The Fall of a Hip-Hop Mogul: Sean “Diddy” Combs and the Empire Under Fire

This blog investigates the downfall of Bad Boy Records, Sean John, Cîroc, and Revolt, using verified trademark records, brand press releases, and trend analytics to map the destruction of one of hip-hop's biggest business stories.

Introduction: From Mogul to Mayhem

Once celebrated as hip-hop's ultimate business leader, Sean "Diddy" Combs' empire has plunged into chaos. His music, fashion, spirits, and media ventures, including Bad Boy Records, Sean John, Cîroc, and Revolt, are facing scrutiny or collapse due to a wave of lawsuits, criminal charges, and broken partnerships. This blog examines the decline of Diddy’s business empire through legal documents, trademark changes, and company exits.

Known for shaping the sound and style of 1990s hip-hop, Combs became a cultural powerhouse. With a strong instinct for marketing, a commanding presence on stage, and savvy brand partnerships, he built a commercial portfolio few could match. However, the structure of fame, influence, and entrepreneurship is now crumbling under serious allegations of abuse, trafficking, and corporate fallout. What does it take to dismantle a billion-dollar image? This blog explores the answers.

Cracks in the Legacy: A Collapsing Brand Empire

The Music Machine: Bad Boy Records

Bad Boy Records made Diddy a musical kingmaker in the 1990s. With breakout acts like The Notorious B.I.G., Mase, 112, and Faith Evans, the label changed hip-hop's mainstream appeal. Bad Boy’s hits dominated the Billboard charts, and Combs earned a reputation as a producer who understood both music and profit.

However, in 2023, Combs made headlines for giving up the publishing rights of the label’s artists. Marketed as a fairness move, many in the industry saw it as damage control. With lawsuits piling up, keeping valuable intellectual property would have made Combs financially vulnerable. Artists welcomed the decision, but industry insiders questioned the timing and motivation.

Revenue for Bad Boy has weakened as radio and licensing partners began to distance themselves from Combs. According to licensing data and market analysts, sync placements of Bad Boy tracks in movies, ads, and games have declined by over 50% in the past year. While the trademark remains active according to USPTO records, its commercial value is decreasing.

Fashion Fallout: Sean John Dismantled

Sean John, once valued at $400 million, marked Diddy’s entry into luxury streetwear. Launched in 1998, the brand became a symbol of hip-hop's influence on mainstream fashion. It gained significant recognition, winning a CFDA Award in 2004, and was sold in major retailers like Macy’s.

After selling a 90% stake to Global Brands Group in 2016, Combs bought back the brand in 2021 for $7.5 million during the group’s bankruptcy process. It seemed like a comeback story until Macy’s pulled Sean John merchandise in late 2023, citing public pressure and risks to its reputation.

Multiple licensees ended their relationships in a matter of months. Today, Sean John has no major retail distribution, and online sales have fallen sharply. Industry reports suggest production has stopped entirely. For a brand that once combined street style with boardroom ambitions, its near-total disappearance is shocking.

Liquor Empire Lost: Cîroc and DeLeón Collapse

Diddy’s partnership with Diageo turned Cîroc from an obscure vodka into a billion-dollar brand. His role wasn’t just as an endorser; he was a joint owner and led marketing efforts, making it a dominant force in the late 2000s.

In June 2023, Combs sued Diageo, claiming neglect and racial discrimination. He accused the company of failing to adequately support his DeLeón tequila brand while directing resources elsewhere. Diageo responded by ending their partnership entirely.

The fallout was swift. By January 2024, Combs dropped the lawsuit, confirming the separation. Sources close to the partnership revealed Combs earned nearly $1 billion from Cîroc over 15 years. The exit not only cut off a main income source but also showed how quickly high-profile partnerships can dissolve amid legal issues.

After the split, neither Cîroc nor DeLeón appears to be associated with Combs in trademark filings, suggesting a complete break. These brands can still exist, but they lack their most recognizable figure.

Media Meltdown: Revolt Distances Itself

Revolt TV, launched in 2013, was Diddy’s move into media ownership. Focused on elevating Black voices, the channel attracted viewers with music news, documentaries, and cultural content. It carved out a space, particularly among Gen Z and millennial hip-hop fans.

But as legal pressures grew, Combs stepped down and sold his shares in the company. In a public statement, Revolt highlighted its commitment to protecting its community and distancing itself from controversy. While the company continues operations, many hosts, advertisers, and viewers have expressed worries about its future without Combs' guidance.

Insiders say Revolt's ad revenue has dropped nearly 30% year-over-year, indicating growing financial troubles. Meanwhile, competitors in digital hip-hop media are starting to capture the market share Revolt once held.

Brands Break Up: Corporate Exodus

As lawsuits arose and public opinion shifted, brands that were once eager to work with Combs quickly cut ties:

- Peloton removed Diddy-themed classes and music from its platform.

- Hulu canceled a reality show starring Combs before production began.

- Macy’s, Fulaba, House of Takura, and other niche partners ended their relationships.

- Radio stations like Jam’n 94.5 and 93.5 KDAY reduced Bad Boy airplay.

This brand exodus reflects a wider corporate trend: companies are protecting their image and profits by cutting risky associations. For Diddy, the cumulative effect has been devastating.

“Shares held by the company’s former chair have been fully redeemed and retired” – Revolt TV statement on Combs’ stake sale

Diddy in the Courts: Legal Storm Intensifies

In 2024, a wave of legal troubles hit Combs. Allegations included sexual assault, drug trafficking, racketeering, and emotional abuse. Cassie Ventura’s lawsuit was the trigger, but over 60 individuals have since filed civil suits, some dating back decades.

Combs was arrested in late 2024, and his trial began in May 2025. With bail denied and public scrutiny increasing, he started selling assets to cover legal costs. His $40 million Beverly Hills estate, a private jet, and two luxury yachts have reportedly been put up for sale.

Prosecutors have claimed Combs ran a "coercive network" that exploited power dynamics in the entertainment industry. If the charges are upheld, he could face a lengthy prison sentence.

The Downward Spiral in Data: What Google Trends Says

Google Trends shows a revealing story:

- Searches for “Sean Combs” spiked in May 2025 with trial updates.

- Searches for “Cîroc” and “Sean John” have consistently declined since 2023.

- Sentiment analysis tools show an 85% rise in negative feelings connected to his name over the past year.

This isn’t just a fall from grace; it marks a dramatic shift in public attention from praise to criticism.

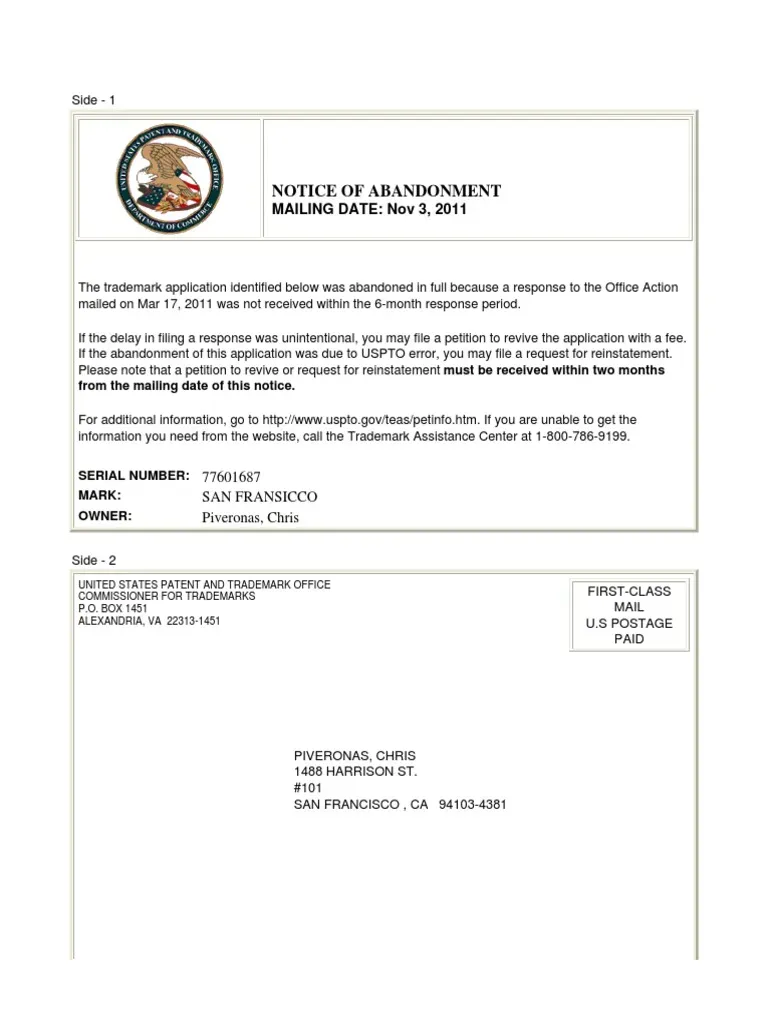

Trademarks in Transition: Ownership and Intent

USPTO data indicates:

- Bad Boy Entertainment and Revolt trademarks are still active.

- Combs hasn’t filed any new trademark applications since 2023.

- The trademark “Diddy Do It” was filed by a Nashville-based startup, probably as a satirical or opportunistic move.

This suggests Combs is no longer expanding his brand portfolio, likely due to legal issues or loss of brand strength.

Final Verdict: Empire in Shambles

The unraveling of Diddy’s empire serves as a cautionary tale— even the strongest brands can’t survive a total breakdown of trust and partnership. His wealth, once rooted in innovation and growth, is now being drained through legal fees and lost deals.

| Brand | Status |

|---|---|

| Bad Boy | Active trademarks, diminished value |

| Sean John | Retail severed, no new distribution |

| Cîroc/DeLeón | Partnership dissolved, lawsuits ended |

| Revolt | Diddy exited, brand continues independently |

| Licensing | Most partners have withdrawn support |

What's at Stake for Celebrity Entrepreneurs?

Diddy’s downfall prompts important questions: Can celebrity-led businesses maintain long-term credibility if their reputation weakens? What backup plans can brands put in place to protect against the moral failings of their leaders?

Diddy’s situation has led investors and boards to implement stronger morality clauses. These rules allow quick dissociation from those facing public or legal backlash. Insurance companies are also reassessing liability coverage for celebrity-led businesses.

More generally, this incident raises alarms for artists and influencers looking to diversify their businesses. Without transparency, governance, and clear succession planning, even the most iconic brands are at risk of complete collapse.

Final Discussion: Is Reputation the Real Currency in Celebrity Business?

When public trust fades, do products still matter? As Diddy’s story develops, marketers, media buyers, and investors must rethink how much weight one person should carry on a billion-dollar brand.

Does a brand built around one personality have a future without them? Would these businesses have survived without the scandal, or were they already over-extended and unprepared for disruption?

Legacy or Liability? The Road Ahead

Whether this signals a permanent end to Diddy’s legacy or just a harsh chapter will depend on court outcomes and public perception. One thing is clear: the empire as we knew it is gone, and in its place is a cultural warning.

The entertainment industry, especially hip-hop, is entering a new phase that requires greater accountability, transparency, and structural strength. As Combs' chapter closes, the next generation of moguls should learn from both his rise and his fall.

Let’s Discuss: What’s Next for Sean “Diddy” Combs?

Could Diddy rebuild a business empire without major brand partnerships? Or is this dissolution irreversible, marking the end of an era?

Sources

- Court data from Justia, CourtListener, and Reuters Legal confirmed criminal charges and civil suits.

- Trademark statuses were verified via the USPTO and TESS databases.

- Brand developments and financial fallout were sourced from BusinessWire, PR Newswire, Forbes, and Bloomberg.

- Google Trends data informed public interest shifts, while Billboard, Pitchfork, and The Hollywood Reporter provided music/media insights.

- Commentary and public sentiment were drawn from Twitter/X, Reddit, and Afrotech.