The Consolidation Endgame: How Media Mergers Are Redefining What We Watch and How We Pay for It

Explore the profound impact of mega-mergers like Disney-Fox and Warner Bros.-Discovery on the entertainment landscape.

Written by Lavanya, Intern, Allegedly The News

LOS ANGELES, September 12, 2025

The entertainment industry is no longer just a business; it's a battleground for corporate titans vying for total dominance. The last half-decade has been defined by two of the largest media mergers in history: Disney’s acquisition of 21st Century Fox and the creation of Warner Bros. Discovery. These aren't isolated events. They are the climax of a decades-long trend of consolidation, driven by the intense pressures of the streaming era. As a result, the content we consume, the platforms we use, and the price we pay for it are being fundamentally reshaped by a shrinking number of powerful players.

A Tectonic Timeline: The Road to the Streaming Wars

The story of media consolidation is rooted in a gradual but relentless dismantling of regulatory guardrails. For much of the 20th century, anti-monopoly laws kept media ownership relatively fragmented. Landmark legislation like the Communications Act of 1934 and subsequent FCC rules were designed to ensure a diversity of voices. However, the Telecommunications Act of 1996 marked a pivotal shift, ushering in an era of mass deregulation. This opened the floodgates for companies to acquire multiple media outlets, setting the stage for the vertically integrated conglomerates we know today.

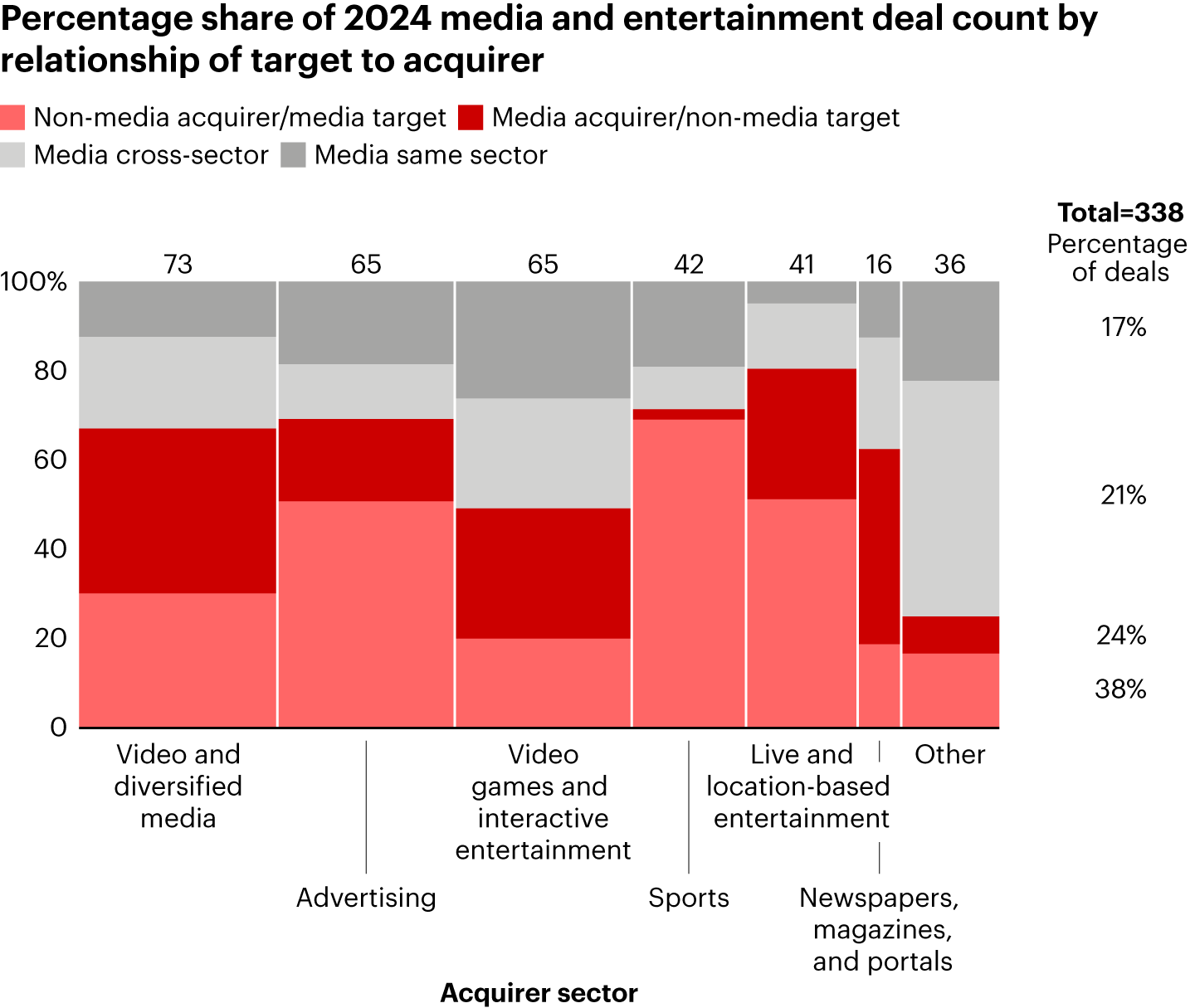

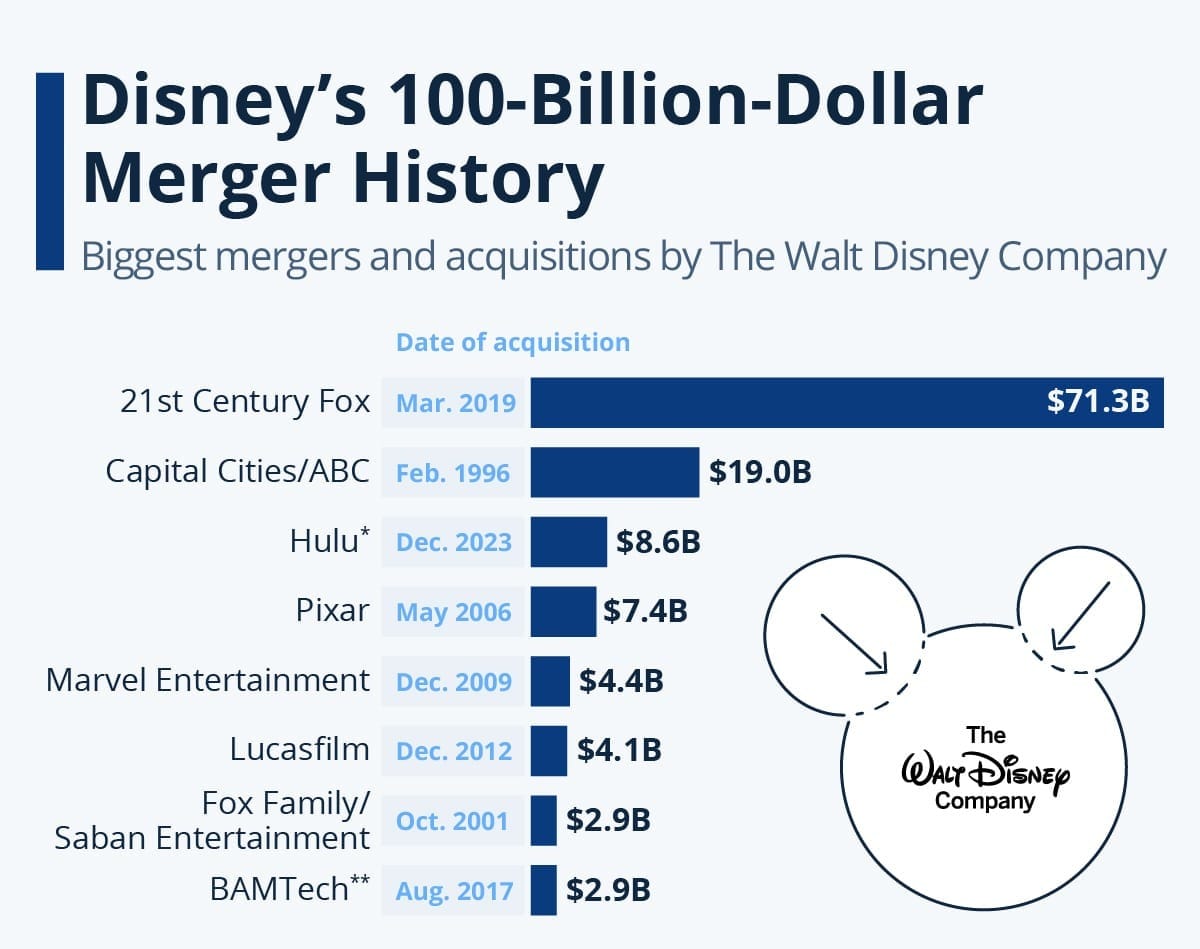

- 2018-2019: The Disney-Fox Deal. The acquisition of a majority of 21st Century Fox by The Walt Disney Company was announced on December 14, 2017, and officially closed on March 20, 2019. This was the culmination of a bidding war with Comcast, ultimately valuing the deal at $71.3 billion. Disney absorbed Fox’s key film and television studios, including 20th Century Fox, Fox Searchlight Pictures (now Searchlight Pictures), and Fox 2000 Pictures, along with a controlling stake in the streaming service Hulu. The remaining assets, including Fox News and Fox Sports, were spun off into a new entity, the Fox Corporation.

- 2021-2022: The WarnerMedia-Discovery Merger. On May 17, 2021, AT&T announced it would spin off its WarnerMedia division and merge it with Discovery, Inc. The $43 billion deal was completed on April 8, 2022, creating the new powerhouse, Warner Bros. Discovery (WBD). This horizontal merger brought together WarnerMedia's portfolio—including HBO, Warner Bros. Studios, DC Comics, and CNN—with Discovery's extensive library of non-fiction content from channels like the Discovery Channel, HGTV, and TLC.

These two deals were not just about buying assets; they were a strategic arms race for intellectual property and global streaming scale, directly aimed at competing with Netflix and Amazon.

The Disneyfication of Everything: The Impact on Content and Choice

The Disney-Fox merger created a media behemoth of unprecedented scale. By absorbing a rival studio, Disney significantly expanded its control over intellectual property and market share.

Evidence of Impact:

- Intellectual Property Integration: The most immediate and visible effect was the "repatriation" of key franchises. Marvel characters like the X-Men and the Fantastic Four returned to Marvel Studios, a move that delighted fans and created new creative possibilities for the Marvel Cinematic Universe. Similarly, popular animated shows like The Simpsons and the vast film library of 20th Century Studios became part of the Disney+ offering.

- Market Share Concentration: The merger reduced the number of major Hollywood studios from six to five. This consolidation has raised concerns from independent filmmakers and creators, who now have fewer large-scale buyers for their projects. Critics argue that this leads to a "monoculture" of content, where the focus is on proven, low-risk franchises rather than original, untested ideas.

- Theatrical Distribution: Disney's market dominance has given it significant leverage in negotiations with theater chains. With a slate of guaranteed blockbusters, Disney can command more favorable terms, potentially squeezing out competition and making it harder for smaller films to secure prime release dates and screens.

The Consumer's Perspective

While the merger delivered on the promise of a more unified Marvel universe, it also led to content shifts that were confusing for some consumers. Titles that were previously on various streaming services or broadcast networks now belong exclusively to Disney’s ecosystem, primarily Disney+ and Hulu. While this offers a one-stop shop for a vast library, it also reinforces the idea that true content access requires a bundle of subscriptions from a single provider.

The Great Content Purge: Warner Bros. Discovery and the Quest for Profit

The formation of Warner Bros. Discovery was a merger of two very different companies, driven by a singular, urgent goal: reducing debt and achieving profitability in a highly competitive market.

Evidence of Impact

- Aggressive Cost-Cutting: Under the leadership of CEO David Zaslav, WBD initiated a series of radical and widely publicized cost-cutting measures. These included the controversial cancellation of the nearly-completed film Batgirl in August 2022 for a tax write-off. The decision shocked the industry and was seen as a blunt signal that creative projects could be sacrificed for financial expediency.

- The Max Platform Consolidation: The company's biggest move was the consolidation of the HBO Max and Discovery+ streaming services into a single platform, rebranded as Max, which officially launched in May 2023. This move was intended to create a more comprehensive and cohesive streaming offering.

- Library Cleansing: Perhaps the most significant impact on consumers was the unprecedented removal of dozens of movies and shows from the HBO Max/Max library. Classic films and critically acclaimed shows that were once part of the streaming service’s appeal were pulled to save on residual payments and licensing fees. This "library cleansing" highlighted the fleeting nature of digital content ownership and the new reality that a subscription does not guarantee perpetual access.

The Consumer's Perspective

The WBD merger has been a mixed bag for consumers, with many expressing frustration over the decisions made. The Batgirl cancellation became a symbol of a new corporate philosophy that prioritized financial metrics over creative output. Furthermore, the removal of content from the streaming library, which included everything from animated series to acclaimed HBO films, was a stark reminder that in the era of streaming, the content you love could disappear without warning. This has led to a renewed interest in physical media and a growing sense of distrust toward the stability of streaming libraries.

Antitrust Concerns and The Big Question

The sheer scale of these mergers has not gone unnoticed by regulators. While both deals were approved, they have fueled a growing debate about the future of antitrust law in a digital-first world. In the years since these mergers, new questions have emerged.

- The Creative Workforce: The consolidation of studios has a direct impact on the creative talent that fuels the industry. With fewer major players, writers, actors, and directors may have less leverage in contract negotiations and fewer places to pitch original ideas. This was a key point of contention during the Hollywood strikes in 2023, where creative professionals argued that consolidation has diminished their power and earnings.

- Defining "Competition": In the streaming era, is competition defined by the number of companies, or by the diversity of platforms and content? Regulators are grappling with this question. A media landscape with five major players may look less competitive on paper, but if each company is fighting for a finite number of subscribers, is that not a form of intense market rivalry?

- The "IP Moat" Revisited: The core motivation behind these mergers was to build an "IP Moat"—a fortified library of intellectual property so valuable that it makes a service indispensable to consumers. Disney's acquisition of Marvel and Lucasfilm, and its subsequent integration of Fox's IP, has created the strongest IP moat in the industry. WBD's combination of HBO, DC, and Discovery's content is an attempt to build a similar fortress. The question is whether these moats will become so powerful that they prevent genuine innovation and new ideas from entering the market.

Food for Thought

The Disney-Fox and Warner Bros. Discovery mergers represent the definitive moves in the entertainment industry's shift from a business of broadcasting to a business of brand and intellectual property control. They were born out of a desire for survival in a volatile market and a need to compete with tech-first companies. The outcome, as seen in the last two years, is a landscape where the battle for subscribers has led to a ruthless focus on profitability and a willingness to make controversial decisions that impact creators and consumers alike. The future of entertainment will likely be dominated by a handful of mega-conglomerates, whose success will depend not on a diversity of voices, but on the strength and synergy of their owned intellectual property.

The Future of Storytelling

Given the increasing focus on franchise IP and the aggressive cost-cutting measures by major media companies, are we entering an era where only stories with existing brand recognition will be told? What happens to the "mid-budget" movie or the original, untested television series in this new environment?

Sources

Justia, Cornell Law, The Hollywood Reporter, Variety, The New York Times, and company press releases from Disney and Warner Bros. Discovery.