Meta’s Q2 2025 Earnings: What’s Fueling the 12% Stock Surge?

Dive into Meta's blockbuster Q2 2025 earnings. We analyze the 12% stock surge driven by a groundbreaking AI strategy, new tools like Llama 4, and what this signals for the entire tech sector and investors. Is this the new face of Big Tech?

Written by Lavanya, Intern, Allegedly The News

MENLO PARK, Calif., July 30, 2025

In a stunning display of financial power that silenced skeptics and electrified Wall Street, Meta Platforms ($META) saw its stock price surge over 12% in after-hours trading Wednesday. The catalyst was a second-quarter earnings report that didn’t just beat expectations, it obliterated them. But this wasn’t just a story of strong ad sales; it was the definitive coronation of Meta’s aggressive, all-in strategy on Artificial Intelligence, transforming the company from a social media giant into a vertically integrated AI powerhouse.

For years, investors punished Meta for its costly and abstract metaverse pivot. Today, the narrative has fundamentally shifted. The billions poured into AI are no longer a research expense but the engine of a newly efficient, hyper-profitable machine.

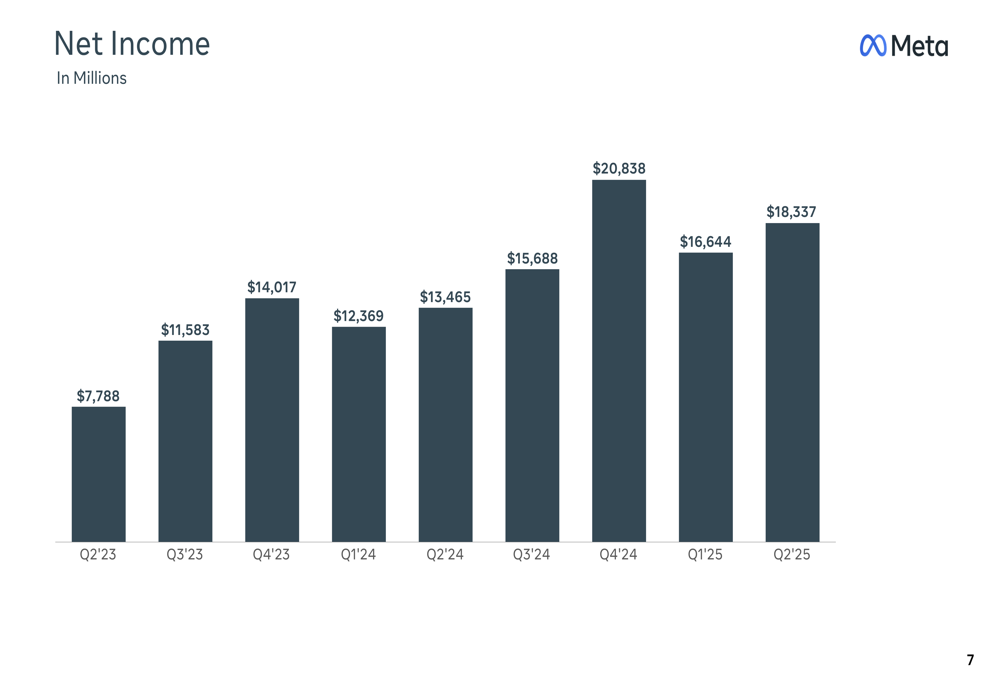

The Numbers Don't Lie: A Look Inside the Q2 Beat

Meta’s Q2 2025 performance paints a clear picture of dominance.

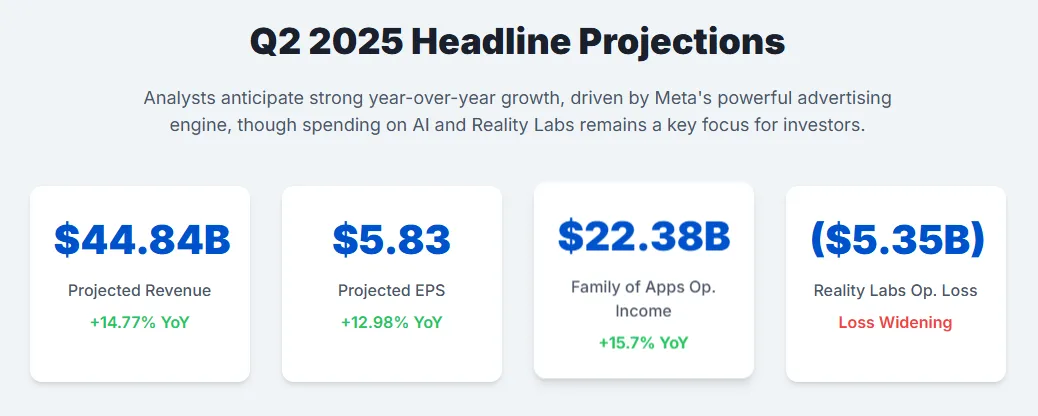

- Total Revenue: $45.2 billion, a 25% year-over-year (YoY) increase that soared past analyst consensus of $42.5 billion.

- Earnings Per Share (EPS): $5.85, crushing Wall Street’s expectation of $5.22. This represents a monumental 40% jump in profitability YoY.

- Daily Active People (DAP): The total number of unique users across the Family of Apps (Facebook, Instagram, WhatsApp, Messenger) hit a record 3.3 billion.

- Ad Impressions: Surged by a staggering 32% YoY across the Family of Apps. While the average price per ad saw a slight decrease of 4%, the massive volume more than compensated, indicating overwhelming demand from advertisers.

- Family of Apps Revenue: This core segment generated $44.7 billion in revenue, proving the health and continued growth of Meta's primary business.

- Reality Labs Operating Loss: The division responsible for the metaverse posted a loss of $3.6 billion. While still a massive number, it was celebrated by investors as it was smaller than the projected $4 billion loss and marked a YoY improvement in capital discipline.

The key takeaway is twofold: Meta’s core advertising business is not just healthy, it’s accelerating thanks to AI. Simultaneously, the company is successfully trimming the fat from its speculative Reality Labs division, presenting a narrative of disciplined spending on the future, funded by an incredibly profitable present.

From Metaverse Misstep to AI Masterstroke

- October 2021 - December 2023: The Metaverse Winter. The company rebrands from Facebook to Meta Platforms, signaling a multi-billion-dollar bet on the metaverse. Investors react with extreme skepticism as Reality Labs' losses mount, user growth stagnates, and the stock price plummets. The vision feels distant and disconnected from the core business.

- 2024: The "Year of Efficiency." Facing immense pressure, CEO Mark Zuckerberg initiates massive layoffs and a company-wide restructuring. The focus shifts from speculative hiring to lean execution. Crucially, the rhetoric begins to pivot from the metaverse to the more immediate and practical applications of AI within the existing product ecosystem.

- Early 2025: AI Seeds Begin to Sprout. The release of the open-source Llama 3 model earns goodwill from the developer community. More importantly, the AI-powered “Advantage+” ad-buying tools begin showing remarkable results, leading to higher conversion rates for advertisers and whispers of a turnaround.

- July 30, 2025: The AI Harvest. The Q2 earnings report serves as the ultimate vindication. The "Year of Efficiency" combined with the AI product integration creates a perfect storm of revenue growth and margin expansion, cementing AI as the new centerpiece of the Meta story.

The AI Arsenal: Unpacking Meta's Newest Weapons

- Llama 4: The Open-Source Behemoth. Meta announced the impending release of Llama 4, its next-generation large language model. Unlike previous iterations, it is fully multimodal, capable of understanding and generating not just text, but also high-fidelity audio, video, and 3D assets. By keeping it open-source, Meta continues to crowdsource innovation and position itself as the foundational platform of the AI ecosystem, a stark contrast to the closed models of Google and OpenAI.

- Advantage+ Hyper-Targeting. The secret sauce behind the ad revenue explosion. This new AI layer moves beyond simple demographic targeting. It analyzes trillions of data points in real-time to predict user intent, serving ads for products users may not even know they want yet. An official statement in the earnings call noted, "Our AI models can now forecast purchase intent with 40% greater accuracy than our systems from just 18 months ago, delivering unparalleled ROI to our advertising partners."

- Creator Studio AI Suite. A powerful new set of tools for influencers and businesses. This suite can auto-generate video scripts, suggest trending audio, perform complex video edits from text prompts, and even create short-form video content from a single image or product link. This democratizes high-quality content creation, keeping creators locked into the Instagram and Facebook ecosystem.

- Horizon OS and Metaverse AI Agents. While Reality Labs losses narrowed, the ambition didn't. Meta announced Horizon OS, a dedicated operating system for its virtual and augmented reality headsets, which it will license to other hardware makers like Lenovo and ASUS. To populate these virtual worlds, they unveiled AI Agents—autonomous, AI-driven characters that can interact with users, act as tour guides, or serve as game opponents, making the metaverse feel more alive and less empty.

Wall Street Reacts: "A Watershed Moment"

Gene Munster, a veteran tech analyst at Deepwater Asset Management, was quoted by Bloomberg as saying, “This is a watershed moment. Meta has successfully weaponized its data and distribution with AI. They are no longer just participating in the AI race; they are arguably leading it in terms of actual, realized profit. The metaverse is now a call option, not the core thesis.”

An internal note from a Morgan Stanley analyst reportedly stated, “Meta’s AI-driven ad engine is creating a moat that competitors will find nearly impossible to cross. The feedback loop is perfect: more users create more data, which builds better AI, which delivers better results for advertisers, who then spend more money. It’s a self-perpetuating profit cycle.”

Critical Assessment: Will This AI Bet Pay Off or Repeat Past Misfires?

It's tempting to get swept up in the hype, but it's crucial to ask: is this sustainable, or is it another metaverse-style illusion?

The evidence suggests this time is different. The key distinction is monetization. The metaverse was a massive capital expenditure with a theoretical, decade-long path to profitability. The AI pivot, by contrast, is a margin-enhancer for Meta's existing, trillion-dollar ad business. It’s not about building a new world from scratch; it’s about making the current one hyper-efficient.

However, risks remain. Regulatory bodies in the EU and US are already scrutinizing the "black box" nature of AI-driven ad targeting. The immense energy consumption required to train models like Llama 4 presents both environmental and cost challenges. And finally, the public's trust, already fragile, could be shattered by the potential misuse of advanced AI tools for generating misinformation or deepfakes.

Meta's aggressive push will pay off financially in the short-to-medium term. The long-term success will depend on its ability to navigate the monumental ethical and regulatory storms it is currently brewing.

What Happens Next? The Road Ahead for Meta & Big Tech

- For Meta: The company has set an incredibly high bar for itself. Investors will now expect sustained growth and continued innovation. The key metric to watch in Q3 and Q4 will be whether the Reality Labs losses continue to shrink while Family of Apps revenue continues its AI-fueled ascent.

- For Competitors: Google, Amazon, and even TikTok are now under immense pressure to demonstrate a clearer path to AI monetization. It’s no longer enough to talk about having powerful AI; they must show how it translates to the bottom line.

- For Investors: The tech investment landscape for the latter half of 2025 will be defined by AI profitability. Companies that can integrate AI to enhance their core business, as Meta has, will be rewarded. Pure-play AI companies with high valuations but no clear path to profit may face a reckoning. Investment tips for tech-focused portfolios now must include a heavy emphasis on a company's "AI execution" rather than just its "AI vision."

The Flywheel of Supremacy

Meta’s Q2 2025 earnings are more than a financial report; they are a thesis statement for the next era of technology. The company’s triumph is not merely in building powerful AI, but in creating a closed-loop, self-perpetuating flywheel.

Its 3.3 billion daily users provide an ocean of data. This data trains the AI to become smarter and more predictive. The smarter AI delivers unprecedented results for advertisers, who then pour more money into the platform. This revenue funds more advanced AI research and keeps the core products free, attracting even more users.

This isn't a pivot from social media to the metaverse. It's the final-stage evolution of a social media company into an AI-driven life-curation engine. Meta isn't just selling ads anymore; it's selling unparalleled efficiency and predictability, and in doing so, has redefined what it means to be a dominant force in the 21st century.

Strategy & Society: Are We Prepared?

Meta's success raises profound questions that extend far beyond its stock price. How we answer them will shape our digital future.

- The Future of Work and Creativity: With AI suites that can generate scripts, videos, and ad campaigns, what happens to the jobs of junior marketers, graphic designers, and content creators? Is this a tool for empowerment or a force for displacement?

- The Nature of Reality and Trust: As AI agents populate virtual worlds and AI tools generate hyper-realistic content, how do we maintain a shared sense of reality? What new forms of verification and digital identity will be necessary to combat misinformation and deepfakes on an industrial scale?

- Monopoly and Power: By successfully fusing its massive user base with a leading AI engine, is Meta building an unassailable competitive moat? What are the long-term implications for market competition and innovation if one company's data advantage becomes insurmountable?

- The Ethics of AI Persuasion: If Advantage+ Hyper-Targeting can predict our desires before we are conscious of them, where is the line between effective advertising and psychological manipulation?

Sources

Meta Platforms Q2 2025 Earnings Report, SEC Filings, Bloomberg Technology, The Wall Street Journal, investing.com.