Shein’s Hong Kong IPO: A Revealing Crossroads of Finance, Ethics, and Fast Fashion

Explore Shein’s strategic pivot to HKEX, valuation outlook, ESG & supply-chain scrutiny, and the long-term impact on fast-fashion in a geopolitically fraught world.

HONGKONG, July 8, 2025

The world’s largest fast-fashion brand, Shein, is set to enter the Hong Kong Stock Exchange (HKEX). This change from plans to list in New York and London reveals more than just a new strategy; it exposes significant geopolitical tensions, investor fears, regulatory issues, and ethical dilemmas. As Shein exchanges secrecy for public accountability, it highlights the struggle between profit-focused growth and evolving moral expectations in global fashion.

Unexpected Shift: From New York Ambitions to Hong Kong Realities

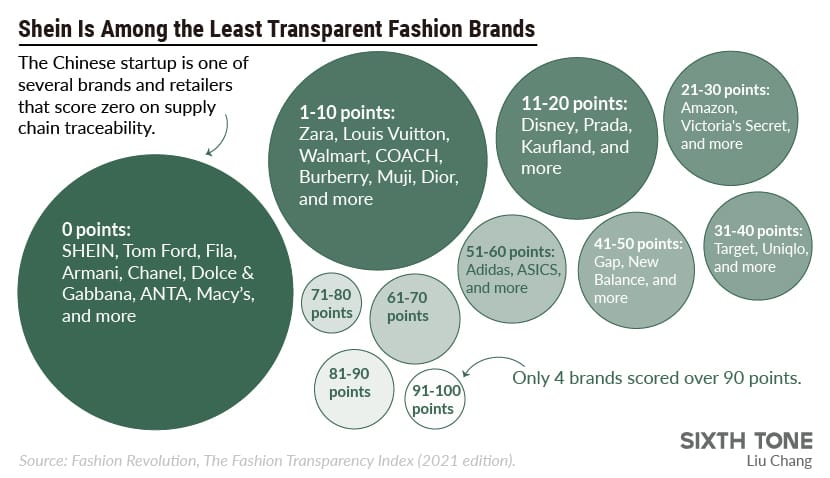

In late 2023, Shein quietly dropped its plans for a U.S. IPO, aiming for a valuation close to $90 billion. However, intense political backlash over allegations of forced labor and supply chain secrecy led the SEC and U.S. Congress to increase their scrutiny. Senator Marco Rubio and Representative Jennifer Wexton were among those who demanded full audits under the Uyghur Forced Labor Prevention Act.

Turning to London seemed like a good option, but significant challenges emerged. Chinese regulators repeatedly rejected the prospectus submitted to the UK’s FCA due to insufficient information on ties to Xinjiang. The group Stop Uyghur Genocide filed for judicial review, and concerns grew about coalitions questioning Shein’s lack of transparency. Ultimately, Shein found itself caught between Western regulators advocating for transparency and Chinese authorities seeking control over the narrative.

By early July 2025, Shein submitted a confidential draft prospectus to the HKEX. This unusual move aimed to pressure London’s regulators. The public revelation of this filing indicates a strategic effort to harmonize regulations between Hong Kong, China, and the U.K.

Ripples in the Financial World: How Markets Respond

Market observers in Hong Kong suggest that Shein’s move could create a “patriot premium,” a perception among international investors regarding Chinese companies. With listings like Alibaba and JD already established on HKEX, Shein could access a wide pool of Asian capital, including new investments from the Stock Connect program.

However, analysts warn that this does not mean an escape. Western investors remain actively involved through global funds, and even asset managers in Hong Kong prioritize environmental, social, and governance (ESG) factors. Canada’s antitrust fine and France’s €40 million penalty for misleading discount claims suggest increasing scrutiny from European consumer protection agencies.

At the same time, economic challenges threaten profit margins. New U.S. import duties, including the end of "de minimis" exemptions for parcels under $800, have raised tariff costs by about 30%. This increase could squeeze Shein’s low-price strategy while allowing competitor Temu to capture U.S. and European market share.

The Political and Ethical Storm Surrounding the IPO

U.S. Investigations Intensify

Shein’s IPO plans ignited a controversy in Washington. Lawmakers repeatedly urged the SEC to delay any listing until the company could confirm that no supply-chain components come from forced-labor areas. Heavy lobbying tracked $1.28 million spent in DC, with meetings involving some of Shein's harshest critics.

Despite Shein’s public denial of ties to Xinjiang cotton in its U.S. products, the volume of images and claims related to cheap packaging and fast production cycles keeps the scrutiny intense.

U.K. Resistance and Regulatory Tug-of-War

At the same time, London faced its own challenges. The FCA’s internal approval of Shein’s prospectus was at odds with Beijing’s demand for a controlled narrative about sourcing. Stop Uyghur Genocide prepared legal challenges, and UK consumer rights groups criticized Shein for lacking transparency.

These disputes showed London’s deeper issue: a persistent shortage of high-profile IPOs compared to other markets. The FCA has recently relaxed listing rules, lowering minimum public float requirements, but allowing Shein to enter was not easy. Shein’s confidential move with HKEX may aim to push the FCA toward alignment.

China and Hong Kong’s Strategic Position

Beijing has long encouraged its companies to list locally, reducing reliance on Western exchanges. HKEX remains linked to Chinese influence since the China Securities Regulatory Commission has the final approval power.

Shein’s strategy seems smart within this context. If it gains approval, it builds momentum; if not, it highlights geopolitical tensions and undermines London’s status as a financial hub.

Financial Profile: Under the Hood of the IPO

Valuation and Underwriting Dynamics

Shein’s private market valuation reached $100 billion in early 2022, but recent estimates place it between $50–60 billion, with some analysts predicting as low as $40 billion. Slow profits, regulatory issues, and rising competition are major factors.

Institutional investors like Sequoia China and Tiger Global remain committed, and underwriters such as Goldman Sachs, Morgan Stanley, and JPMorgan are reportedly leading the book, focusing on strategic placement in Asian high-net-worth pools.

Revenue Breakdown and Cash Reserves

In 2024, Shein reported about $38 billion in annual revenue, a 19% increase from 2023, but net income dropped sharply by 40% to almost $1 billion. This suggests heavy reinvestment in marketing, fulfillment, and global warehousing, yet structural cost inefficiencies persist.

Fortunately, Shein has built a strong balance sheet. It has around $12 billion in cash reserves, far exceeding its debt, allowing it to adjust its strategy and navigate international challenges.

Strategic Risks Lurking in the Shadows

Tariff volatility: Increased U.S. duties and potential EU fees threaten profits. Some trade analysts suggest shifting supply-chain logistics away from China to avoid punitive tariffs.

ESG and forced-labor litigation: Legal reviews in the U.K. and possible SEC audits could arise if due diligence standards aren’t seen as strong. U.S. states are already pushing for action.

Governance scrutiny: As a previously private, founder-led business, Shein must now adapt to quarterly reporting, audit disclosures, board independence standards, and accountability to the public market.

Competitive landscape: Competitors like Temu, which have U.S.-based logistics and fewer labor controversies, could push Shein to focus more on emerging markets like Southeast Asia and the Middle East.

An Industry at a Turning Point

Shein’s path to IPO has raised concerns among industry insiders. If it successfully lists in Hong Kong, smaller fast-fashion brands may follow, using Asia as a base while minimizing Western oversight. This could lead to real consumer growth for some and persistent opacity risks for all.

Governance firms note that investors now consider ESG as crucial as revenue growth. Demand for third-party audits, labor reports, and environmental metrics is now essential. Even Hong Kong asset holders insist that any listing must effectively address sustainability and human rights.

A Closer Look at Shein’s Supply Chain and Scrutiny

Shein’s supply chain raises serious concerns. Investigations from the BBC, Channel 4’s Inside the Shein Machine, and other reports have revealed:

- Excessive work hours by subcontractors, with some logging 75-hour workweeks, are a violation of local labor laws.

- Two incidents of child labor were found during audits in 2024, involving an 11-year-old worker.

- The presence of toxic chemicals, including high lead content in products sold across various jurisdictions.

- Allegations of using Xinjiang-linked cotton, while Shein claims to control such sourcing for U.S. goods, its stance remains unclear for global channels.

EU regulators also started inquiries under the Digital Services Act, investigating counterfeit sales and misleading discount pricing in France, which resulted in fines.

These ongoing issues highlight the challenge of reconciling Shein’s rapid, low-cost model with meaningful governance reform. For the IPO to succeed, auditors and shareholders will demand verified supplier lists, traceability data, and strong compliance measures supported by financial penalties or threats of delisting.

Strategic Appraisal: Confidence or Capitulation?

A Calculated Win

Regulatory Path of Least Resistance: Hong Kong offers more flexible governance aligned with SEA standards and less political backlash over ESG issues compared to New York or London. A dual listing could follow once compliance frameworks are established.

Asia-Centric Investor Base: By focusing on local capital, Shein navigates financial instability in the West while maintaining global brand appeal.

Precedent of Tech Listings: Companies like Alibaba, Meituan, and Xiaomi have succeeded with Asia-first trades before aiming for U.S. cross-listings; Shein seems to follow a similar path.

A Cautionary Tale

Perception of Retreat: Listing outside major Western markets could harm global consumer confidence and brand reputation.

Mounting ESG Backlash: Conservative Western funds are increasingly embedding ESG checks. Hong Kong’s more lenient approach may change, as investment linked to Shanghai begins to enforce stricter self-regulation.

Ongoing Cross-Border Challenges: After the IPO, Shein will still face risks from tariffs, customs enforcement, SEC audits, EU sanctions, and UK legal actions—it cannot escape its global footprint.

Rewriting the Fast-Fashion Playbook?

Shein’s ambitious IPO plans reflect a larger trend: where rapid growth once took priority, supply-chain transparency is now critically important. If Shein can prove real labor reforms, factory traceability, chemical safety standards, and executive independence, it could set a new standard for significant Chinese consumer listings.

On the other hand, failing to address these issues could lead to severe consequences: sanctions, loss of value, and reputational damage—not just for Shein but for any future tech company seeking international investment.

A Moment of Truth for Ethics and Earnings

Shein’s IPO is more than a financial event; it represents a social challenge. The company’s low prices may appeal to consumers, but persistent questions about human rights, environmental damage, and corporate transparency remain. Will deep financial resources win out if they lack real accountability? Or will major investment firms demand more before committing funds?

Ultimately, Shein needs to decide if it is ready for public scrutiny and whether fast fashion can succeed under such accountability.

Navigating Growth, Governance, and Global Ethics

Shein’s upcoming IPO may be the most significant fast-fashion financial event of the decade. It will test its ability to handle complex geopolitical issues, ESG responsibilities, and consumer expectations. If it can gain trust through verified supply chains and ethical improvements, it may emerge stronger and reform IPO standards. Otherwise, it faces the risk of becoming a cautionary tale about unchecked growth and public exposure.

Are Fast-Fashion IPOs Sustainable—Or Ethically Hazardous?

Is investing in a company like Shein during a major global IPO a wise choice linked to its market dominance? Or do you worry that, despite impressive results, unresolved labor, environmental, and governance challenges pose significant long-term risks for both investors and society?

Sources

- Reuters – on Hong Kong IPO filing, failed US/UK attempts, and forced labor concerns

- Financial Times – on Shein's confidential HKEX filing and UK regulatory tension

- The Guardian – on Shein abandoning London IPO in favor of Hong Kong

- Public Eye – infographic on Shein’s ownership structure and factory practices

- FourWeekMBA – visual on Shein’s data-driven business model

- JoinInFlow – analysis of Shein’s decentralized supplier ecosystem

- Sixth Tone – labor dispatcher graphic showing temporary staffing model

- SheinGroup – official business model visuals and corporate statements