Inside Trump’s “Big, Beautiful Bill”: What the Text Reveals and Why It’s So Controversial

Trump’s “Big, Beautiful Bill” reshapes healthcare, tech, and immigration—but critics warn of hidden clauses, lobbying influence, and major risks to civil rights and democratic checks.

WASHINGTON D.C., June 30, 2025

In late May 2025, former President Trump introduced a 1,100-page legislative package called the “One Big Beautiful Bill.” It includes significant tax reforms, cuts to entitlement programs, border security measures, $150 billion for military expansion, and some judicial provisions that are yet to be revealed. The bill has sparked concern among legal observers, civil rights groups, health organizations, and political insiders. Supporters argue that it will lead to substantial economic growth, extended benefits, and responsible spending. Opponents see it as a way to benefit special interests while weakening essential checks and balances.

Below is provided a clause-by-clause breakdown of the bill, a detailed look at its drafting process, potential implications across crucial policy areas, and information on its financial supporters.

Clause-by-Clause Breakdown: What the Bill Actually Does

After reviewing the House and Senate texts through Congress.gov and the Senate Judiciary Committee's publication. Here are the major provisions:

Title I – Tax & Budget Reform

- Permanently extends Trump’s 2017 tax cuts and eliminates taxes on overtime and tips.

- Raises the SALT deduction cap to $40,000 for higher-earning households, but the Senate version phases it out in 2029.

- Sets new work requirements for Medicaid eligibility for able-bodied adults without dependents.

Title II – Health Care Restructuring

- Replaces ACA subsidies with block grants, reducing Medicaid funding, tightening eligibility, and requiring low-income seniors ($4,000 deduction) to prioritize work.

- The CBO warns that 10.9–11.8 million more people may be uninsured by 2034 due to the loss of subsidies and coverage restrictions.

Title III – Defense & Border Security

- Adds $150 billion for military spending, including a $25 billion “Golden Dome” system.

- Allocates $50 billion for border wall expansion, $4 billion for border patrol, and enhances surveillance measures.

Title IV – Energy & Environment

- Eliminates green energy tax credits, such as those for electric vehicles and solar power, that were added under Biden.

- Redirects funds toward domestic fossil fuel expansion, reversing decades of clean energy incentives.

Title V – Tech Regulation & AI Governance

- Prevents state and local AI election regulation for 10 years, placing oversight at the federal level.

- Requires major social platforms to verify user identities, which critics claim threatens free speech.

Title VI – Judiciary & Checks on Courts

- Imposes bond requirements on plaintiffs to claim contempt against government officials, limiting court enforcement unless a premium is paid upfront.

- Court observers describe this as an attack on the separation of powers.

Drafting in the Shadows: What the Public Didn’t See

Unlike landmark legislation such as the early ACA or New Deal initiatives, this bill was created quickly.

It was drafted mostly in private meetings, with fewer than 20 public markup sessions recorded.

Freedom of Information Act requests were blocked with claims of executive privilege.

The Senate Judiciary version changed controversial judicial restrictions, revealing that closed negotiations involved more extreme text.

Legal scholar Prof. Elaine Rosenberg from Georgetown Law stated, “This looks less like democracy and more like a corporate roadmap created behind closed doors.”

Implications Across Key Issue Areas

Healthcare

- Medicaid cuts are projected to leave 10–12 million Americans without coverage by 2034.

- Hospitals in rural and swing states, such as Wisconsin and Michigan, are warning of potential bankruptcies.

- Low-income families will lose not only coverage but also critical safety provisions.

Taxes & Economy

Some middle-income workers will see modest relief from tax breaks on overtime and tips.

Top 10% earners could gain around $12,000 per year, while the bottom 10% may lose $1,600 overall.

Conflicting deficit forecasts:

- CBO estimates a $2.4–3.3 trillion increase in debt over 10 years.

- The White House claims $1.7 trillion in savings and suggests a $6.6 trillion reduction, considering tariffs and cuts.

Immigration & Border Control

$54 billion will be allocated for enforcement, detention, wall construction, and surveillance, all financed through social cuts.

Civil liberties groups are warning of racial profiling and erosion of due process.

Tech & Civil Rights

The federal AI permit system threatens local ballot-security algorithms.

Federal ID requirements for social media could discourage participation from marginalized groups.

Judiciary / Separation of Powers

The bond requirement for contempt claims may allow elected officials to bypass judicial rulings without consequence.

It threatens to hinder courts from enforcing constitutional rights.

Who’s Funding It—and Who Benefits

Campaign Finance & Lobbying

- Oil and gas companies spent $38 million on lobbying in early 2025.

- Agribusiness and hospitality industries also invested millions in hopes of favorable provisions.

- Defense contractors supported the “Golden Dome” spending.

- Clean-energy lobbyists saw green credits disappear.

- OpenSecrets reports that Trump’s fundraising for 2024 exceeded $1.45 billion, with large corporate donors making up 69% of contributions.

Industry & PAC Support

- Endorsers include AT&T, Comcast, 3M, and Delta, likely seeking deregulation or tax advantages.

- The Heritage Foundation donated $26,000 to Trump and is pushing for judicial constraints.

- Major GOP Super PACs like MAGA Inc and America PAC contributed millions, with significant donations from megadonors Mellon ($150 million) and Uihleins ($20 million).

Financial Incentives for Key Sectors

- Oil, military contractors, and border-security firms stand to make billions.

- Big Pharma will benefit from changes to Medicaid.

- Silicon Valley companies may face compliance costs but could welcome uniform federal regulations.

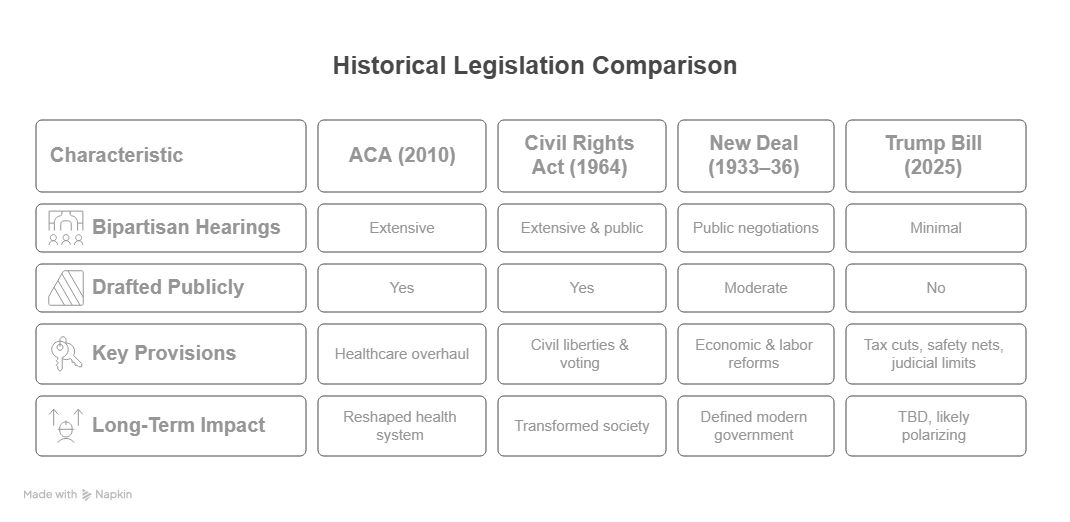

A Historical Comparison: How It Stacks Up

- The ACA, despite partisan conflicts, survived due to open debate and CBO cost projections over 15 months.

- The Civil Rights Act relied on bipartisan cooperation and compromise.

- The New Deal allowed for gradual negotiation and transparency.

- In sharp contrast, Trump’s bill was drafted in weeks through reconciliation, avoided minority input, and delayed complete CBO scoring until mid-June.

Why It’s Controversial

- Concerns about exploding deficits versus disputed savings – CBO indicates significant debt, while the CEA claims trillion-dollar savings.

- Vulnerable Americans risk losing health coverage, with 11 million potentially affected.

- Judicial overreach – bond provisions could limit enforcement powers.

- Civil rights issues – AI and social media ID requirements challenge free speech and democratic processes.

- A lack of transparency in the drafting process – important decisions were made behind closed doors.

- Pressures for loyalty – threats against dissenters, such as North Carolina’s Tillis being forced out, and pressure on institutions like the University of Virginia.

What Happens Next?

Senate Outlook

The narrow 51–49 majority allows reconciliation to pass, but internal GOP divisions persist.

Senators Tillis and Rand Paul oppose the Medicaid and debt ceiling terms. Thompson and Collins suggest amendments.

Filibuster delays and forced readings are planned for the Senate floor.

Legal Challenges

Civil rights organizations, the ACLU, and digital rights advocates are preparing lawsuits.

Scholars argue that the bond clause is unconstitutional.

State attorneys general may join lawsuits to defend Medicaid benefits and voting rights.

Public & Political Reaction

Public polls indicate only 27% approval, with most opposing cuts to Medicaid and other benefits.

Senate Minority Leader Schumer demands a full reading of the bill.

Senator Mark Warner (D-VA) warns that Medicaid cuts “will cripple GOP support.”

Media & Political Backlash

Conservative editorial critics describe it as a corporate “logroll” disguised as populism.

Next Steps Timeline

A full Senate vote is expected on June 30 or July 1.

If passed, it would need House agreement and final reconciliation.

The President plans a signing ceremony on July 4.

Lawsuits and protests will start immediately, with Supreme Court challenges anticipated by late summer or fall.

Closing Arguments: Transparency, Power & the People

Trump’s “Big, Beautiful Bill” is a large-scale legislative effort that combines tax cuts, military spending, entitlement restructuring, judicial limits, and tech regulation into a swift process. Its expected economic growth might come at the cost of social safety nets and democratic protections. As Senate watchers, voters, and civil rights advocates prepare for a summer of intense politics and legal disputes, one question remains:

Where Do We Go From Here?

Which provision concerns you most, and why? Is this the future of federal governance or a retreat from democratic accountability?

Sources

- Legislative text & analysis: Congress.gov, House Resolution 1472; Senate Judiciary markup (Politico, June 27, 2025).

- Legal commentary: Prof. Elaine Rosenberg (Georgetown Law); Campaign Legal Center report on judicial bond clause.

- Budget & economic impact: CBO estimates; White House CEA projections via Time, Reuters, and Washington Post.

- Healthcare effects: AP News, The Guardian, CBS News analysis of Medicaid and ACA subsidy changes.

- Lobbying & campaign finance: OpenSecrets.org, 2025 Q1 lobbying reports, donor tracking for oil, pharma, and tech industries.

- Media insights: Reuters, NPR, Politico, The Daily Beast, Vanity Fair, NYMag, The Guardian (June 2025 coverage).

- Public reactions: Senate statements (C-SPAN); tweets from @SenAlexPadilla, @ACLU, @EFF.

- Image sources: AP News protest photo, Reuters Capitol dome image, Le Monde corridor photo, Al Jazeera healthcare protester, Michigan Advance legislative graphics.