Why Google Is Slashing Cloud Prices for the US Government: Disruption, Dependency, or Digital Dominance?

Google is slashing cloud prices for U.S. government contracts. Here’s why it’s shaking up the federal tech landscape.

WASHINGTON D.C., July 11, 2025

The $100 Billion Cloud Grab: Why Google Just Made Its Boldest Move Yet

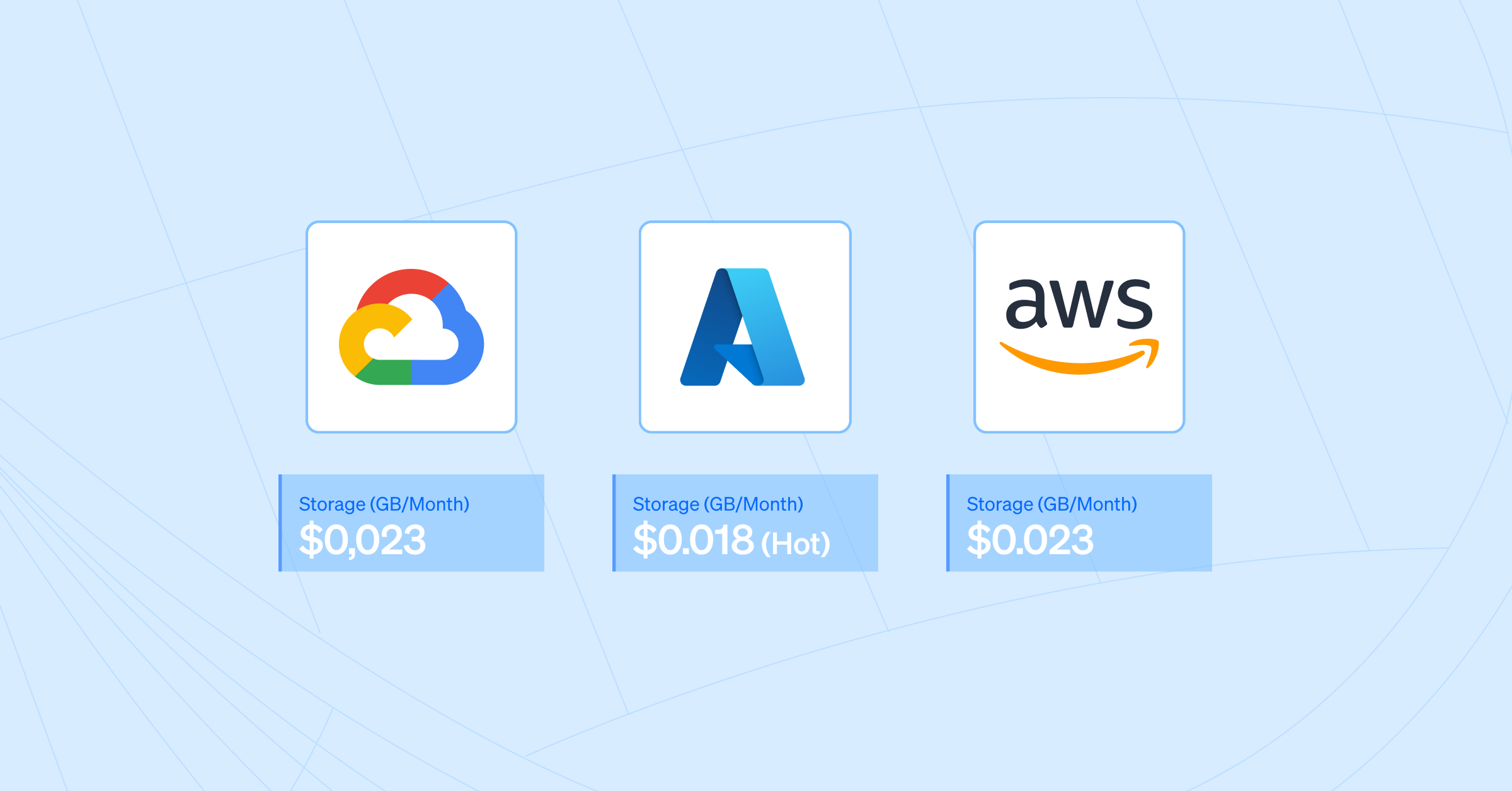

In the high-security hallways of Washington, a quiet tech war is heating up. Google, once thought to be lagging behind Amazon Web Services (AWS) and Microsoft Azure in the U.S. government cloud race, has made a surprising move by cutting its prices on cloud services for federal agencies by as much as 40%.

This shift is shaking up the industry.

At first glance, it seems like a classic market strategy: undercut the competition, secure contracts, gain market share. However, analysts and insiders say this is more than just about money. It could change how federal data is stored, who controls vital AI infrastructure, and if Big Tech's influence in government grows too large to challenge.

Welcome to the next phase of cloud warfare, where affordability meets national strategy!

The Stakes: Powering the Digital Heart of America

The U.S. government isn’t just any cloud customer—it’s the biggest one. It manages everything from the Pentagon’s drone data to the Department of Homeland Security (DHS) immigration systems and the IRS’s 60-year-old mainframes. Modernizing federal systems is urgent and highly valuable.

Estimates show that the federal cloud market will exceed $100 billion by 2030, fueled by AI automation, security upgrades, and data sharing between agencies.

Until now, AWS and Microsoft have held the upper hand, achieving major wins such as:

- The Joint Warfighting Cloud Capability (JWCC), a multi-vendor contract for the Department of Defense.

- The CIA’s Commercial Cloud Enterprise (C2E).

- Numerous hybrid cloud projects by Microsoft under Azure Government.

Google, once hesitant to work with military contracts, is now coming back strong.

Its new pricing strategy reportedly gives the DoD and DHS access to Google Cloud Platform (GCP) services—like storage, machine learning (ML) tools, and BigQuery analytics—at significantly reduced rates. These discounts cover compute services, data migration, security audits, and integration with Google’s AI tools.

What's Behind the Discount?

So, what’s driving this sudden generosity?

Market Penetration at Any Cost

Google has struggled to gain a foothold in the federal cloud market. Unlike AWS and Microsoft, it doesn’t have long-standing contracts in place. Offering lower prices might be its best chance to gain traction.

“This isn’t charity—it’s conquest,” said Alex Engler, a governance fellow at Brookings. “They’re betting on long-term lock-in after a short-term hit.”

National Security and AI Integration

Sources indicate that Google’s pitch to agencies includes not just cheap storage but also integrated AI tools like pre-trained models, cybersecurity threat detection, and advanced data visualization, powered by Gemini and Vertex AI.

This is more than just data storage. It’s about understanding data.

A PR Reboot After Antitrust Scrutiny

Following several antitrust investigations and a tough legal battle with the DOJ in 2024, Google needs to restore political goodwill. Becoming an essential partner to the public sector could help change its image from an advertising giant to a patriotic infrastructure provider.

The Competition: AWS and Microsoft Don’t Like It

The tech giants that have long held power in federal contracts are not taking this quietly.

AWS, which manages some of the most sensitive intelligence workloads, privately warned that Google's pricing model could become “unsustainable” and a “security risk” if it pressures agencies to choose budget over quality.

Microsoft, on the other hand, has expanded its hybrid cloud offerings and improved federal compliance capabilities. It recently teamed up with Lockheed Martin to deliver AI-enhanced battlefield software.

Both companies now face new pressure: either lower prices or improve services, or risk losing their edge in government contracts.

“Price wars in federal IT can backfire if they compromise long-term reliability,” warned a GSA technology advisor, requesting anonymity.

Modernization or Monopoly?

Google's cloud offer isn’t just cheaper; it’s smarter, using AI to speed up digital changes in slow-moving departments. Take the IRS, which still relies on COBOL, a programming language from 1959. With Google Cloud, agencies can access automated document classification, fraud detection, and real-time support for taxpayers.

However, modernization can come with downsides. Privacy advocates are raising concerns about increased reliance on a few tech companies to handle vital government functions.

“We’re approaching a moment where tech vendors become shadow operators of the state,” said Meredith Whittaker, President of Signal Foundation.

Some watchdogs argue that Google’s lowered contracts could harm fair competition while increasing dependence on vendors, especially if agencies do not have clear exit strategies.

Cloud, Classified: The Cybersecurity Implications

The White House’s National Cyber Strategy 2025 stresses the importance of resilient digital infrastructure. This means federal cloud contracts are not just about money; they’re strategically important.

Critics question whether Google, despite recent security improvements, can meet AWS and Microsoft in FedRAMP High and DoD IL6 compliance requirements for handling sensitive data.

Yet Google's investments in zero-trust architecture, its acquisition of the cybersecurity firm Mandiant, and its use of AI-driven threat detection show that it is quickly catching up.

Additionally, Google’s Tensor Processing Units (TPUs) offer unique on-chip privacy capabilities that might make its cloud services not only affordable but secure.

Political Capital in the Cloud

While Google’s pricing tactics may seem financial, many believe it is a strategic move to gain influence in Washington.

Cloud infrastructure deals come with power over:

- Digital identity systems

- Data-sharing frameworks for law enforcement

- AI governance tools in public policy

If Google becomes the foundation of systems such as DHS border monitoring or Social Security’s digital platform, its influence could surpass that of traditional lobbyists.

This is why this isn’t just about contracts; it’s about the structure of governance itself.

What Happens Next?

Washington’s cloud procurement landscape is changing due to three main forces:

- Requirements for inter-agency coordination under the Federal CIO to reduce duplication and adopt common platforms.

- The urgent need for AI deployment, especially after the White House’s Executive Order on AI Safety (2024), mandates AI oversight tools in key departments.

- Budget pressure as Congress looks to cut tech spending in the 2026 budget, making Google’s discounts particularly appealing.

Industry insiders expect:

- AWS and Microsoft to start lobbying against Google’s bids.

- Congress to hold oversight hearings on federal tech reliance.

- Agencies to revisit contract terms to avoid becoming dependent on vendors.

Meanwhile, Google is increasing its federal data center presence and announcing new GovCloud regions in Virginia and Colorado, tailored for defense and public health needs.

The New Cloud Monopoly Question

Are we witnessing Google’s redemption in government, or a quiet takeover of America’s digital framework?

The answer hinges on how procurement officers, Congress, and the public balance the trade-offs between cost savings and consolidation. Google’s pricing could make federal reforms affordable. But at what long-term cost?

If just a handful of companies manage everything from food stamps to battlefield AI, do we risk giving too much control to private entities over democratic governance?

Public Code or Private Cloud? A Democracy at a Crossroads

Google's approach isn’t just about storage, bandwidth, or processing power. It’s about creating the infrastructure for public life. Once this infrastructure is in place, it is hard to replace.

In the next few months, the federal cloud landscape could change quickly. If Google succeeds, it will show that affordable and AI-driven innovation can disrupt even the most established government systems. But if caution is disregarded, the U.S. may head into a future where vital decisions are influenced more by corporate algorithms than by democratic oversight.

The choice is still ours, but the cloud is already coming together.

The Debate That Matters:

Is Google’s aggressive pricing a sign of healthy tech competition, or does it serve as a Trojan horse for greater corporate control of U.S. government systems?

Sources

- Reuters: Google Cloud Cuts Prices for US Agencies

- Federal News Network: Inside JWCC Procurement

- CNBC: Google's Federal Strategy Post-Antitrust

- Justice.gov: 2024 Google Antitrust Filing

- FedRAMP Marketplace Certifications

- Brookings: Cloud Vendors and Public Trust

- Signal Foundation Testimony – Meredith Whittaker

- FedScoop

- Yahoo Finance

- TECHi

- US News

- The Straits Times

- https://cloud.googleblog.com/

- Cloud Research Report, 2025