The Real Cost of Trump's Tariffs: An Analysis of Impacts on American Households and the Economy

Trump's tariffs are raising prices for everyday Americans, disproportionately hitting low-income families. This investigative report reveals how trade protectionism strains supply chains, dampens exports, and reshapes global alliances, costing households thousands annually.

Written by Lavanya, Intern, Allegedly The News

The United States has recently embarked on a significant shift in its trade policy, marked by the widespread implementation of tariffs. This approach, often articulated under the "America First" doctrine, aims to rebalance global trade, boost domestic manufacturing, and enhance national security. However, a comprehensive examination of available economic data and expert analyses reveals a complex and often contradictory picture of the policy's real-world effects, impacting everything from household budgets to global trade architecture.

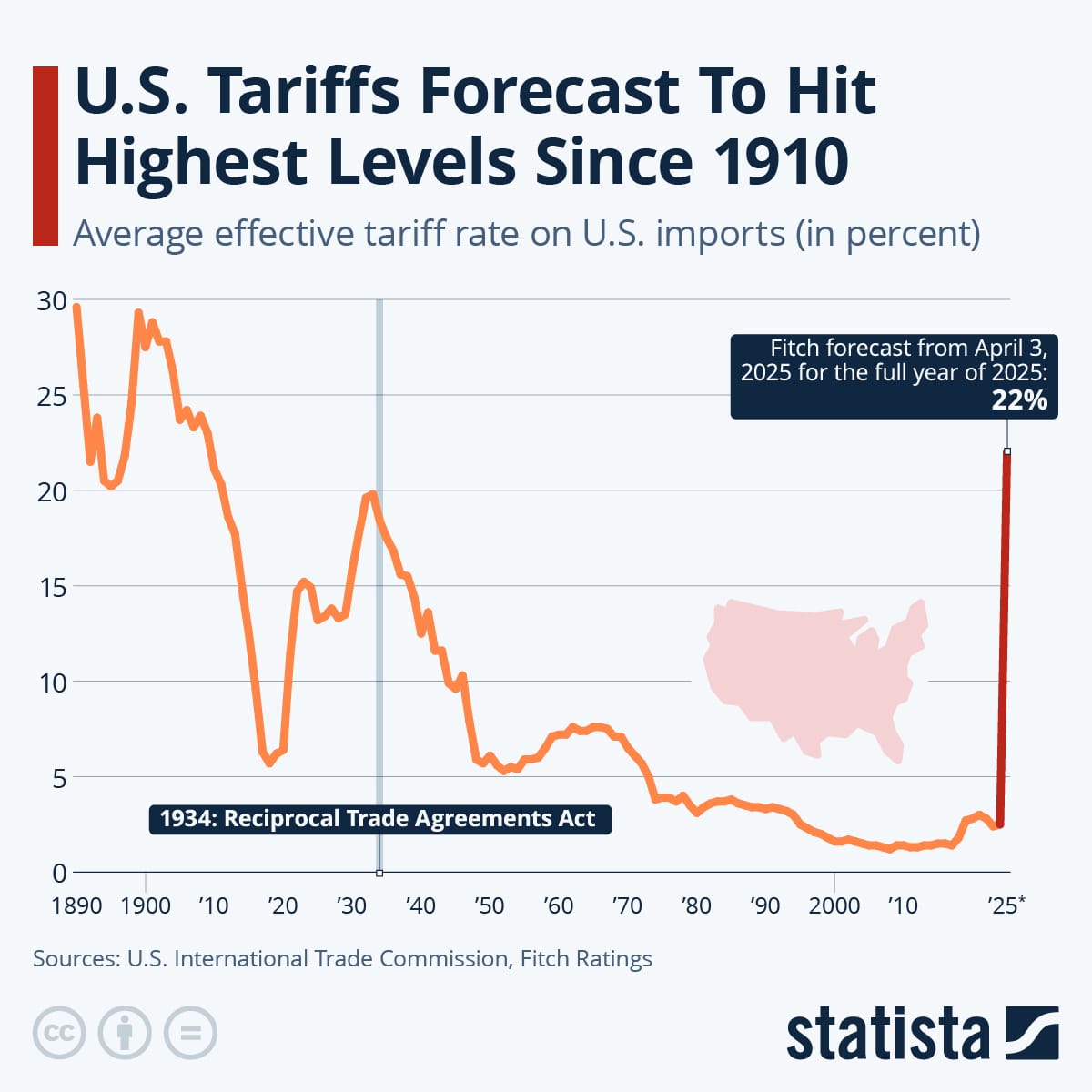

The Resurgence of Tariffs: A Policy Shift

The current wave of US tariffs began with sweeping import taxes unveiled in April 2025, initially including a 10% baseline tax on most imports and reciprocal duties of up to 50% on goods from countries with which the U.S. ran trade deficits. While some initial rates were temporarily suspended, new, often higher, tariffs came into effect by August 7, 2025, for dozens of countries, including a 40% tariff on imports from Laos, 39% on Switzerland, and 30% on South Africa. Existing duties, such as a 50% tariff on imported aluminum and steel, also remained in place.

This aggressive stance is rooted in an economic nationalist ideology that prioritizes domestic industries and jobs, rejecting multilateralism in favor of tighter economic borders. The stated objectives include promoting investment and productivity, enhancing industrial and technological advantages, defending economic and national security, and benefiting American workers, manufacturers, and farmers. Proponents claim these measures lead to stable supply chains, economic growth, low inflation, and increased real wages. However, the actual implementation has often involved unpredictable changes to tariff rates and complex, country-specific negotiations, leading to significant policy uncertainty.

Economic Impact on the United States

The economic consequences of these tariffs have been multifaceted, extending across consumer prices, employment, industrial sectors, and even the broader fiscal and monetary policy landscape.

Consumer Prices and Household Welfare

One of the most immediate and widely observed effects of the tariffs has been an increase in consumer prices. The Federal Reserve's research indicates that US import tariffs implemented in 2018-19 led to a statistically significant increase in consumer goods prices, with full pass-through occurring rapidly, within two months of implementation. For the 2025 tariffs, a partial pass-through has already been observed, contributing to a 0.3% increase in core goods Personal Consumption Expenditure (PCE) prices and a 0.1% increase in overall core PCE prices.

The rapid pass-through of tariff costs to consumers, often within two months, suggests that American businesses, which technically pay the tariffs at the border, are quickly transferring these costs down the supply chain rather than absorbing them.This directly contradicts the political assertion that foreign countries bear the tariff burden, as economists at Goldman Sachs estimate that overseas exporters have absorbed only about one-fifth of the rising costs, with Americans and US businesses picking up the majority.

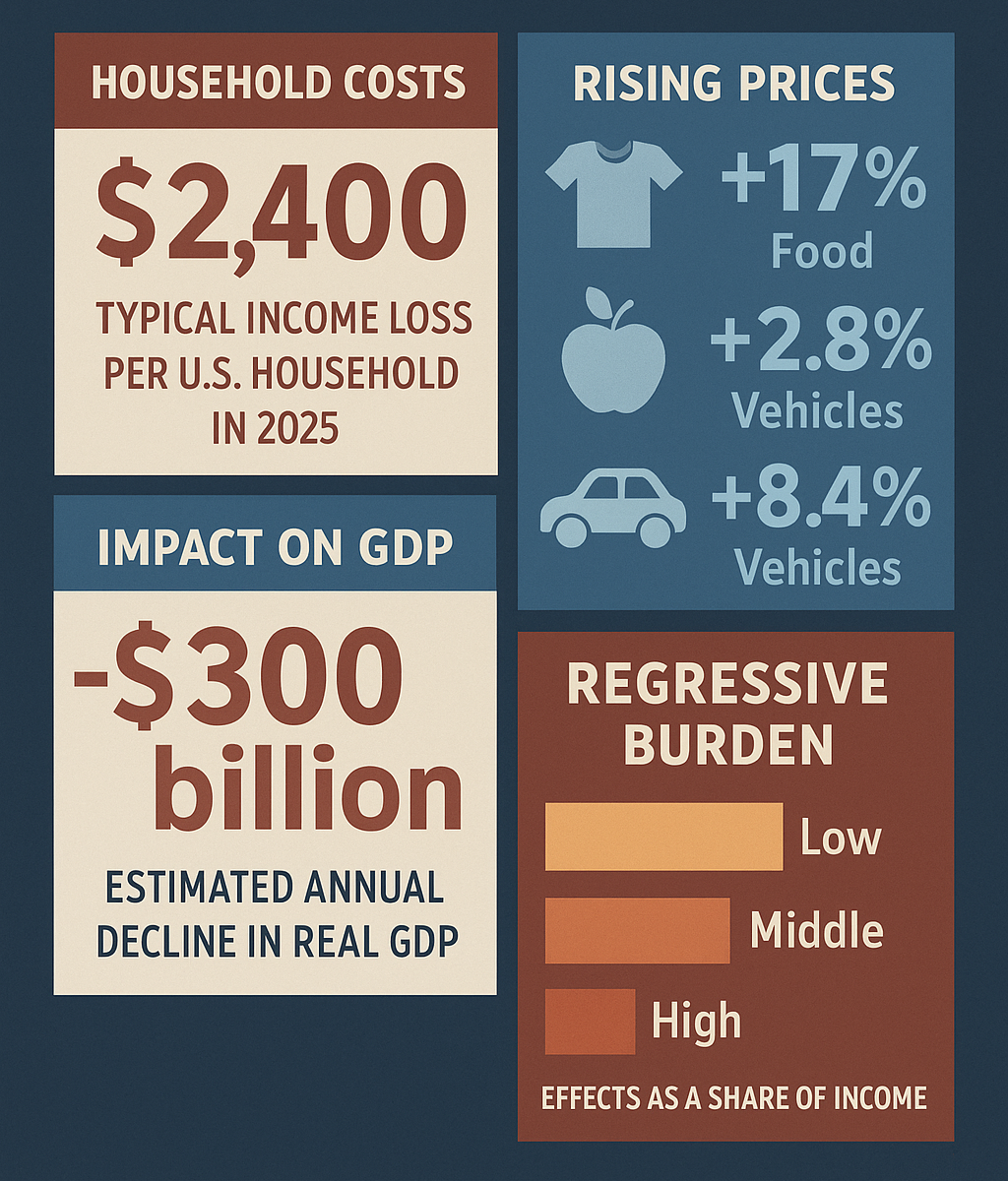

The Yale Budget Lab estimates that the price level from all 2025 tariffs could rise by 1.8% in the short run, equivalent to an average income loss of $2,400 per household annually. More severe scenarios project a 2.9% short-run price increase, translating to a $4,700 average household loss. This burden is disproportionately borne by lower-income households, for whom tariffs act as a regressive tax. For the poorest fifth of Americans, tariffs could impose a tax increase equal to 6.2% of their income, compared to 1.7% for the richest 1%. This exacerbates income inequality, as lower-income families allocate larger budget shares to tradable goods affected by tariffs.

Specific product categories have seen notable price spikes:

- Clothing and Textiles: Consumers face 38-40% higher apparel and shoe prices in the short run, remaining 17-19% higher in the long run. Ninety-seven percent of clothing and shoes sold in the U.S. are imported, primarily from Asia.

- Food and Beverages: Food prices could rise by 2.6-3.4% in the short run, with fresh produce initially 5.4-7.0% more expensive. For items like bananas and Brazilian coffee, where domestic substitution is difficult or impossible due to climate or land scarcity, tariffs act as a direct tax on consumers with no corresponding domestic benefit. Fish, beer, and liquor are also likely to become more expensive.

- Motor Vehicles: Prices could rise by 12-19% in the short run, adding an estimated $5,800 to $9,000 to the price of an average new car. Even US-assembled vehicles are affected by tariffs on steel, aluminum, copper, and parts. Automakers like General Motors and Ford have reported billions in tariff-related costs, absorbing some of these hits to maintain sales, but leading to declining profit margins. This suggests that while consumers may not immediately feel the full brunt, the long-term health and investment capacity of these industries are impacted.

- Electronics and Home Goods: Furniture, appliances, and computers have seen price increases, with appliances up 1.9% and computers up 1.4% in June. Consumer electronics and video game devices are also expected to rise in price, as few are made in America.

GDP, Employment, and Industry Effects

Far from stimulating broad economic growth, the tariffs are projected to slow it. The Yale Budget Lab estimates that US real GDP growth could be 0.5-1.1 percentage points lower annually over 2025-2026 due to tariffs and foreign retaliation, leading to a persistently smaller US economy in the long run (equivalent to $120 billion to $170 billion annually).

Employment figures also reflect a negative trend. The unemployment rate is projected to rise by 0.3-0.6 percentage points by the end of 2025, with payroll employment potentially 497,000 to 740,000 lower. Manufacturing, a sector often cited as a target for protection, lost 14,000 jobs after the April tariffs, with a total of 37,000 manufacturing jobs lost since the "Liberation Day" announcement. While manufacturing output might expand by 2.0-2.1%, these gains are "more than crowded out" by contractions in other sectors, notably construction (down 3.5-4.1%) and agriculture (down 0.8-0.9%). This indicates that tariffs do not lead to net job creation or overall economic expansion, but rather an inefficient reallocation of economic activity.

The impact on specific industries is varied:

- Manufacturing: US factories face higher costs (2-4.5%) due to tariffs on intermediate inputs like steel and aluminum. Domestic steelmakers, facing reduced foreign competition, have hiked their prices, further increasing costs for downstream US manufacturers.

- Agriculture: US agricultural exports to China dropped by 53% after initial tariffs, leading to a projected 8-15% decline in overall export opportunities. China, a major buyer of US soybeans, has diversified its sourcing away from the US. This loss of foreign markets, combined with high input costs, has squeezed farmers' margins, making them "the ones that get it first and hardest in a trade war".The US government has responded with substantial subsidies, providing approximately $25.7 billion in direct income support to farmers from 2018 to 2020 to offset trade damages. This means that a significant portion of tariff revenue is being recycled as compensatory payments, obscuring the true net fiscal impact and creating a dependency on government aid.

- Technology Sector: While Indian IT services are not directly tariffed, US firms facing increased costs from other tariffs may reduce their discretionary technology spending, creating a ripple effect that dampens demand for IT services globally. The administration has also announced new tariffs on semiconductor and chip imports, aiming to boost domestic manufacturing, despite the US being critically dependent on foreign sourcing for these essential goods.

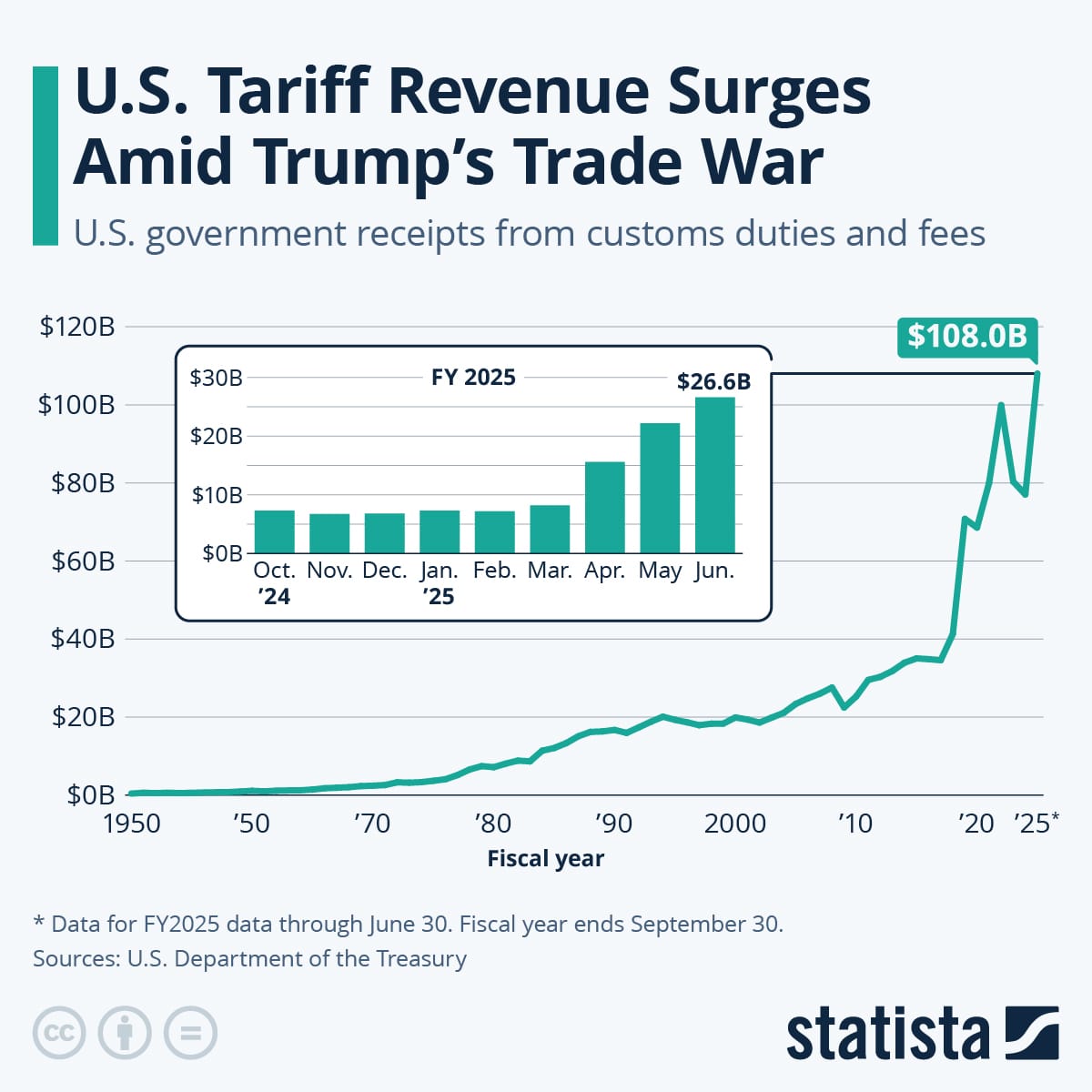

Fiscal Implications

Tariffs have generated substantial revenue for the US Treasury. By July 2025, $152 billion in tariff and excise revenue had been collected, nearly double the amount from the same period last year. The Congressional Budget Office (CBO) projects that the 2025 tariffs could reduce the US budget deficit by $2.8 trillion over the next decade, with an additional $500 billion in reduced debt service costs.

However, this fiscal benefit is not without caveats. The CBO warns that the economy will shrink relative to a non-tariff scenario, offsetting some revenue gains. The administrative complexity of tariff collection also adds another layer of cost. Furthermore, the aforementioned billions in subsidies to industries like agriculture complicate the net fiscal picture, as revenue collected from consumers is effectively redistributed to specific sectors harmed by the policy.

Monetary Policy Challenges

The tariffs have created a significant challenge for the Federal Reserve. Inflation, as measured by the Fed's preferred gauge, rose to 2.6% in June (up from 2.4% in May), exceeding the Fed's 2% target. Core prices, excluding food and energy, also increased.

The Fed has maintained its benchmark interest rate, citing the risks of higher inflation due to tariffs. Fed officials are grappling with whether the tariff-driven price hikes will be temporary or lead to a more persistent inflationary problem. This creates a "delicate balancing act" for the central bank, which is mandated to keep both inflation and unemployment low. If the Fed cuts rates too soon, inflation could accelerate; if it waits too long, the job market could suffer. This dilemma is compounded by political pressure from the White House to cut rates, highlighting how trade policy directly constrains and complicates domestic monetary policy.

Global Repercussions and Trade Dynamics

The US tariff strategy has not only impacted the domestic economy but has also significantly reshaped global trade relations, prompting various responses from international partners.

Retaliation and Trade Diversion

Many countries have responded to US tariffs with retaliatory measures, making US goods less competitive in foreign markets. China, for instance, imposed retaliatory tariffs on US agricultural products like chicken, wheat, corn, soybeans, pork, beef, and fruit, leading to lost market share for American farmers as Chinese buyers turned to alternatives from countries like Thailand and Malaysia.

The policy has also led to "tariff jumping," where Chinese firms, under pressure from US tariffs, have begun shifting manufacturing to ASEAN countries. This strategy, facilitated by agreements like the Regional Comprehensive Economic Partnership (RCEP) with its common rule-of-origin, allows goods to bypass US tariffs by being routed through third countries. This undermines the effectiveness of US tariffs in isolating specific countries or boosting domestic production, instead leading to more complex and potentially less efficient global supply chains.

Shifting Global Alliances and Trade Blocs

In response to rising US protectionism and its withdrawal from multilateral agreements like the Trans-Pacific Partnership (TPP), other major economies are deepening their own regional trade integration.

- RCEP: The Regional Comprehensive Economic Partnership (RCEP), signed in late 2020 and in force since January 2022, is the world's largest free trade agreement, encompassing 10 ASEAN members plus China, Japan, South Korea, Australia, and New Zealand.RCEP aims to reduce or eliminate 92% of tariffs over 20 years and establish common rules, simplifying procedures and helping small and medium-sized enterprises (SMEs). Its formation was partly driven by renewed interest in regional trade deals following US-China trade tensions and the US withdrawal from TPP. This agreement is estimated to add up to $500 billion in world trade by 2030, with significant benefits for China, Japan, and South Korea. The US's absence from RCEP and CPTPP limits its ability to influence regional trade rules and motivate a US-friendly foreign policy.

- EU-Japan Economic Partnership Agreement: Japan also entered into an FTA with the European Union in 2019. This, along with CPTPP and RCEP, has led to reduced barriers on imports from these blocs into Japan, which some stakeholders contend may undermine US export competitiveness.

- India's Diversification: Facing a 25% US tariff, India has reiterated its refusal to concede on agriculture, dairy, and genetically modified (GM) products, citing religious sentiments and the need to protect its millions of farmers. India has consciously diversified its trade relationships, advancing discussions with the EU and UK, and focusing on "Make in India" and "Atmanirbhar Bharat" (self-reliance) initiatives. This strategic pivot aims to reduce dependency on any single country, including the US, and highlights how non-economic factors can shape a nation's response to trade pressure.

This global reorientation suggests a long-term erosion of US economic influence and market access, as the world economy reconfigures itself around new trade hubs.

Trade as a Geopolitical Tool

The application of tariffs under the current administration extends beyond purely economic objectives, often serving as a tool for geopolitical leverage. Tariffs are imposed not just based on trade imbalances, but also on "country-specific assessments of economic alignment, security posture, and trade practices". For example, India's 25% tariff was partly attributed to its continued trade with Russia. Similarly, Canada faced a 35% tariff, partly linked to its stance on recognizing a Palestinian state and alleged lack of cooperation on illicit drugs.

This approach transforms trade policy into a direct instrument of foreign policy, blurring the lines between economic and geopolitical objectives. While it aims to reward "trusted economic partners" and penalize "non-cooperative" ones, it risks increased global fragmentation, reduced trust in the rules-based trading system, and a more confrontational international environment where economic penalties enforce political compliance.

Legal Challenges and Policy Uncertainty

The legality of the sweeping tariffs has been challenged in US courts, with questions raised about the President's authority to declare an "emergency" to bypass congressional approval. While the administration has alternative authorities (like Section 301 for unfair trade practices and Section 232 for national security concerns) to impose tariffs, the ongoing legal battles add another layer of risk and unpredictability for businesses and international partners. This persistent uncertainty dampens investment and makes long-term planning difficult for global companies, contributing to broader economic instability.

What Happens Next?

The current trajectory of US trade policy, characterized by broad tariffs and unilateral actions, is demonstrably leading to higher costs for American consumers, reduced economic growth, and a complex web of international reactions that may diminish US global economic influence. To mitigate these adverse effects and foster a more stable and prosperous economic future, a recalibration of trade strategy is imperative.

Policymakers should prioritize evidence-based approaches that acknowledge the true burden of tariffs on American households and businesses. This includes a critical re-evaluation of the assumption that tariffs are paid by foreign entities, recognizing instead their nature as a domestic consumption tax. Efforts should focus on reducing the regressive impact on lower-income families.

Furthermore, a shift away from broad, unpredictable tariffs towards more targeted measures, possibly reserved for genuine national security concerns, would reduce policy uncertainty and allow businesses to plan and invest more effectively. Addressing the fundamental drivers of trade imbalances, such as domestic savings and investment dynamics, rather than relying on tariffs, would yield more sustainable results.

On the international front, the US should consider re-engaging with multilateral trade frameworks and exploring comprehensive free trade agreements that promote genuine market access and foster cooperation, rather than driving partners to form exclusive blocs that could marginalize US exports. A clear distinction between economic and geopolitical objectives in trade policy would enhance predictability and rebuild trust among allies.

Ultimately, a robust and sustainable economic future for the United States requires a trade policy that is transparent, predictable, and genuinely beneficial to all Americans, while fostering a cooperative and stable global economic environment.

What do you think?

What specific policy mechanisms could be implemented to directly offset the regressive impact of existing tariffs on lower-income households, beyond broad tax cuts or general subsidies? In an increasingly fragmented global trade environment, how can the US effectively address issues like currency manipulation or unfair trade practices without resorting to broad tariffs that harm its own economy?

Sources

This report draws on economic analyses and data from the Federal Reserve, Yale Budget Lab, Peterson Institute for International Economics, Congressional Budget Office, and various news agencies, including AP News, Statista, The Economic Times, PBS NewsHour, CBS News, and Al Jazeera.