The US Tax Bill Vote: How It’s Fueling Volatility in Asian Equities

Explore how the US Senate tax bill vote is shaking Asian markets through dollar depreciation, capital flows, sector winners, and regional hedging strategies.

HONGKONG, July 1, 2025

“A domestic tax bill may start in Congress, but its effects are felt globally.” Dr. Mei Lin, Senior Economist, Bank of Singapore

Introduction: When Washington Ripples Through Asia

As the U.S. Senate moves forward with a major fiscal package that combines tax cuts and regulatory changes, informally called the “One Big Beautiful Bill Act,” Asian equity markets have experienced significant volatility. This blog explores the complex interactions between U.S. fiscal policy, the weakening dollar, and how capital is allocated in Asia, along with sector performance and risk flows. By examining key questions, we assess whether the gains in Tokyo, Seoul, and Shanghai are short-lived or represent a long-term shift.

"Fiscal policy choices in the U.S. have global repercussions, especially through capital flows and the dollar’s valuation."

— Janet Yellen, U.S. Treasury Secretary, speech at the Council on Foreign Relations, April 2025

D.C. Speaks, Asia Jumps

The proposed tax legislation, which includes substantial corporate tax cuts and Section 899 adjustments for foreign income, has a global effect. According to J.P. Morgan, Section 899 could reduce foreign investment in U.S. assets and put pressure on the dollar while benefiting U.S. multinationals. Asian markets reacted swiftly. The MSCI Asia-Pacific ex-Japan index surged close to three-year highs after the removal of the bill's "revenge tax" clause.

Central banks and regional policymakers are paying close attention. Lower U.S. borrowing costs and a weaker dollar might lead to capital inflows. However, unexpected changes in tax regulations could cause sudden risk-off sentiments.

The Dollar Slide: Blessing or Burden for Asia?

A. Asia Trade-Weighted Dollar

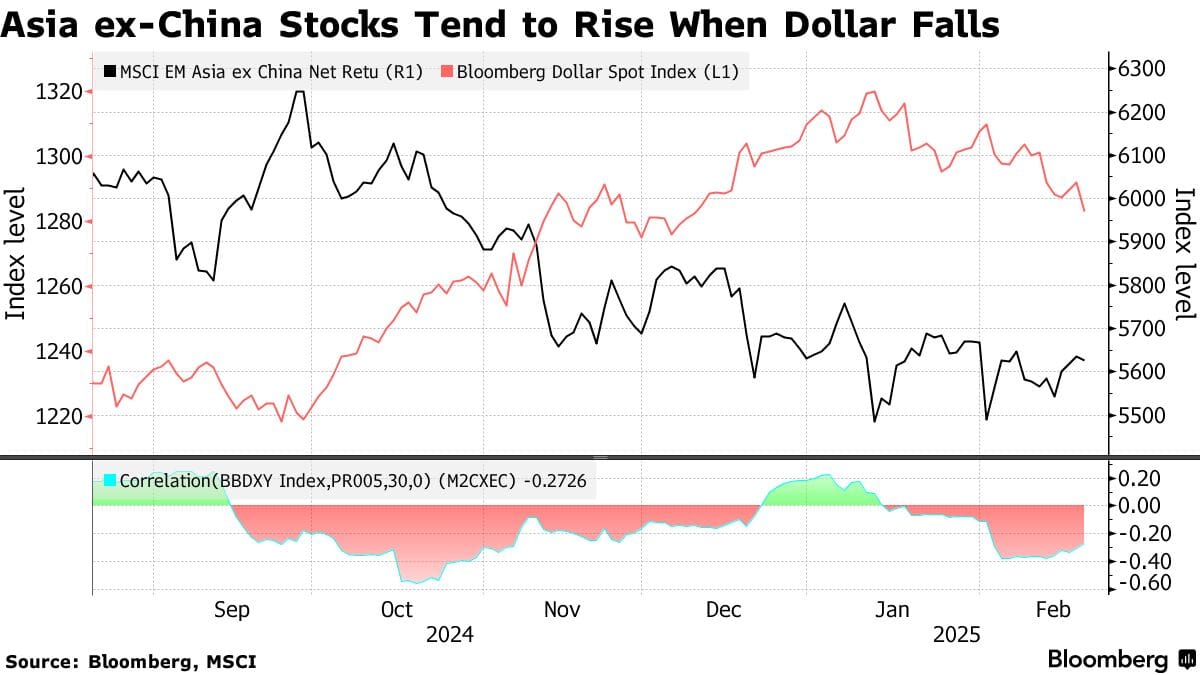

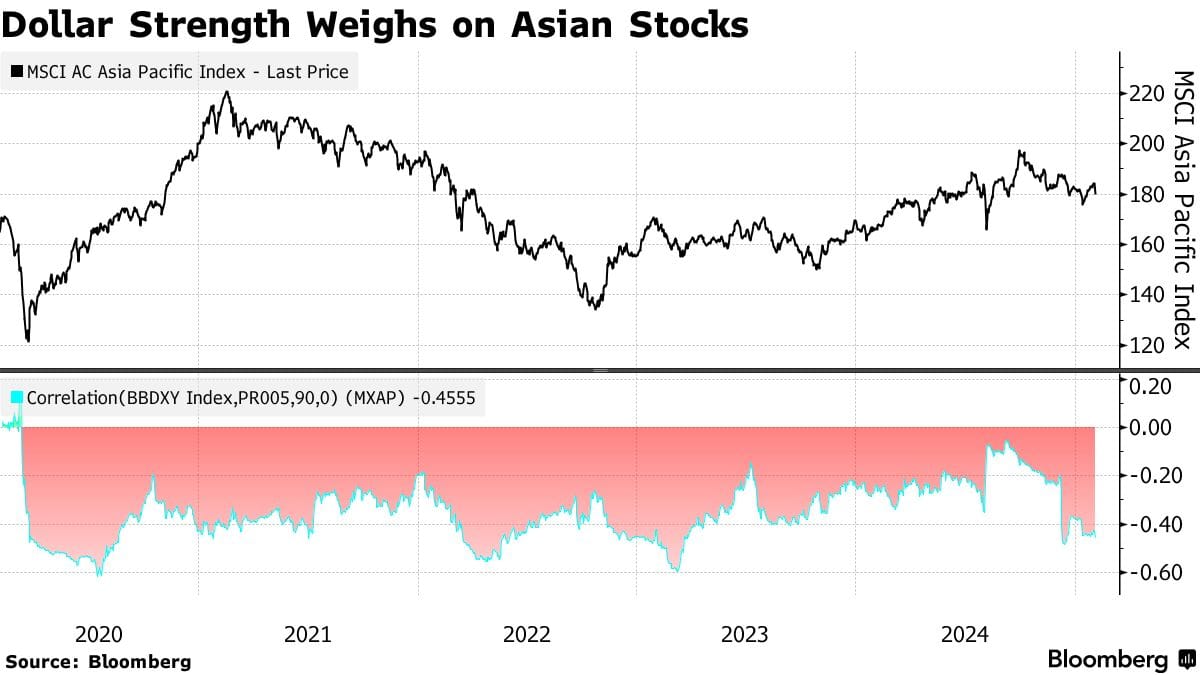

J.P. Morgan’s Asia trade-weighted dollar index shows slight depreciation, only about 1% lower from April peaks, compared to nearly a 3% drop in the broader DXY index. This indicates that for Asian exporters, the dollar remains strong, even as the global conversation about dollar overvaluation continues.

B. Equity-Driven Earnings Tailwinds

Société Générale reports that for every 10% drop in the U.S. dollar, Asian corporate earnings increase by 3-5%, driven by improved export margins and lower import costs. This relationship has supported recent rallies in tech and semiconductor stocks.

C. Capital Flow Dynamics

The dollar's decline—or the expectation of it—encourages capital flow changes. Emerging-market investors are borrowing in cheaper dollars to invest in high-yield Asian assets, leading to record bond inflows into countries like India and South Korea.

Investor Behavior Across Asia

In markets from Mumbai to Taipei, investment strategies among institutions are changing:

- Hedged Equity Positions: Foreign portfolio managers are selectively buying equities outside of Japan, but they are adding currency hedges to manage dollar risk.

- Carry Trades: Investors are borrowing dollars at low U.S. rates to invest in higher-yield opportunities in Asia. This strategy has resulted in notable inflows, including $9 billion into emerging Asian bonds in April and $2.3 billion into India in June.

- Speculation on U.S. Policy Changes: The removal of the "revenge tax" provision sparked new investments into regional equities and currencies.

"Emerging markets like India are extremely sensitive to U.S. fiscal surprises—especially when they alter capital flow dynamics and currency expectations."

— Raghuram Rajan, World Economic Forum, Davos 2025

Key Sectors Benefiting or Losing

- Tech & Semiconductors: Leading companies like Samsung and TSMC see improved margins and stronger pricing when converted to local currencies.

- Consumer Discretionary: A weaker dollar enhances purchasing power for consumers across Southeast Asia, improving prospects for e-commerce, automotive, and retail sectors.

- Commodities & Manufacturing: A lower dollar strengthens local currencies, which makes imports cheaper. At the same time, exporters gain global competitiveness.

- Financials & Exporters: There is a mixed impact: firms that benefit from overseas revenue thrive, but currency gains can negatively affect bank earnings. Strong currencies may also squeeze margins for insurance and financing companies.

- Airlines & Energy-Intensive Industries: S&P notes that dollar depreciation pressures companies with costs in dollars, such as fuel and equipment. Airlines and power producers are particularly affected.

Nation-Level Effects

Japan

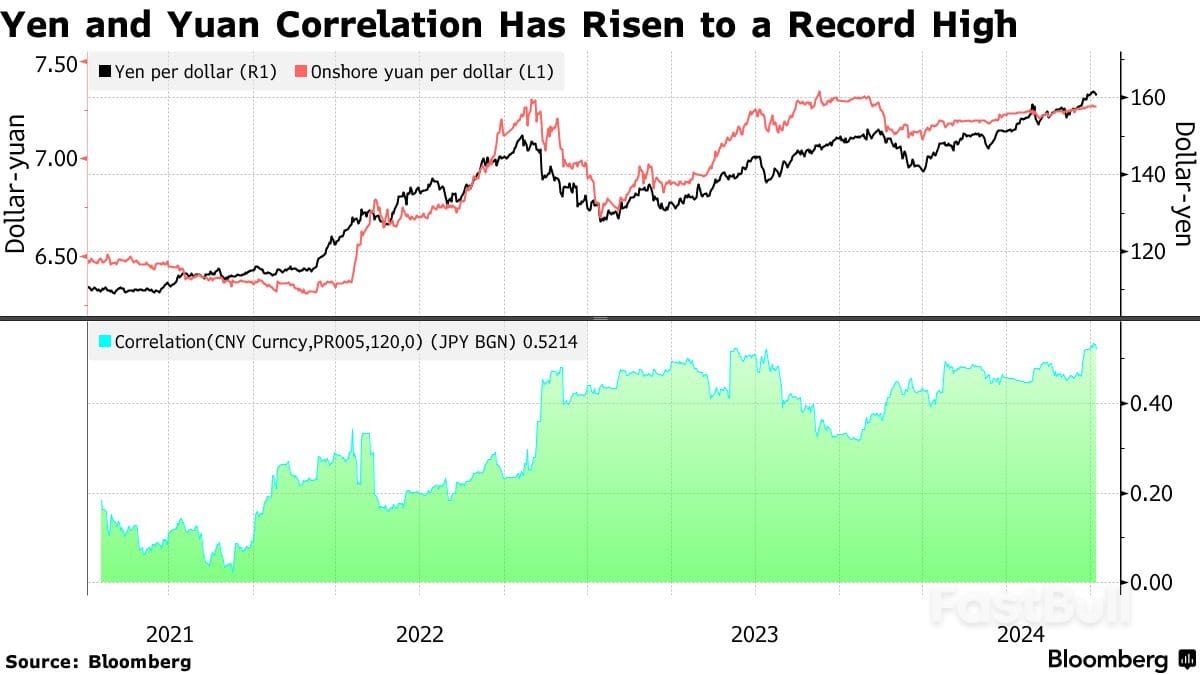

The yen remains about 38% below decade highs, supporting Nikkei rallies. However, capital outflows could lead to overheating. The central bank in Tokyo is prepared to intervene.

Southeast Asia

Indonesia and Thailand are struggling as the dollar strengthens, while capital is moving into China.

India

The rupee experienced its "strongest one-day gain in a month" due to lower oil prices and reduced geopolitical tensions, leading to rises in the Sensex and Nifty.

South Korea

A strong won and differing bond yields attract foreign investment, with $8 billion flowing into bonds in April. However, exporters may have issues with foreign exchange translation.

China

As the yuan stabilizes, exporters see renewed strength, but heavily indebted companies with dollar liabilities are at risk. A recent study shows significant spillover from Chinese equity volatility throughout the region.

Temporary Reaction or Sustainable Rally?

Sustainability Factors

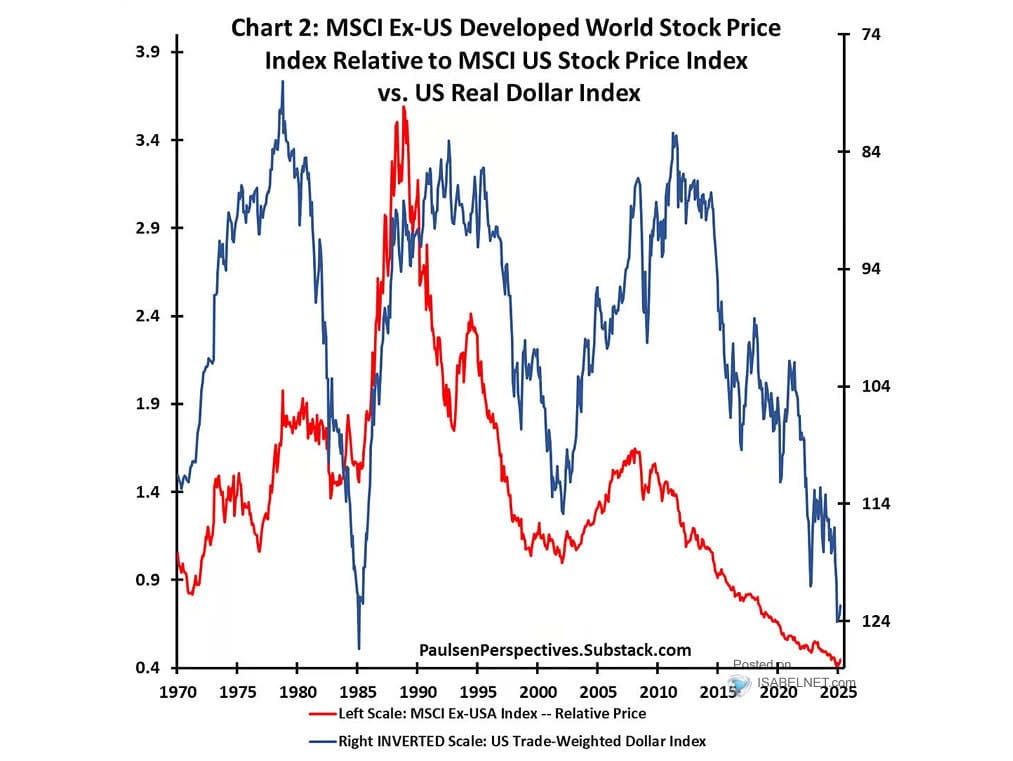

- Asia trades at 10-year valuation lows. Forward price-to-earnings ratios are around 30% below average.

- Structural drivers include shifts in global supply chains, a demographic dividend, and growth in digital sectors.

- Core inflation remains stable in key Asian economies, allowing local central banks some flexibility.

Risks

- There is potential for U.S. tax policy changes, as Section 899 may be reintroduced.

- The Federal Reserve could limit the dollar's decline with unexpectedly aggressive policies, reversing yield differentials.

- Geopolitical tensions in areas like the Taiwan Strait and trade tariffs could create sudden risks.

Global Interconnectedness: U.S. Tax to Asian FX

Studies by the IMF and BIS show that U.S. fiscal actions, such as tax cuts or changes to foreign income, impact capital flows, foreign exchange reserve demands, and equity prices in Asia within weeks. The dollar remains a central factor; even local fiscal or monetary decisions are influenced by its movements.

"The dollar is the world's reserve currency. When it moves, every asset class from Shenzhen to Singapore feels the tremor."

— Ray Dalio, LinkedIn Newsletter, March 2025

Currency Shifts & Institutional Hedging

Financial institutions across Asia are making adjustments:

- FX Reserves: Central banks in India, Indonesia, Malaysia, and Thailand are increasing their U.S. dollar reserves to help stabilize local currencies.

- Corporate Hedging: Manufacturers and exporters are revising their dollar-hedge programs to better respond to ongoing dollar weakness.

- Portfolio Strategy: Multi-asset funds are changing their allocations, now favoring Asian equities and bonds for carry and diversification benefits.

What Happens Next?

- Senate Vote & Tax Legislation: With Section 899 removed, attention turns to final edits of the Senate bill. Any reinstatement could change capital appetites worldwide.

- Fed Commitments & Rate Signals: If interest rate cuts are on the horizon, as priced into futures, versus slower easing in Asia, carry strategies will remain attractive, supporting core currencies and equity inflows.

- Geopolitical Developments: Trade talks with China or tariffs on imports, such as renewables and semiconductors, could cause sudden market changes by tightening global risk margins.

- Asian Central Bank Interventions: Actions by the Bank of Japan, the People’s Bank of China, and others will impact currency and equity trends. A weak dollar presents opportunities but also risks.

Tax Policy as a Trigger: Is Asia Riding a Wave or Facing a Storm?

The U.S. tax bill vote is more than just a domestic issue—it acts as a global catalyst. In Asia, it strengthens the case for capital rotation, dollar-driven earnings growth, and long-term investment trends. However, lasting success depends on underlying fundamentals like earnings quality, geopolitical stability, and consistent macroeconomic policies.

Investor Insight: Can Asia Decouple from the Dollar’s Mood Swings?

Can Asia turn this dollar-driven rally into growth over several years, or will volatility be the norm due to interconnected global factors?

Sources

- Market data & analysis: Bloomberg, MSCI Asia ex-Japan Index, Nikkei Asia, and JP Morgan Q2 2025 Strategy Note.

- Currency trends: IMF Spring 2025 Briefing, Council on Foreign Relations (Janet Yellen), World Economic Forum Davos 2025.

- Expert commentary: Raghuram Rajan (WEF), Ray Dalio (LinkedIn), Nouriel Roubini (Bloomberg), Kristalina Georgieva (IMF).

- Visuals & charts: Bloomberg Markets, FastBull, NikkoAM, MacroMicro, IsabelNet, m.fastbull.com.

- Generated visuals: OpenAI DALL·E (cover image and infographic with stock charts and headline overlays).

- Legal references: U.S. Congressional Budget Office (CBO), Treasury Department releases, Federal Reserve economic projections.