape, particularly concerning trade tariffs and supply chain realignments, specifically impact India's competitive edge in key manufacturing and services sectors? Furthermore, with an upcoming general election, how will the political discourse and policy continuity affect investor confidence and the implementation of long-term economic reforms?

Sources

DD News, Local and Global Eco, Times of India, Indian Bank, Drishti IAS, PIB, Financial Express, Newsonair, Economic Times, India Budget, Tribune India, The New Indian Express, Ujjivan Small Finance Bank.