Satoshi Nakamoto: The Unknown Billionaire Behind Bitcoin’s $50 Billion Wallet

Satoshi Nakamoto, the anonymous Bitcoin creator, holds a $130B fortune that’s never moved—fueling theories, market fears, and crypto’s decentralized ethos. Who is he? Why did he vanish? And what happens if he returns? Discover the story behind Bitcoin’s ghost billionaire.

TOKYO, July 14, 2025

The Silent Rise: How a Few Lines of Code Became a Colossal Fortune

In 2008, the world faced a global financial crisis. Big banks were being bailed out. Trust in fiat currency was fading. Amid this chaos, a whitepaper appeared online, written by a pseudonym, "Satoshi Nakamoto." At just nine pages, it introduced Bitcoin, a digital, peer-to-peer form of money that worked without banks, governments, or middlemen.

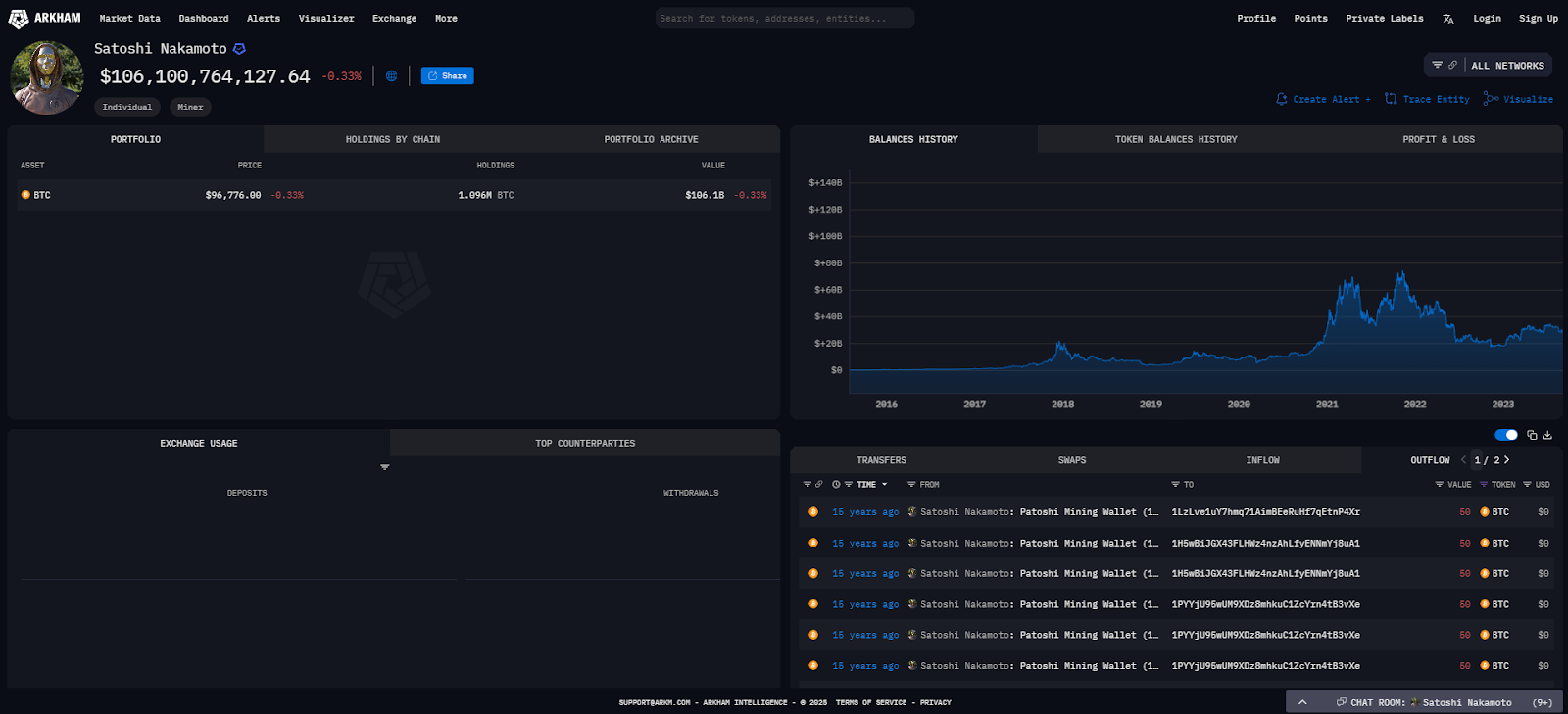

Few realized then that this blueprint was not just innovative; it was an economic time bomb. By mining the first blocks of Bitcoin, Satoshi quietly gained nearly 1.1 million BTC. At that time, it was worth almost nothing. Today, it is valued at over $130 billion, placing the anonymous creator among the top ten richest people on Earth.

There are no Instagram posts, no TED talks, and no covers of Fortune. Just code and a silence that has lasted more than a decade.

Crypto’s Holy Grail: Why Satoshi’s Silence Still Shapes the Industry

Bitcoin is often seen as a system without rulers, governed only by consensus and cryptography. This image falters if its creator becomes visible. Unlike Elon Musk, Jeff Bezos, or Mark Zuckerberg, whose wealth is linked to companies, Satoshi’s fortune remains locked in a mathematically clear state, sitting in a handful of wallets, untouched since 2010. This silence is not mere absence; it is a strategy.

Satoshi didn’t just create a currency; he created a myth. This myth became the ethical foundation of decentralization.

In a space filled with schemes, overexposed founders, and algorithmic failures, his choice to remain silent and not sell or signal has raised Bitcoin beyond simple financial speculation. It has evolved into an ideology.

There are no annual letters to shareholders, no product roadmaps, and no press conferences.

There is only the code and the legend that surrounds it.

The Sleeping Wallets: Why Every Crypto Analyst Watches for a Flicker

The crypto world fears one event: movement in Satoshi’s wallets. These early blocks, mined before Bitcoin had a market price, are believed to belong to him due to distinct patterns in their nonce values. Blockchain analysts have mapped these coins as if they were constellations, tracing the fingerprint of an unseen creator.

Whenever old wallets from the Satoshi era show signs of activity, panic spreads throughout the community. A recent transaction of 20,000 BTC from a decade-old wallet caused an immediate price drop and sparked conspiracy theories on Reddit and X (formerly Twitter). Was it Satoshi testing the waters? Was his private key compromised? Or was it just another early miner cashing out?

Every whisper becomes a headline. Every satoshi, the smallest unit of BTC, moved is examined as if it were evidence from a crime scene.

If Satoshi sells even one coin, the idea of his ideological detachment begins to fall apart. And with it, perhaps the spiritual core of Bitcoin.

Who Is Satoshi Nakamoto? Theories, Suspects, and the Cult of Mystery

After 15 years of intense searching, no clear identity has surfaced. However, several contenders remain in the spotlight:

Hal Finney, the cryptographer who received the first BTC transaction from Satoshi, is a popular figure among supporters. Before he died in 2014, he insisted he was not the creator. Yet his connection to the early project and similar writing style keep the theory alive.

Nick Szabo, inventor of “Bit Gold,” stands out as another strong candidate. Linguistic analysis shows similarities to the Bitcoin whitepaper, and his deep understanding of cryptographic currency predates Bitcoin by ten years.

Dorian Nakamoto, mistakenly identified by Newsweek in 2014, became an unwilling symbol of the mystery. Despite denying involvement, his name alone keeps the theory alive in the public imagination.

Craig Wright, an Australian computer scientist, claims to be Satoshi. However, he has faced repeated legal defeats. Courts have stated he is not the creator and even referred him for possible perjury.

Then there’s the idea that Satoshi isn’t just one person but a small team using a shared pseudonym. A 2022 academic paper published on arXiv suggests consistent British spelling, varied technical expertise, and time zone patterns that imply collaborative authorship from Europe and the U.S.

More fringe theories suggest involvement from the NSA, global financial watchdogs, or even AI-generated code well ahead of its time. But these stories reveal more about our desire for myth than about the truth.

Because maybe it’s not just about who Satoshi is, but what it would mean if we ever found out.

Why This Matters Now: Crypto's Future Is Still Tethered to a Ghost

Bitcoin is not just a currency; it is the foundation of an entire digital economy. From Ethereum to NFTs, from Layer 2 scaling to central bank digital currencies (CBDCs), nearly everything in web3 traces back to Satoshi’s whitepaper.

However, that legacy is fragile. As Bitcoin’s acceptance rises, with ETFs now on Wall Street and countries like El Salvador and Argentina considering Bitcoin as legal tender, the stakes have changed.

Picture this: if Satoshi were to return and transfer even 5% of his holdings, it could destabilize the global market. ETFs would halt. Retail traders would panic. Twitter would explode.

The ghost is powerful, not despite his silence but because of it.

And that ghost now oversees a trillion-dollar industry.

The New Billionaire Order: Satoshi vs. the Tech Titans

Let’s be clear: Satoshi is one of the wealthiest people alive. But unlike traditional billionaires, his wealth isn’t tied to companies, commodities, or political power. It is tied to trust.

Jeff Bezos leads Amazon. His wealth relies on consumer habits, shareholder backing, and global logistics.

Elon Musk navigates Tesla, SpaceX, and X. His empire is heavily connected to public perception and fluctuating assets.

Satoshi Nakamoto needs just one thing: for his coins to stay untouched and for Bitcoin to continue to prosper.

In this way, he represents a new type of wealth—detached, decentralized, and immortal.

He could be dead. He could be watching. He could be no one or everyone.

But his net worth remains intact because the market still believes in the myth.

The Political Time Bomb: What If He Comes Back?

A reappearance would not only stir the markets—it could ignite legal and geopolitical conflicts.

Regulators in the U.S., EU, and China would rush to classify Bitcoin holdings. Would Satoshi owe back taxes? Would he face subpoenas?

Legal claims over intellectual property might arise. Could someone assert ownership of the Bitcoin whitepaper or protocol?

Debates over forks could resume. If Satoshi opposed Taproot or supported another fork, it could divide the Bitcoin community.

Nations might attempt to control or suppress his influence, viewing him both as a threat to monetary sovereignty and a potential economic ally.

The crypto space is unprepared for Satoshi’s return. That’s why his ongoing absence remains one of Bitcoin’s greatest assets.

Rewriting the Rules of Wealth and Power

Satoshi’s real contribution is not just Bitcoin. It is the idea that wealth can exist without visibility. That power can rise without centralization. That trust can form without authority.

This challenges the legacy of capitalism. It reshapes the playbook of influence. It encourages the next generation to think beyond brands, nations, and even identity.

And it raises a thought-provoking question: what if the future isn’t crafted by leaders but by ghosts?

Echoes of a Whitepaper: How Nine Pages Shaped the 21st Century

Every revolution has a foundational text. For the French, it was Rousseau’s The Social Contract. For the U.S., it was the Declaration of Independence. For crypto, it is Satoshi’s whitepaper.

With just 3,219 words, it remains the most studied document in tech finance history. It has inspired countless cryptocurrencies, reshaped discussions around monetary policy, and led to the rise of decentralized finance (DeFi), blockchain voting, and sovereign crypto identities.

It is not just a technical paper; it is a political statement, a call against surveillance, a tool against corruption.

And it all began with: "A purely peer-to-peer version of electronic cash..."

Why the Ghost Matters More Than the Gold

In a culture obsessed with celebrity, Satoshi stands out as an anomaly. He didn’t raise venture capital, ring the Nasdaq bell, or sell.

He left.

In doing so, he showed that it’s possible to create something world-changing and then step aside.

His absence has become Bitcoin’s backbone. His silence is its source of his stability. His anonymity conveys the message.

In a time when everyone wants attention, Satoshi chose to be heard and then vanished.

Provocation of the Day!

If Satoshi returned tomorrow—not as a person but with a simple wallet signature—would Bitcoin be stronger with a leader, or weaker without its myth?

Sources

- Bitcoin Whitepaper by Satoshi Nakamoto (2008) – The foundational document outlining Bitcoin’s architecture. (bitcoin.org/bitcoin.pdf)

- Wikipedia: Satoshi Nakamoto – Background on the pseudonymous creator, timeline, and identity theories. (en.wikipedia.org/wiki/Satoshi_Nakamoto)

- The Tie Research – Analysis of Satoshi’s estimated 1.1 million BTC wallet holdings. (research.thetie.io/satoshi-bitcoin-holdings)

- BBC News – Court ruling against Craig Wright’s claim to be Satoshi. (bbc.com/news/technology-68699336)

- BeInCrypto – Report on dormant Bitcoin wallets suddenly moving funds and sparking market panic. (beincrypto.com/two-whale-wallets)

- Phemex Academy & Paxful – Summaries of top theories on Satoshi’s identity, including Hal Finney, Nick Szabo, and NSA speculation. (phemex.com/academy/satoshi) (paxful.com/university/id/facts-about-satoshi)

- arXiv Paper (2022) – Linguistic and metadata research suggesting Satoshi may have been a group or operated across time zones. (arxiv.org/abs/2206.10257)

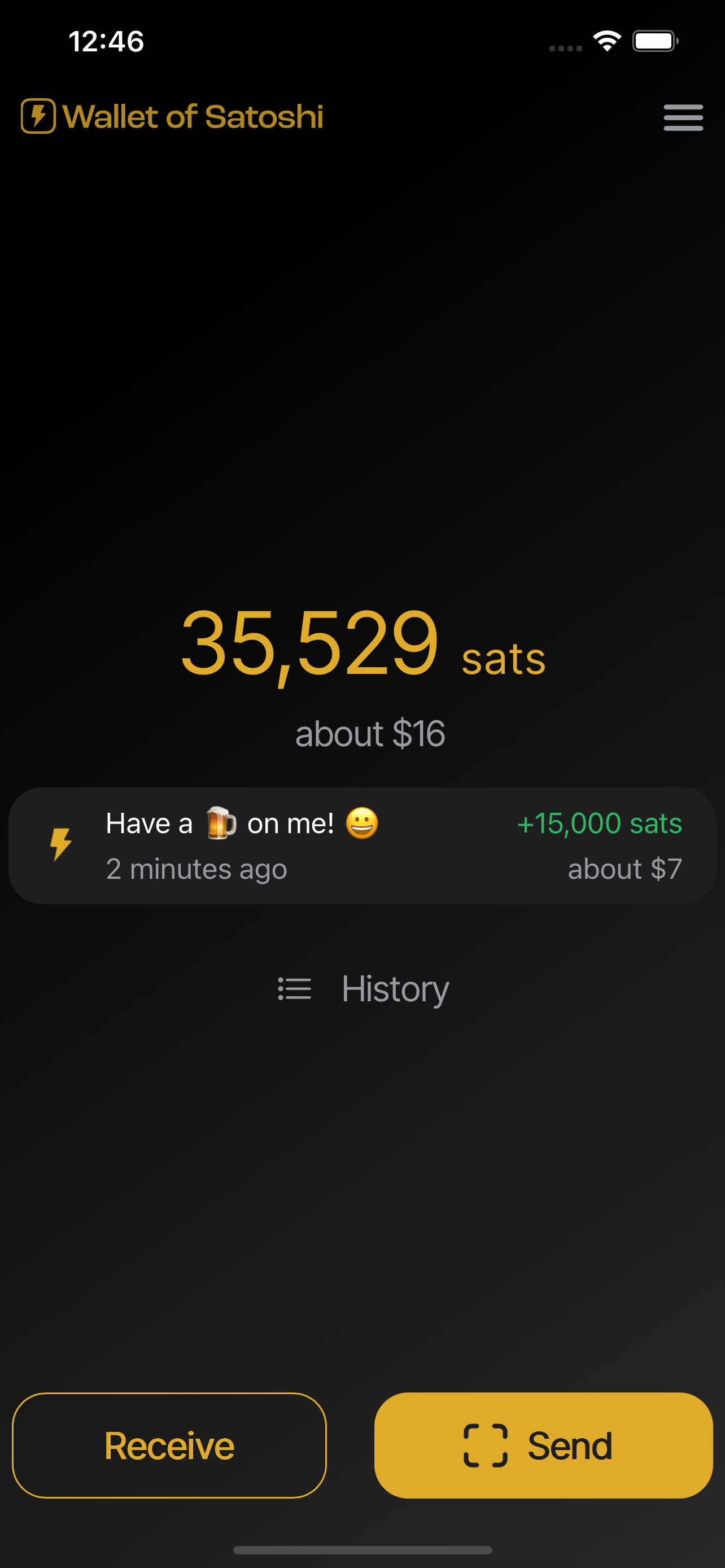

- WalletOfSatoshi promotional site

- Arkham Intelligence clustering research

- Wikimedia Commons