More Jobs, More Growth? Why Canada’s Labor Market Could Be Turning a Corner

Discover why Canada added 83k jobs in June 2025, what sectors led the rally, and whether this signals real GDP growth or a seasonal surge.

TORONTO, July 12, 2025

Unpacking the Surprise Employment Surge

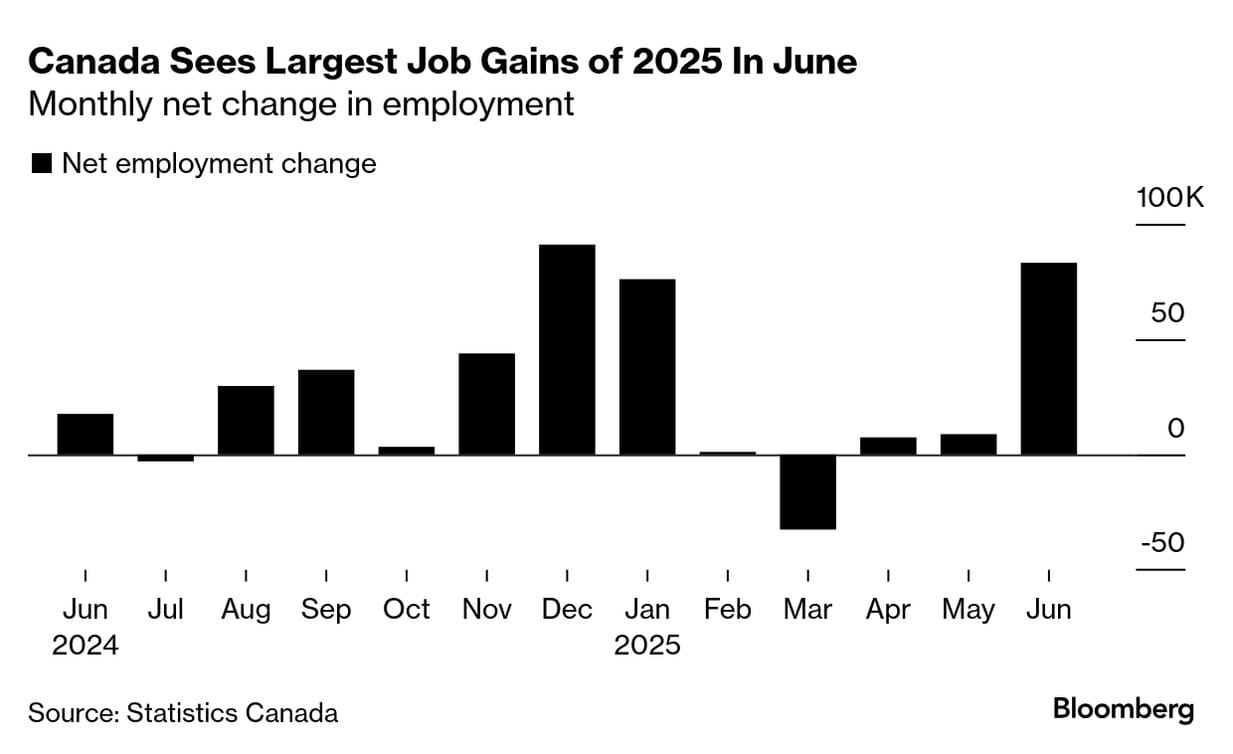

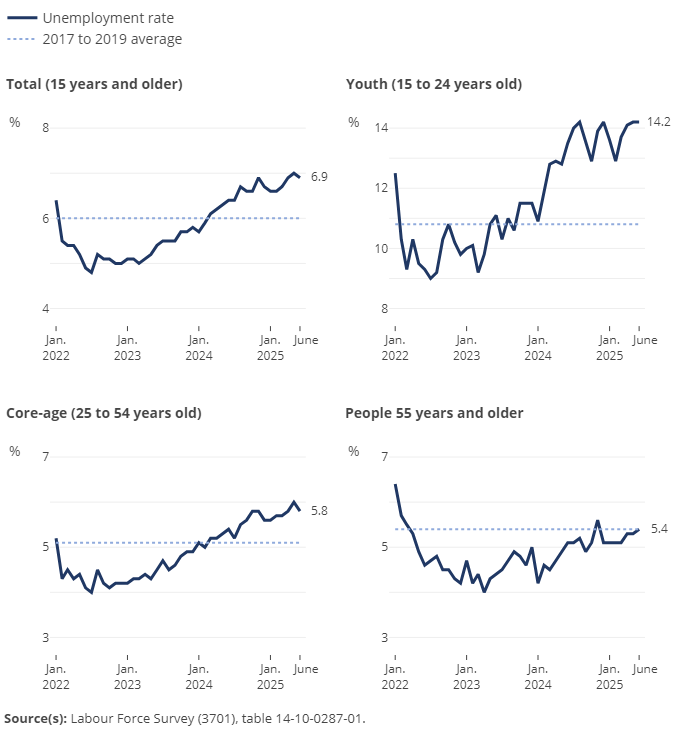

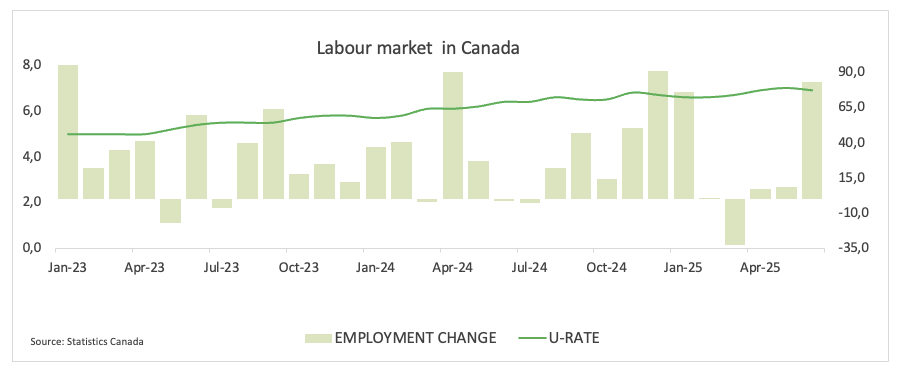

Canada’s June 2025 Labour Force Survey surprised analysts with a net addition of 83,100 jobs, much higher than the expected range of 25,000 to 30,000. The unemployment rate dropped to 6.9% from 7.0%.

Key contributors:

- Wholesale & Retail Trade: +34,000

- Healthcare & Social Assistance: +16,700

- Manufacturing: +10,500

- Construction also showed notable gains.

Part-time roles made up about 84% of all new job creation. This looks good on paper but deserves closer examination.

Why Consumers Might Start Feeling Better

Jobs drive consumer behavior. More people working means they are likely to spend more on housing, durable goods, and services. Indeed, Ivey PMI data showed economic activity expanding to 53.3 for June, indicating growth. Early signs suggest:

- Consumer sentiment is rising.

- Retail sales are improving.

- The services sector is recovering.

If the surge in employment continues, we can expect a noticeable rise in GDP in Q3, thanks to stronger household spending.

Sectors Leading the Gains: A Closer Look

Here’s a breakdown, based on information from Robert Half and Reuters:

Wholesale & Retail: +33,600 jobs, the best month since December.

Healthcare & Social Assistance: +17,000, fueled by public hiring and ongoing investments.

Manufacturing: +10,500, a welcome recovery after the spring downturn.

Construction: +7,600 jobs, due to infrastructure and housing projects.

These sectors match Canada’s GDP composition: construction around 7%, healthcare about 6.6%, and manufacturing close to 10%. A balanced recovery across different areas is a positive indicator.

Is This a Structural Shift or Temporary Spike?

Monthly labour data can be quite unpredictable. RBC Economics noted the 83,000 job increase in June as a high since December, but warns that fluctuations are still likely. Indeed, the first quarter saw quick hires followed by slowdowns or reversals.

However, compared to earlier this year, when hiring stalled due to tariffs and global uncertainty, June’s rebound shows stronger underlying resilience, especially in sectors less affected by trade.

The Youth & Entry-Level Lens

There are signs of improvement among younger people:

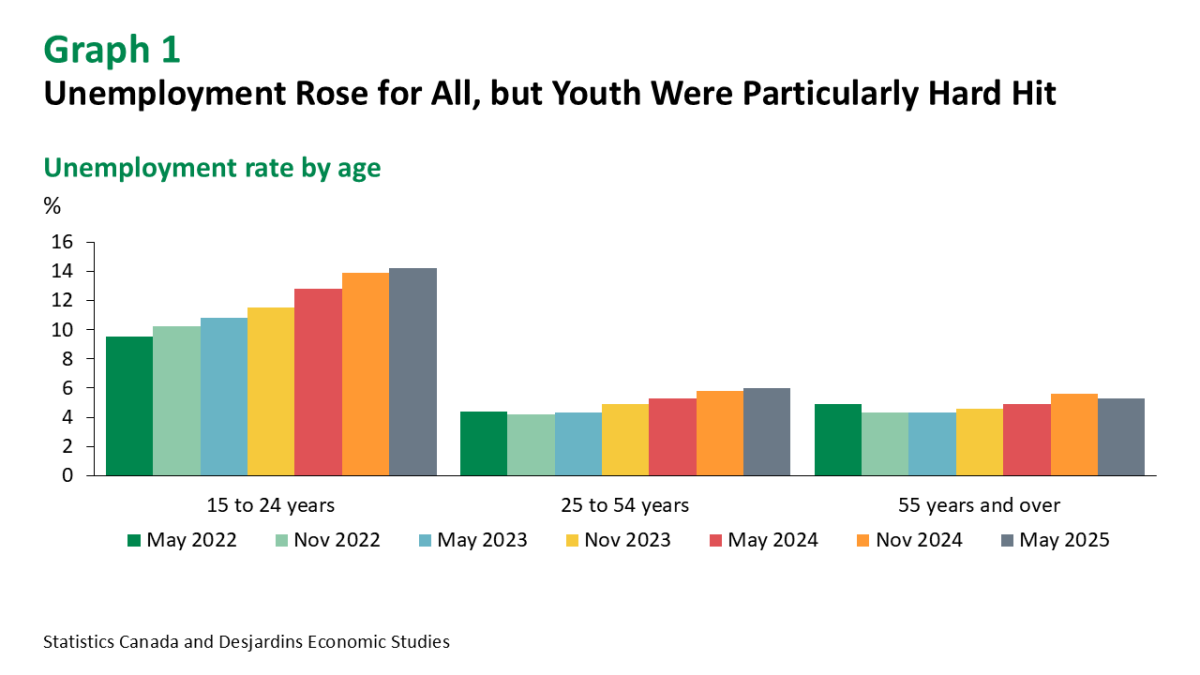

- Youth (15 to 24) job numbers stabilized, though unemployment remains high at around 14%, the highest June rate since 2009.

- Student unemployment stayed elevated at about 17.4%, reflecting delays in summer job hiring.

- Interestingly, prime-age workers (25 to 54) led the job gains, indicating a recovery in core labor demand.

While entry-level jobs may lag, the stabilization among younger groups is encouraging.

Wage Dynamics, Inflation, and the BoC

Wage growth in June was around 3.2% to 3.5% year-over-year, down from over 5% during the pandemic. Importantly, this wage growth has not caused inflation; the current consumer price index is around 2.6%, moving closer to the Bank of Canada’s target.

With inflation easing and employment gains stabilizing, the Bank of Canada may decide to wait before making any rate cuts. Analysts now consider rate cuts in July unlikely, with futures markets pushing those decisions into later in 2025.

GDP Growth: Taking a Deeper Dive

Desjardins estimates Q2 growth to be near zero, with some upside potential thanks to job creation. Meanwhile, the OECD predicts a temporary slowdown in 2025, followed by a gradual recovery into 2026.

Canada’s next challenge is turning labor market strength into lasting growth through smart fiscal policy, decisive rate cuts, or complex trade agreements.

Risks & Regional Disparities

National figures can hide regional differences:

- Newfoundland & Labrador: unemployment is around 9.9%, with ongoing challenges.

- Manitoba & Alberta: robust labor markets with unemployment around 5 to 6%.

- Ontario: modest job gains, but the auto sector still drags.

- British Columbia: unemployment is around 5.6%, among the lowest in the country.

The divide among youth and regions could hinder national progress if not addressed.

Entrepreneurs, SMEs & Hiring Pressures

Tight labor markets benefit workers but make recruitment difficult for small and medium-sized enterprises (SMEs). Headline job numbers only tell part of the story:

- Small businesses struggle to fill frontline positions, particularly in retail, hospitality, and health.

- Rising wage costs may reduce profit margins.

- Skill shortages increase demand for experienced hires, especially in technology and healthcare.

Recommendations for SMEs:

Improve retention through training, benefits, and flexible work arrangements.

Utilize underused labor pools—youth, immigrants, and older workers.

Consider automation to reduce labor challenges.

Beyond the Headlines: Digging One Layer Deeper

Job Quality vs Quantity

Are the new positions sustainable, permanent, and fairly paid? High part-time numbers indicate some may be seasonal or entry-level roles, not long-term careers.

Trade Shock Recovery

June’s job gains may reflect a thaw in hiring freezes from the spring caused by tariffs. Whether this trend holds as global uncertainty arises is uncertain.

Productivity and GDP Elasticity

If job growth increases labor productivity, Canada could improve its lackluster trends. The key is securing quality jobs tied to innovation and infrastructure.

New Insights: Making Sense of Complex Signals

There is a confidence feedback loop: jobs lead to spending, which boosts growth, leading to more hiring and increased confidence.

The Bank of Canada must balance its rate policy, managing inflation while weighing growth risks.

There is a chance for structural reforms—like in immigration, training, and housing—to complement labor strength.

The focus should be on smart growth, channeling wage gains and hiring power toward productivity-driven expansion.

Final Reflections: Is Canada’s Recovery Real?

Is this a temporary rebound? June might reflect a bounce back from a slow spring, and data volatility is a real concern.

Is it a structural shift? Changes in hiring trends across key age groups, sectors, and wage conditions suggest something deeper is happening.

Is there a policy turning point? Labor strength offers time and credibility for policy changes, provided inflation remains stable.

Ultimately, Canada may be on a path to a smooth landing, allowing gradual monetary easing without sudden inflation spikes—a careful balance to maintain.

What’s the Real Story?

Is Canada’s impressive June job report the beginning of lasting economic growth, or just a brief surge hidden by volatility and seasonal summer hiring? How should policymakers, business leaders, and job seekers interpret June’s data—overhyped optimism or a promising turning point?

Sources

- Labour Force Survey, June 2025 – Statistics Canada (Statistics Canada+1Indeed Hiring Lab+1)

- Recruitment breakdown – Robert Half Canada

- Sector analysis – Reuters, FXStreet, BNN Bloomberg

- Wage & inflation data – Desjardins

- Macro context – OECD, Bank of Canada benchmarks

- Labour Force Survey (3701), Statistics Canada, Table 14-10-0287-01

- Bloomberg via Statistics Canada

- Statistics Canada and Desjardins Economic Studies