Tariff Timeout? Why the US Delayed Higher Import Duties but Still Raised New Taxes

Explore the U.S. dual-track trade strategy: delaying broad tariffs while deploying digital service taxes and green levies. Learn why markets reacted, which countries are affected, and what it means for global trade.

WASHINGTON, D.C., July 10, 2025

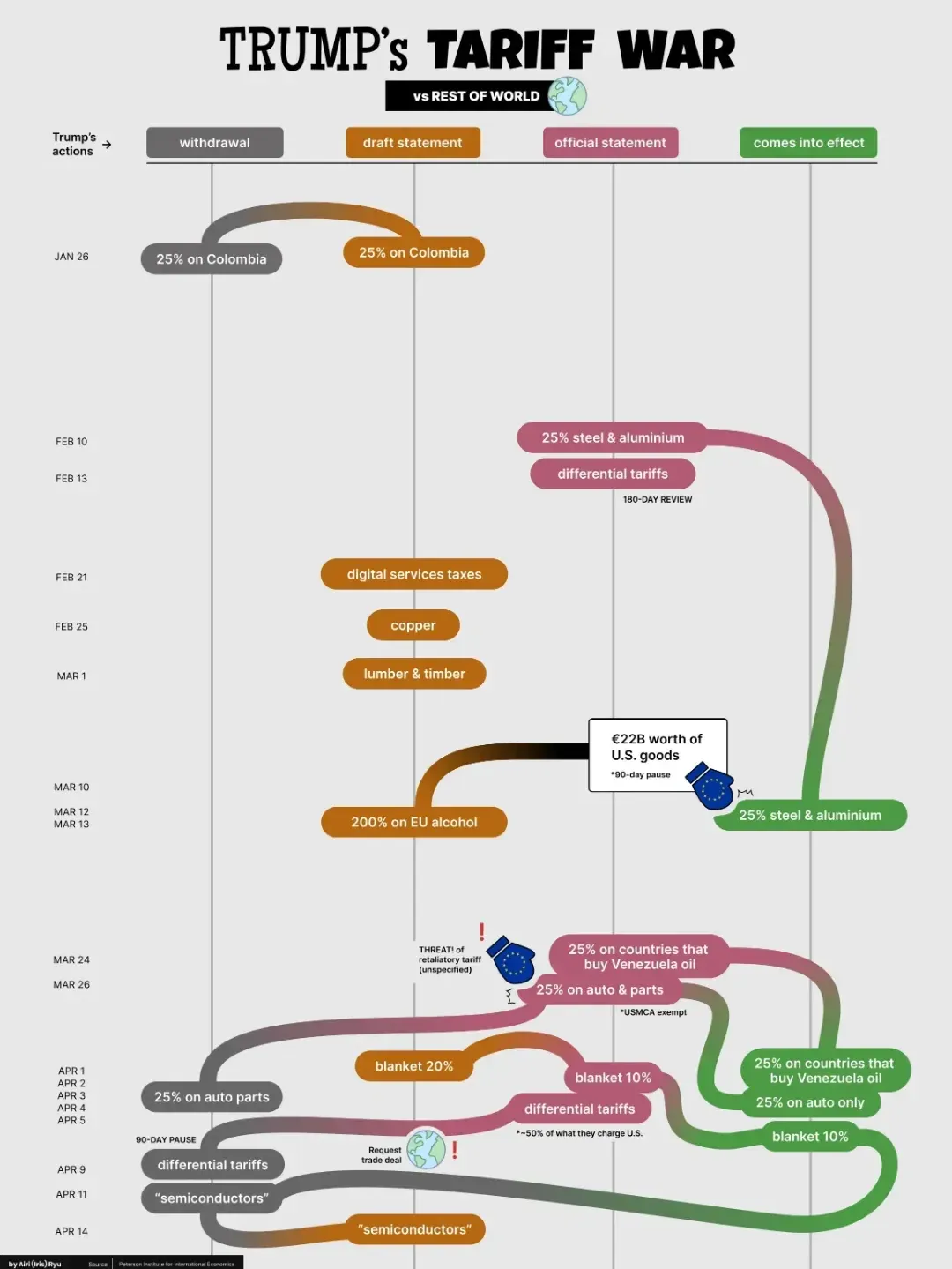

In a moment that combines dramatic headlines with government specifics, the U.S. government has adopted a two-pronged strategy. It postponed broad tariff increases while introducing new, targeted taxes on certain sectors and countries. This approach shows a careful shift from outright trade conflict, responding to inflation, diplomatic shifts, and political pressures as elections approach.

Dual-Track Strategy: Pausing Tariffs, Deploying Taxes

The USTR officially delayed broad Section 301 tariff hikes, which ranged between 25% and 70%, originally set for July 9. They are now rescheduled for August 1, with the option to extend further. At the same time, the administration introduced country-specific digital service taxes (DSTs) and carbon-border adjustments, avoiding typical tariff practices to send a precise message to trading partners.

The main idea? Broad tariffs are on hold to prevent price shocks, while targeted taxes enable economic pressure on specific entities without adding to inflation. This is a deliberate mix of intensity and restraint.

Who’s on the Hit List—and Why It Matters

While the broad tariffs were postponed, several countries now face new challenges:

- Japan: 25% tariffs on tech and industrial goods

- South Korea: 25% reciprocal tariffs plus a 50% copper import levy

- South Africa: Threatened 30-40% tariffs

- UK, France, Italy, Austria, Spain, Turkey: DST investigations under Section 301

- Brazil: Green adjustment taxes on steel and agricultural products

- India: DST-inspired 27% reciprocal tariffs

The impact on bilateral trade: Allies like Japan, Korea, and the UK are now squeezed by both strained supply chains and increased export costs. India and Brazil, important players in the Indo-Pacific and Latin America, face the risk of retaliation. This fragmented approach presents a negotiation dilemma—halt broad tariffs to ease market pressures while targeting specific allies.

Market Response: Stocks, Sentiment & Currency Flows

Investor Mood

Wall Street's reaction has been mixed. The S&P 500 and Nasdaq experienced slight gains following the tariff delay, fueled by hopes of Fed rate cuts. Meanwhile, the FTSE, Nikkei, and other markets declined as the impact of digital and steel penalties became apparent. Strategic sectors, especially tech firms with significant exposure to the UK and EU, warned of potential profit losses.

Currency Flight

The Indian rupee and South Korean won weakened amid rising tariff concerns. The euro remained stable, bolstered in part by Germany's readiness to retaliate. Meanwhile, the USD traded steadily, with trading volume increasing as foreign investors adjusted their emerging-market positions.

Safe-Haven Rotation

Treasury bonds gained ground, and gold saw slight inflows as investors shifted to safer assets. Volatility in equity markets remained above normal, driven by discussions about possible 70% tariffs and uncertainty around digital taxes.

Why the Delay? Politics, Inflation & Election Math

The choice to delay broad tariffs reflects a mix of political timing, economic decisions, and electoral strategy:

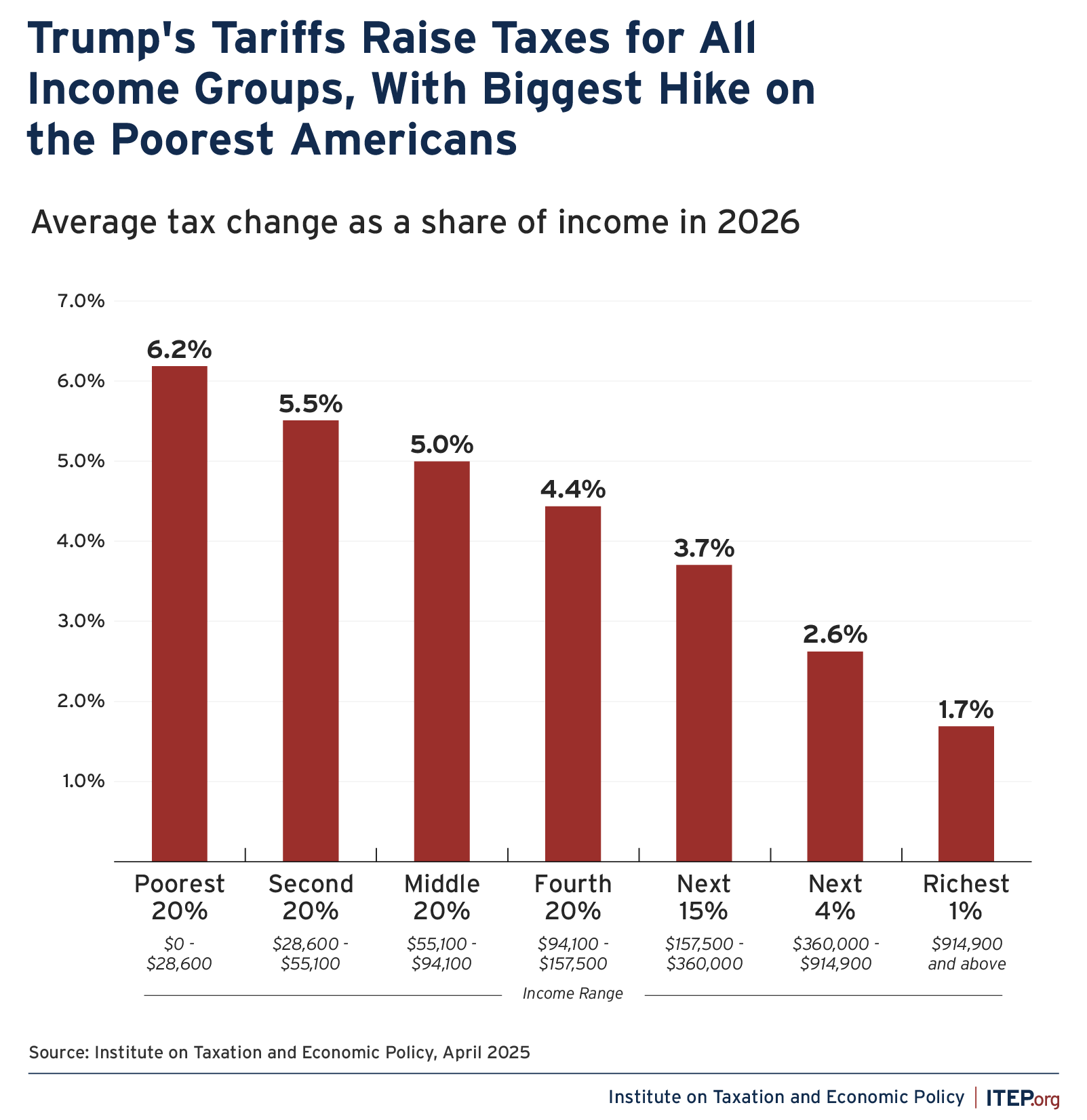

Inflation Concerns: The National Retail Federation warned that further tariffs could slow down supply costs in electronics and automobiles; they might also worsen inflation in food and clothing. Estimates suggest that regressive tariffs could impose a burden of 4% on the poorest households, equating to more than 6.2% of their income.

Election-Year Concerns: With the 2026 midterms approaching, policymakers are cautious about upsetting many consumers sensitive to retail prices.

Republican Party Dynamics: Trump’s renewed rhetoric suggests tariffs, but Biden counters with tax measures that specifically target competing tech and carbon-emitting sectors, framing tariffs as blunt instruments and emphasizing consumer protection.

Treasury Secretary Yellen and key economists assert that if controlling inflation is a priority, increasing tariffs is counterproductive. This explains why targeted taxes are incrementally introduced.

Is It Protectionism 2.0? Non-Tariff Shielding in Action

What we are seeing is less of a retreat than a smarter, more defensible backlash:

- Digital Service Taxes: Taxes linked to digital revenues within countries enable levies on U.S. tech companies, such as Amazon and Google, even for services delivered globally, fitting a world focused on intangible trade.

- Carbon Border Adjustments: Global pressure states that steel and cement from countries with less stringent climate regulations will face penalties upon arrival in the U.S. This approach bypasses WTO tariff limits.

- Export Controls: The USTR and Commerce are tightening export restrictions on semiconductor and AI-related technologies, tools designed to support economic containment strategies.

This combination introduces more legal uncertainty than traditional tariffs and is more difficult to challenge in court. The WTO has not yet classified these as "tariffs," allowing for more flexibility.

Geopolitical Chess: Exemptions, Alliances & Economic Diplomacy

The strategy is not arbitrary. Notable exemptions include Canada, Australia, Japan, and Australia, hinting at concessions linked to strategic agreements like QUAD, AUKUS, and USMCA. In contrast, Japan and South Korea, despite being U.S. allies, face penalties because of their economies' reliance on exports and intellectual property.

India and Brazil are considered emerging competitors in tech and green energy, signaling Washington's intent to counterbalance China’s rise not only militarily but also economically.

Final Reflections: Smarter Trade War or Diplomatic Tightrope?

This change indicates a more considered U.S. trade policy:

Shopfloor vs. Boardroom Focus: Tariffs broadly affect consumers; digital and carbon taxes target the pain towards large multinational tech firms and commodity giants.

Legal Ambiguity as Leverage: DSTs and environmental taxes take advantage of gray areas in trade law, avoiding WTO disputes while prompting negotiations.

Presidential Positioning: The White House can project strength against China, India, and the UK, while addressing domestic voters with messages like, “We held off on consumer tariffs.”

Flexible Firepower: With deadlines for tariffs pushed back and tax measures active, U.S. negotiators maintain options while the markets settle.

Alliance Stress Test: Allies feel the pressure, diverging from trade consensus; trade disagreements could undermine diplomatic unity.

The Art of Economic War

This new strategy shows a blend of deterrence and discretion. Washington’s approach mirrors hybrid warfare, using economic pressure without direct confrontation. It effectively directs global trade tensions while allowing for tactical flexibility. For allies and companies, survival will hinge on navigating this new landscape of economic power, where taxes—not just tariffs—shape national boundaries.

Wise Realism or Risky Escalation?

Is this a reasonable shift in trade policy, balancing consumer protection with strategic escalation, or is it an invitation to global backlash? Do digital taxes and carbon levies provide a sustainable future, or will they undermine trust, trigger retaliation, and jeopardize the global trading system?

Sources

- USTR announcements, tariff deadlines & country-specific rates finance-monthly.com+2en.wikipedia.org+2tradecomplianceresourcehub.com+2

- Market sentiment: Bloomberg, FT, Reuters, MarketWatch theguardian.com+2ft.com+2wsj.com+2

- Equity analysts: Bank of America, Goldman Sachs, investopedia.com

- Investor trends: WSJ, Barron’s, BlackRock, Deloitte blackrock.com

- Tariff fiscal analysis: Tax Foundation, Yale Budget Lab, Coalition on Human Needs theguardian.com+11taxfoundation.org+11chn.org+11

- DST: Canada’s repeal, OECD policies

- Images and graphics: itep.org, reuters.com, whitehouse.gov, unsplash.com, piie.com, livemint.com, pixabay.com, commons.wikimedia.org, europarl.europa.eu, hls.harvard.edu.