PM Modi’s Bold Trade Move: How the UK-India Pact Will Shape Global Economics

PM Modi and UK PM Starmer sign landmark UK-India Free Trade Agreement in London, poised to redefine global economics post-Brexit. A bold move amidst rising protectionism, set to double trade to $120B by 2030, boosting "Make in India" and UK investments.

Written by Lavanya, Intern, Allegedly The News

LONDON, July 25, 2025

In a strategic manoeuvre set to redefine post-Brexit Britain's global trade landscape and elevate India's economic standing, Prime Minister Narendra Modi and UK Prime Minister Keir Starmer today officially signed the much-anticipated UK-India Free Trade Agreement (FTA). This landmark pact, years in the making, is more than just a reduction of tariffs; it's a bold statement of intent, positioning both nations as indispensable global trade powerhouses in an increasingly fragmented world.

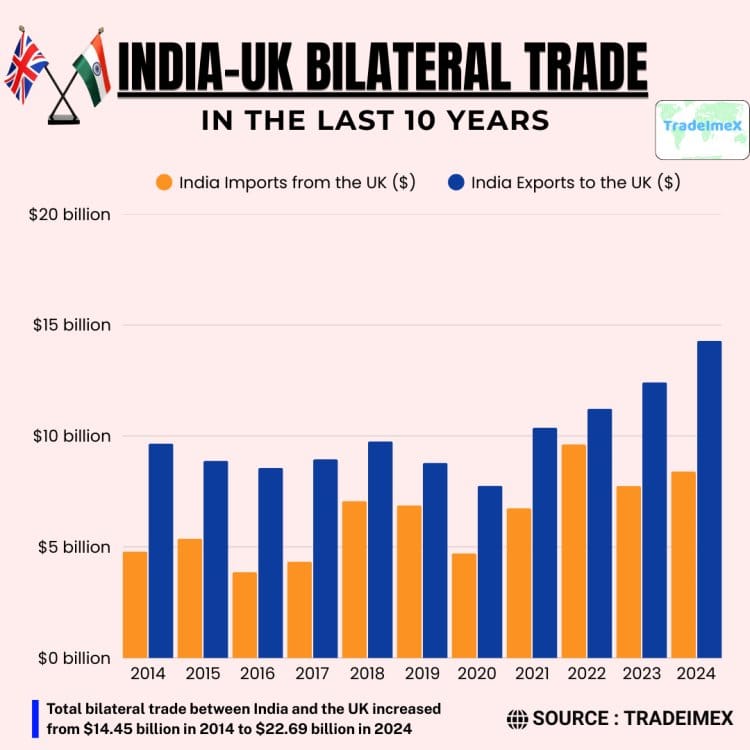

The deal, which aims to double bilateral trade to an ambitious $120 billion by 2030, is a testament to India's burgeoning economic clout and the UK's determined pivot towards dynamic, high-growth markets beyond Europe. As global protectionism rears its head, this FTA emerges as a beacon of open trade, promising shared prosperity and deeper strategic alignment.

A Post-Brexit Power Play: India and the UK as Global Trade Powerhouses

The UK-India FTA is a significant step in the UK's post-Brexit strategy, aiming to forge new, robust trade relationships with rapidly growing economies. India, poised to become the world's third-largest economy by 2030, is a natural fit for this ambition. For the UK, the deal offers enhanced access to a massive and expanding consumer market, while for India, it provides a crucial gateway to developed Western markets and advanced technologies.

This agreement positions both nations as key players in shaping future global trade norms. The comprehensive nature of the pact, extending beyond goods to services, digital trade, and intellectual property, signals a mature and multifaceted partnership. It demonstrates the UK's commitment to diversifying its trade portfolio beyond its traditional European partners and India's readiness to engage in high-quality, comprehensive trade agreements.

Unpacking the Deal: Key Sectors, Tariff Cuts, and Mutual Gains

The newly signed FTA is designed to deliver substantial mutual gains through significant tariff reductions and regulatory easing across a wide array of sectors.

For India

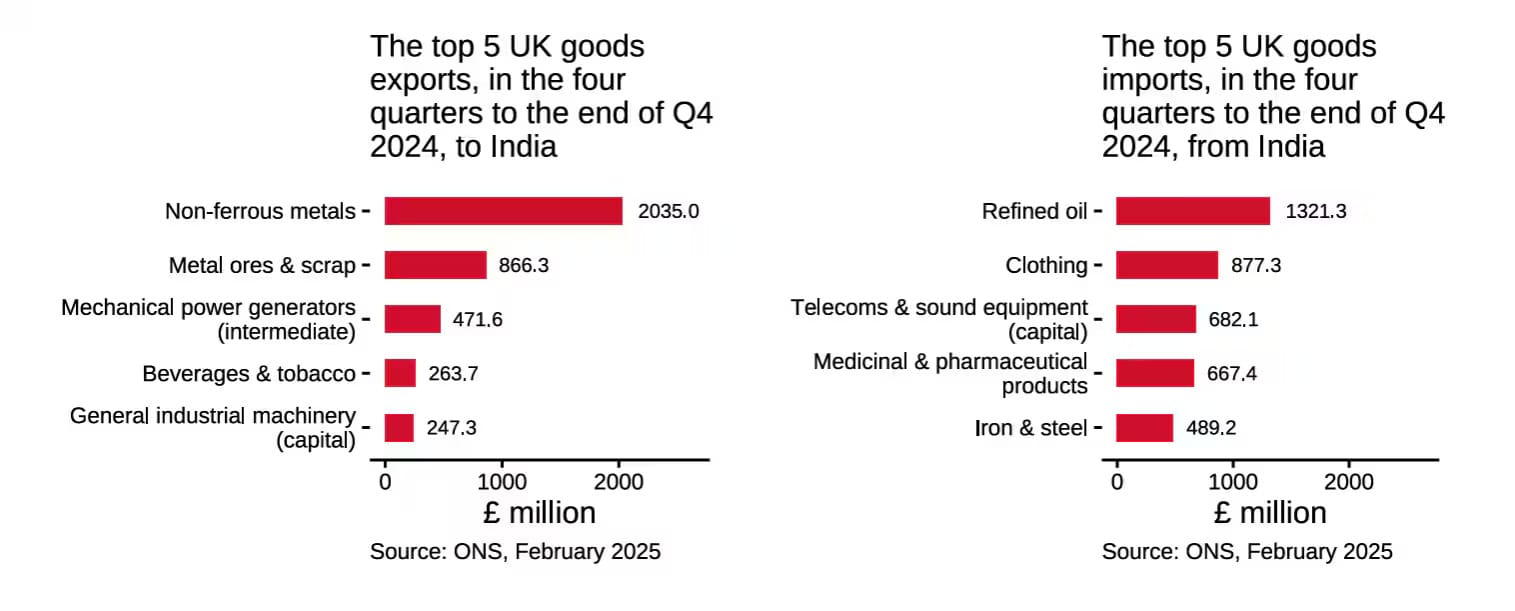

- Duty-Free Access for 99% of Exports: This is a game-changer for Indian goods. Sectors like textiles and clothing (from 12%), marine products (from 20%), chemicals (from 8%), and base metals (from 10%) will see tariffs eliminated, making Indian products far more competitive in the UK market.

- Processed Food Industry Boost: Duties on 99.7% of processed food items, previously as high as 70%, have been entirely removed. This opens vast opportunities for Indian agricultural and processed food exports, including spices like turmeric, pepper, and cardamom, and food items like mango pulp and pickles.

- Gems and Jewellery: With UK importing $3 billion worth of jewellery annually, India's exports in this sector are expected to double in 2-3 years due to zero-duty access.

- Pharmaceuticals: While a smaller number of tariff lines are covered, zero-duty access for Indian generics to the UK's $30 billion pharmaceutical import market is strategically vital.

- Engineering Goods, Auto Components, and Electronics: These sectors will also benefit from duty-free treatment, with projections of significant export growth.

For the UK

- Reduced Tariffs on Key Imports: India will significantly lower its import duties, with an average levy on UK products dropping from 15% to 3%. Around 90% of tariff lines will see reductions, and 85% will become entirely tariff-free over a decade.

- Whisky: Import duties on Scotch whisky and gin will drop from 150% to 75% immediately, further reducing to 40% over ten years. This gives UK producers a substantial competitive edge.

- Cars: Tariffs on UK-manufactured cars, including luxury brands like Jaguar and Land Rover, will decrease drastically from over 100% to just 10% under quota limitations. This makes premium British vehicles more affordable for Indian consumers.

- Cosmetics, Chocolates, Biscuits, Medical Devices: These products will also become more affordable for Indian consumers due to boosting market access for UK firms.

- Public Procurement: UK firms will gain guaranteed and unprecedented access to India's vast federal procurement market, worth at least £38 billion annually.

- Financial and Professional Services: The agreement includes a dedicated chapter ensuring UK financial services companies are treated on an equal footing with domestic suppliers, alongside strong commitments on Software and IT services.

Industry Impact: Winners and Short-Term Challenges

The FTA is poised to create a wave of opportunities, but also some adjustment periods.

Industries that will benefit the most

- India: Textiles, leather goods, footwear, marine products, gems and jewellery, pharmaceuticals (generics), processed foods, engineering goods, automotive components, IT and software services. These sectors, often labour-intensive, will see increased production and export opportunities, leading to job creation.

- UK: Scotch whisky, premium automobiles, medical devices, advanced manufacturing, financial services, and certain high-end consumer goods like chocolates and cosmetics.

Industries that may face short-term challenges

- India: Some domestic industries that previously enjoyed high protective tariffs might face increased competition from cheaper UK imports. While the agreement has taken care to protect sensitive sectors like dairy, vegetables, and apples, some segments might need to innovate and enhance competitiveness.

- UK: Conversely, certain UK sectors that rely on high tariffs against Indian imports may see an adjustment as these barriers are lowered. However, the overall emphasis is on complementary trade rather than direct competition.

Economic Ripple Effects: Employment, Startups, and Capital Flow

The UK-India FTA is expected to have far-reaching economic implications beyond direct trade benefits.

- Employment: The agreement is projected to significantly boost job opportunities in labour-intensive Indian sectors like textiles, footwear, and food processing due to increased export demand. The UK also anticipates the creation of thousands of British jobs as Indian firms expand their UK operations and new export opportunities emerge. The Social Security Agreement, exempting Indian professionals in the UK for up to three years from paying into the British social security system, is expected to save Indian workers and firms around ₹4,000 crore annually and facilitate greater mobility.

- Startups: For startups in both countries, the FTA presents a conducive environment for growth and collaboration. Indian tech startups can more easily access the UK market, while British tech firms gain deeper penetration into India's rapidly digitalizing economy. Provisions for digital trade and intellectual property protection will encourage innovation and cross-border partnerships. The emphasis on e-commerce and digital tools within the FTA will particularly benefit MSMEs looking to expand internationally.

- Capital Flow: The deal is set to encourage foreign direct investment (FDI) in both directions. The UK announced £6 billion of new investment and export wins for Britain, concurrent with the FTA signing, creating over 2,200 UK jobs. India's commitment to lower barriers and provide market access is designed to attract British investments into Indian manufacturing, aligning with the "Make in India" initiative. Similarly, Indian businesses will find it easier to invest and establish a presence in the UK.

Political Framing vs. Economic Deliverables

The signing of the UK-India FTA is a significant political win for both Prime Minister Modi and Prime Minister Starmer, demonstrating their commitment to strengthening bilateral ties and securing economic advantages in a complex global environment. The political framing emphasizes the "shared prosperity" and "strategic partnership" aspects, highlighting the deal as a success story of global cooperation.

From an economic deliverables perspective, the pact undeniably offers tangible benefits:

- Clear Tariff Reductions: The specific percentage cuts on key products like whisky, cars, textiles, and processed foods are concrete and measurable.

- Market Access Commitments: Guaranteed access for UK firms to India's public procurement market and for Indian exports to the UK market are significant economic wins.

- Service Sector Liberalization: The inclusion of chapters on financial services, IT, and business mobility goes beyond traditional goods-focused FTAs, reflecting the modern economic strengths of both nations.

While the political narrative focuses on the broader strategic alignment, the economic deliverables provide a solid foundation for future growth and trade volume increases. The immediate and phased tariff reductions offer clear pathways for businesses to capitalize on the new regime.

Retail Costs: Cars, Whisky, Pharma, and Tech

The tariff reductions will directly impact retail costs for consumers in both nations.

- Cars (India): The dramatic drop in tariffs on UK-made cars from over 100% to 10% (under quota) means luxury vehicles like Jaguars and Land Rovers will become significantly more affordable in India, potentially increasing their market share.

- Whisky (India): With duties on Scotch whisky and gin plummeting from 150% to 75% immediately and then to 40% over ten years, British spirits will become considerably cheaper for Indian consumers, likely boosting demand.

- Pharma (UK): Zero-duty access for Indian generic drugs into the UK market could lead to more affordable pharmaceutical products for British consumers, enhancing access to essential medicines.

- Tech (UK and India): Products like smartphones, inverters, and optical fiber cables will benefit from zero-duty treatment in the UK, potentially reducing costs for British consumers. Similarly, British tech products entering India may become more competitive due to reduced tariffs.

Targeting Small Businesses and Tech Entrepreneurs

This FTA is particularly significant for small businesses and tech entrepreneurs looking to expand internationally.

- Small Businesses (India): Indian MSMEs, especially in labour-intensive sectors like leather, footwear, textiles, and handicrafts, will gain duty-free access to the UK's $23 billion market. This provides a strong advantage over competitors from non-FTA countries and opens up vast new export opportunities. The agreement's encouragement of digital tools and e-commerce will further empower these businesses to reach a broader international audience.

- Tech Entrepreneurs (Both Nations): The robust chapters on digital trade, intellectual property, and services will facilitate easier cross-border operations for tech startups. Indian tech professionals are expected to benefit from eased mobility provisions, fostering collaboration and knowledge exchange. British tech companies will find it simpler to set up operations or provide services in India, tapping into its large talent pool and growing digital economy.

Mobility, Work Visas, and Student Exchange

Beyond goods and services, the FTA addresses critical aspects of people-to-people movement.

- Mobility and Work Visas: The agreement includes provisions for temporary business travel, locking in access for professionals in sectors like engineering and accounting. While it doesn't create new visa routes or paths to permanent settlement, it ensures existing access is guaranteed and, in some areas, expanded beyond baseline WTO commitments. The social security agreement is a significant financial benefit for Indian professionals. An estimated 1,800 Indian chefs, yoga instructors, and classical musicians will also be allowed temporary entry to the UK.

- Student Exchange: While direct student exchange agreements are not a primary focus of the FTA itself, the broader strategic partnership fostered by the deal is likely to encourage greater academic collaboration and student mobility between the two countries. The UK remains a popular destination for Indian students, and stronger bilateral ties could lead to further facilitations in educational pathways.

The UK’s Post-Brexit Global Trade Strategy: A Pivot Towards India

The UK's pivot towards India is a cornerstone of its post-Brexit global trade strategy. Having left the European Union, the UK is actively seeking to forge new, independent trade deals with fast-growing economies around the world. India, with its massive market, democratic values, and shared historical ties, represents a highly attractive partner.

This FTA demonstrates the UK's commitment to its "Indo-Pacific tilt" – a strategic reorientation towards the region. By securing a comprehensive deal with India, the UK signals its intent to be a significant player in the economic dynamics of Asia, diversifying its trade relationships and reducing reliance on the European single market. This move aligns with the UK's broader ambition to become a global trading nation, leveraging its strengths in services, technology, and high-value manufacturing.

Immediate Tariff Relief and Regulatory Easing: Key Sectors

The agreement outlines immediate tariff relief and regulatory easing for several critical sectors:

Immediate Tariff Relief for Indian Exports to the UK:

- Marine Products: Duty-free access immediately.

- Textiles and Clothing: Duty-free access immediately.

- Chemicals: Duty-free access immediately.

- Base Metals: Duty-free access immediately.

- Processed Food Items: 99.7% of items become duty-free immediately.

Immediate Tariff Relief for UK Exports to India:

- Scotch Whisky & Gin: Duties halved from 150% to 75% immediately.

- Cars: Tariffs reduced from over 100% to 10% immediately (under quota).

- Cosmetics, Chocolates, Biscuits, Medical Devices: Average tariffs will drop from 15% to 3% immediately.

Regulatory Easing:

- Services: Mutual recognition of professional qualifications and easier temporary movement for service providers.

- Digital Trade: Provisions to ensure the free flow of data with trust, bolstering e-commerce and digital services.

- Public Procurement: Guaranteed access for British firms to bid for federal-level contracts in India.

Comparative Advantage: India's FTA Network

India has been actively pursuing FTAs as a core part of its economic strategy, and the UK pact stands as a significant addition to its growing network.

- Compared to the UAE (CEPA) and Australia (ECTA), the UK-India FTA is generally considered more comprehensive, especially in its depth of commitments on services, digital trade, and intellectual property. While the UAE and Australia FTAs focused heavily on goods trade and specific sectors, the UK deal delves into more nuanced areas, reflecting the advanced nature of both economies. For instance, the detailed provisions on public procurement and financial services in the UK deal are more extensive than in previous agreements.

- Compared to ASEAN, India's trade pacts with ASEAN are broader in scope, covering a larger bloc of nations. However, the UK-India FTA offers a targeted approach with a developed economy, focusing on specific high-value sectors where both countries have a comparative advantage. The UK deal also represents a deeper integration of regulatory frameworks in certain areas compared to the broader, often less granular, ASEAN agreements.

This agreement aligns with India's long-term trade volume targets. The aim to double bilateral trade to $120 billion by 2030 is ambitious but achievable given the broad scope of the agreement and the complementary strengths of the two economies.

Incentivizing "Make in India" and British Investments

The FTA is designed to strongly incentivize India's "Make in India" goals and attract British investments into Indian manufacturing. By securing easier market access for Indian goods in the UK, the deal provides a strong impetus for domestic production. Companies manufacturing in India will find it more lucrative to expand operations to meet increased demand from the UK.

Furthermore, the reduced tariffs on raw materials and intermediate goods imported from the UK will lower production costs for Indian manufacturers, making "Make in India" more competitive globally. British companies, in turn, will be encouraged to invest directly in Indian manufacturing facilities to leverage lower production costs and access India's vast domestic market and onward export opportunities. The investment chapter within the FTA is crucial here, providing a more stable and predictable environment for cross-border capital flows.

India's Broader Diplomatic and Economic Agenda

This deal fits seamlessly into India's broader diplomatic and economic agenda.

- Diversification of Trade: India is strategically diversifying its trade relationships to reduce reliance on any single market or region. The UK, as a major global economy, is a key partner in this diversification.

- Global Leadership: By concluding a high-standard FTA with a developed economy like the UK, India burnishes its credentials as a responsible and active player in global trade, signaling its commitment to open markets.

- Counterbalancing Geopolitical Shifts: The pact can be seen as part of India's strategy to strengthen ties with like-minded democracies, particularly in the context of evolving geopolitical dynamics and supply chain resilience.

- "Amrit Kaal" Vision: The economic benefits, including job creation, increased manufacturing, and technological collaboration, align with India's long-term vision of becoming a developed nation by 2047.

A Success Story Amidst Rising Protectionism

In an era characterized by rising global protectionism, trade wars, and supply chain disruptions, the UK-India FTA stands out as a significant success story. At a time when many nations are raising trade barriers, this agreement demonstrates a shared commitment to liberalized trade and economic cooperation. It sends a powerful message that collaboration and open markets can still drive growth and prosperity, even in challenging global circumstances. This deal is not merely about economic gains; it's a statement of faith in the power of international cooperation to deliver mutual benefits.

Probing the Pact: Unanswered Questions and Future Trajectories

As the UK-India FTA takes effect, several critical questions for businesses, policymakers, and global citizens demand further consideration to fully grasp its long-term implications and foster truly sustainable growth. How effectively will the agreement's provisions for digital trade and data flow translate into tangible benefits for e-commerce and tech startups, particularly concerning data localization and cybersecurity concerns?

Given the global push for green technologies and sustainable practices, how will this FTA specifically incentivize and support collaborations in renewable energy, circular economy models, and climate-resilient manufacturing between the two nations? What measures will be implemented to ensure that the benefits of increased trade are broadly distributed across all segments of society, preventing potential widening of economic disparities in either country?

Sources

- Official Government Sources (UK & India): Comprehensive Economic and Trade Agreement (CETA)

- Indian Ministry of Commerce & Industry (Mcommerce) / Press Information Bureau (PIB)

- Press Trust of India (PTI) / Reuters / Bloomberg / ANI

- The Economic Times / Times of India / The Indian Express / Financial Express (India)

- NDTV / India Today

- GOV.WALES / GOV.UK

- Industry Associations and Expert Commentary:

- Statements from organizations like the Confederation of Indian Industry (CII), Gem & Jewellery Export Promotion Council (GJEPC)

- Publicly Available Information on Previous FTAs

- Office for National Statistics (ONS), February 2025

- Reuters

- TradeImex historical data